ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

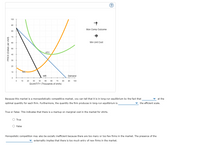

Transcribed Image Text:100

90

Mon Comp Outcome

80

70

Min Unit Cost

60

50

ATC

40

30

20

10

MC

MR

Demand

10

20

30

40

50

80

70

80

90

100

QUANTITY (Thousands of shirts)

Because this market is a monopolistically competitive market, you can tell that it is in long-run equilibrium by the fact that

v at the

optimal quantity for each firm. Furthermore, the quantity the firm produces in long-run equilibrium is

v the efficient scale.

True or False: This indicates that there is a markup on marginal cost in the market for shirts.

O True

O False

Monopolistic competition may also be socially inefficient because there are too many or too few firms in the market. The presence of the

externality implies that there is too much entry of new firms in the market.

PRICE (Dollars per shirt)

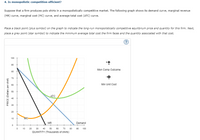

Transcribed Image Text:4. Is monopolistic competition efficient?

Suppose that a firm produces polo shirts in a monopolistically competitive market. The following graph shows its demand curve, marginal revenue

(MR) curve, marginal cost (MC) curve, and average total cost (ATC) curve.

Place a black point (plus symbol) on the graph to indicate the long-run monopolistically competitive equilibrium price and quantity for this firm. Next,

place a grey point (star symbol) to indicate the minimum average total cost the firm faces and the quantity associated with that cost.

(?

100

90

Mon Comp Outcome

80

70

60

Min Unit Cost

50

ATC

40

30

20

10

MC

MR

Demand

10

20

30

40

50

60

70

80

90

100

QUANTITY (Thousands of shirts)

PRICE (Dollars per shirt)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that the market for polos is a competitive market. The following graph shows the daily cost curves of a firm operating in this market. Esc 50 PRICE (Dollars per polo) 78°F Sunny 45 40 F1 35 30 25 20 15 10 5 0 + 0 + 2 F2 MC -0- + 4 ATC AVC 6 8 10 12 14 QUANTITY (Thousands of polos) F3 0+ F4 69 16 18 F5 20 a F6 i I F7 4- F8 Q+ H F9 F10 FO F11 F12 Fn Lock Insarrow_forwardProfit is the incentive that drives our market economy. Firms make production, pricing, andhiring decisions based on their quest for profit. But what happens when a firm discoversthat it can make dramatically higher profits by stopping production altogether? In December2000, due to wild swings in the market for electricity, Kaiser Aluminium faced just such adecision.Kaiser Aluminium had contracted with Bonneville power for all of its electricity needs andfound itself in the unique position of being an electricity consumer and, potentially, anelectricity reseller. By December 2000, Kaiser faced a difficult decision of continuing itscurrent aluminium production and profit levels, or closing the plant to dramatically increaseits profit by simply reselling its electricity.When making production decisions, firms must consider both their costs and revenues. Oneimportant concern for many firms is utility costs. In 1996, Kaiser Aluminium Corporation inSpokane, Washington, entered into a…arrow_forwardQuestion 21 A firm is a price taker only when the market is perfectly competitive. only when the market is perfectly competitive or monopolistic. Oonly when the market is perfectly competitive or monopolistically competitive. when the market is perfectly competitive, monopolistically competitive, or monopolistic. Question 22arrow_forward

- Suppose the graph depicts the marginal cost (MC) curves of two profit maximizing Texas cotton farmers, Jesse and Neal. Assume Jesse and Neal sell their cotton in the same competitive market. What is the most efficient way for Jesse and Neal to produce a total of 1200 bales of cotton? Jesse's optimal output: Neal's optimal output: 400 Incorrect 200 Incurrect bales bales Price and cost $10- 9- 8- 7- 6- MC MC 0 100 200 300 400 500 600 700 800 900 1000 Bales of cottonarrow_forwardThe American market for shoes is a good example of monopolistic competition. In a situation where Adidas is earning a large economic profit in the short-run, Nikemay try to increase their advertising to capture some of that business, If Nike is successful in their campaign, what would happen to the demand curve for Adidas and the price at which they can sell?O a. The demand curve shifts up and to the right, and the price rises.O b. The demand curve shifts up and to the right, and the price falls.O c. The demand curve shifts down and to the left, and the price walls.O d. The demand curve shifts down and to the left, and the price rises.Oe. Nike cannot affect the demand for Adidas since this is a monopolistically competitive market.arrow_forwardConsider the competitive market for rhenium. Assume that no matter how many firms operate in the industry, every firm is identical and faces the same marginal cost (MC), average total cost (ATC), and average variable cost (AVC) curves plotted in the following graph. 0 90 80 70 60 V 50 40 ATC 30 20 AVC MC D COSTS (Dollars per pound) PRICE (Dollars per pound) 100 90 80 70 60 The following graph plots the market demand curve for rhenium. 50 40 30 Use the orange points (square symbol) to plot the initial short-run industry supply curve when there are 10 firms in the market. (Hint: You can disregard the portion of the supply curve that corresponds to prices where there is no output since this is the industry supply curve.) Next, use the purple points (diamond symbol) to plot the short-run industry supply curve when there are 20 firms. Finally, use the green points (triangle symbol) to plot the short-run industry supply curve when there are 30 firms. 20 100 10 10 0 0 0 5 0 15 20 30 35 40…arrow_forward

- The following graph shows the daily market for small cardboard boxes in San Diego. PRICE (Dollars per small box 10 9 Demand 0 161 6 QUANTITY (Millions of small boxes) 2 Supply 19 10 Suppose that Talero is one of more than a hundred competitive firms in San Diego that produce such cardboard boxes. Based on the preceding graph showing the daily market demand and supply curves, the price Talero must take as given isarrow_forwardHelp me pleasearrow_forward12. Consider a duopoly market. Two firms are selling identical products and all costs are assumed to be zero for simplicity. Market demand schedule is given in the following table. Note that firms always choose an integer value for the quantity of production. Quantity Price Total Profit 3 $12 4 11 5 8 6 6. 7 4 8 2 1 10 a. Fill in the column of total profit.arrow_forward

- Uncertain if what I have is correctarrow_forwardThe market for agricultural products such as wheat or corn would best be described by which market model? O monopolistic competition Opure competition Opure monopoly oligopolyarrow_forwardSuppose the market for fast-food value meals is monopolistically competitive, with many restaurants selling their own brand of food. Assume the restaurants in the industry behave optimally by maximizing profit. The figure to the right represents the market for one monopolistically competitive firm's value meals. How will this figure change as the market moves toward long-run equilibrium? In the long run, O A. the average cost curve and the marginal cost curve will shift up because the firms are currently making profit. O B. the demand curve will shift to the left and become more elastic because the firms are currently making profit. nothing will change because monopolistically competitive markets have barriers to new firms entering. OC. O D. the demand curve will shift to the right and become more elastic because the firms are currently experiencing losses. O E. nothing will change because the firms in this market are breaking even. Price and cost (per value meal) 8.00- 7.60- 7.20 6.80…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education