FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

FINANCIAL RATIO:

Requirement: Compute for the following financial ratios for the year 2021 (round-off answers to two decimal places)

a. Current ratio

b. Quick (Acid-test) ratio

c. Working capital

d. Inventory turnover

e. Days of inventory (use 365 days)

f. Accounts receivable turnover (assume all sales are on credit)

g. Days of receivable (use 365 days)

h. Debt ratio

i. Equity ratio

j. Debt-to-equity ratio

k. Gross profit ratio

1. Net profit ratio

m. Return on assets

n. Return on equity

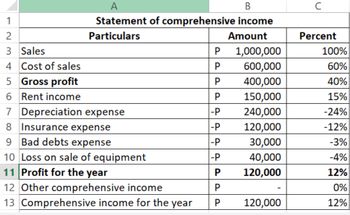

Transcribed Image Text:B

Statement of comprehensive income

Particulars

Amount

1

2

3 Sales

4 Cost of sales

5 Gross profit

6 Rent income

7

8 Insurance expense

9 Bad debts expense

Depreciation expense

10 Loss on sale of equipment

11 Profit for the year

12 Other comprehensive income

13 Comprehensive income for the year

P

P

P

P

-P

-P

-P

-P

P

P

P

1,000,000

600,000

400,000

150,000

240,000

120,000

30,000

40,000

120,000

120,000

Percent

100%

60%

40%

15%

-24%

-12%

-3%

-4%

12%

0%

12%

Transcribed Image Text:3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

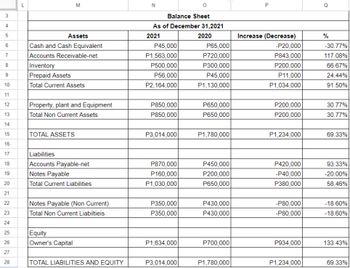

L

Assets

Cash and Cash Equivalent

Accounts Receivable-net

Inventory

Prepaid Assets

Total Current Assets

M

Property, plant and Equipment

Total Non Current Assets

TOTAL ASSETS

Liabilities

Accounts Payable-net

Notes Payable

Total Current Liabilities

Notes Payable (Non Current)

Total Non Current Liabiltieis

Equity

Owner's Capital

TOTAL LIABILITIES AND EQUITY

N

O

Balance Sheet

As of December 31,2021

2021

2020

P45,000

P1,563,000

P500,000

P56,000

P2,164,000

P850,000

P850,000

P3,014,000

P870,000

P160,000

P1,030,000

P350,000

P350,000

P1,634,000

P3,014,000

P65,000

P720,000

P300,000

P45,000

P1,130,000

P650,000

P650,000

P1,780,000

P450,000

P200,000

P650,000

P430,000

P430,000

P700,000

P1,780,000

P

Increase (Decrease)

-P20,000

P843,000

P200,000

P11,000

P1,034,000

P200,000

P200,000

P1,234,000

P420,000

-P40,000

P380,000

-P80,000

-P80,000

P934,000

P1,234,000

Q

%

-30.77%

117.08%

66.67%

24.44%

91.50%

30.77%

30.77%

69.33%

93.33%

-20.00%

58.46%

-18.60%

-18.60%

133.43%

69.33%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You have been presented with the following selected information from the financial statements of one of Canada's largest dairy producers, Saputo Inc. (in $ millions): Statement of financial position 2021 2020 2019 Accounts receivable $1,217 $1,372 $1,248 Inventory 2,294 2,221 1,681 Total current assets 3,948 4,069 3,134 Total assets 13,123 13,793 9,886 Current liabilities 2,146 2,494 1,932 Total liabilities 6,679 7,234 4,465 Statement of income Sales $14,294 $14,944 $13,502 Cost of goods sold 9,575 10,181 9,179 Interest expense 79 96 67 Income tax expense 218 217 230 Net income 626 583 755arrow_forwardCalculate the following Ratios: d) Quick Acid Ratio e) Inventory Turnover Ratio (Days) f) Accounts Receivable Turnover Ratioarrow_forwardA firm’s Balance Sheet and Income Statement for FY 2021 is displayed below and in the in the attached excel file. Answer the following questions. NOTE: For this question, use the end-of-the year approach (and not the mid-year convention). For example, this means that days receivables = end of FY receivables/daily sales; similarly for the remaining relevant ratios. BALANCE SHEET 2021 Cash and cash equivalents 280 Receivables 2588 Inventory 2516 Other 189 TOTAL CA 5573 Fixed assets 5024 TOTAL ASSETS 10597 Accounts payable 4713 Short term debt 78 TOTAL CL 4790 LT debt 921 Shareh. Equity 4886 TOTAL LIAB. AND SHARH. EQUITY 10597 INCOME STATEMENT 2021 Sales 19418 COGS 13136 Depreciation 354 SG&A 4952 EBIT 976 Interest Expenses 52 Tax 268 Net income 656 Determine the managerial balance sheet for the FY 2021.arrow_forward

- You have been hired as a financial analyst of a firm and your team is working on an independent assessment of XYZ Inc. Your assistant has provided you with the following data for XYZ Inc. and their industry. Ratio Inventory Turnover Receivables in days Debt to Equity 2020 2019 2018 2020- Industry Average R r 62.65 42.42 32.25 94 63 50 115 d 53.25 0.75 0.85 0.90 0.88 Quick Ratio Curr:ent Ratio 1.028 1.03 1.029 1.33 1.21 1.15 1.25 1.031 Required: a) In annual report of firm CEO wrote, we had higher liquidity largely due to an increase in highly liquid current assets (cash, account receivables and short- term marketable securities).” Is the CEO correct? b) What can you say about the firm's collection period and inventory turnover?arrow_forwardWhat is the Financial Performance and Financial Position for:-a. Liquidityb. Profitabilityc. Leveragearrow_forwarda. Compute the current ratio for the current year. (Abbreviations used: STI = Short-term investments. Round your answer to two decimal places, X.XX.) Current ratio More Info a. Current ratio b. Cash ratio c. Acid-test ratio d. Inventory turnover e. Days' sales in inventory f. Days' sales in receivables g. Gross profit percentage Print Done Choose from any list or enter any number in the input fields a Financial Statements Balance Sheet: Cash Short-term Investments Net Accounts Receivables Merchandise Inventory Prepaid Expenses Total Current Assets Total Current Liabilities Income Statement: Net Credit Sales Cost of Goods Sold $ Current Year Preceding Year 15,000 $ 11,000 56,000 64,000 13,000 159,000 132,000 465,000 317,000 29,000 27,000 94,000 82,000 7,000 239,000 89,000arrow_forward

- The condensed financial statements of Ivanhoe Company for the years 2020-2021 are presented below: (See Images) Compute the following financial ratios by placing the proper amounts for numerators and denominators. (Round per unit answers to 2 decimal places, e.g. 52.75.) (a) Current ratio at 12/31/21 $ $ (b) Acid test ratio at 12/31/21 $ $ (c) Accounts receivable turnover in 2021 $ $ (d) Inventory turnover in 2021 $ $ (e) Profit margin on sales in 2021 $ $ (f) Earnings per share in 2021 $ (g) Return on common stockholders’ equity in 2021 $ $ (h) Price earnings ratio at 12/31/21 $ $ (i) Debt to assets at 12/31/21 $ $ (j) Book value per share at 12/31/21 $arrow_forwardexplain the result of ACCOUNTS RECEIVABLE TURNOVER RATIO DAYS TO COLLECT INVENTORY TURNOVER DAYS TO SELL ACCOUNTS PAYABLE TURNOVERarrow_forwardREQUIRED Use the information provided below to calculate the ratios for 2021 (expressed to two decimal places) that would reflect each of the following: The time taken by the company to settle its debts with trade The amount of debt that the company uses to finance its The operational effectiveness of the company before considering interest income, interest expense and company tax. The percentage of the profit that has been put back into the What investors are willing to pay for the shares of the company with due consideration given to the profit generated by each share in the company. Comment on the FIVE (5) ratios of Oslo Limited as compared to the industry average provided in the additional information. INFORMATION The information given below was extracted from the books of Oslo Limited:…arrow_forward

- Compute the following ratios for 2022 and 2021. Inventory on December 31, 2020, was $330. Assets on December 31, 2020, were $1,910. Stockholders' equity-common on December 31, 2020, was $900. (Round current ratio and inventory turnover to 2 decimal place e.g. 15.25. Round other answers to 1 decimal place, e.g. 15.2 or 15.2%.) (a) (b) Inventory turnover (c) (d) (e) (f) Current ratio (g) Profit margin Return on assets Return on common stockholders' equity Debt to assets ratio Times interest earned 2022 1.67 2 7.73 :1 times % % % % times 2021 1.79 2 4.42 :1 times de % % % % timesarrow_forwardIn 2020, Sahara Company has net credit sales of $923,795 for the year. It had a beginning accounts receivable (net) balance of $38,275 and an ending accounts receivable (net) balance of $35,988. Instruction: Compute Sahara Company’s (a) Accounts receivable turnover. (b) Average collection period in days.arrow_forwardces Given the following information, complete the balance sheet shown next. Collection period Days' sales in cash Current ratio Inventory turnover Liabilities to assets Payables period Assets Current assets: Cash Accounts receivable Inventory Total current assets Net fixed assets Total assets (All sales are on credit. All calculations assume a 365-day year. The payables period is based on cost of goods sold.) Note: Round your answers to the nearest whole dollar. Liabilities and shareholders' equity Current liabilities: 71 days 33 days 2.2 times Accounts payable Short-term debt Total current liabilities Long-term debt Shareholders' equity Total liabilities and equity 5 65% 35 days $ $ 1,300,000 2,000,000 7,000,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education