FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

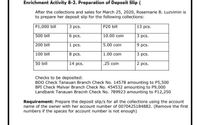

Transcribed Image Text:Enrichment Activity 8-2. Preparation of Deposit Slip (

After the collections and sales for March 25, 2020, Rosemarie B. Luzvimin is

to prepare her deposit slip for the following collections:

P1,000 bill

3 pcs.

P20 bill

13 pcs.

500 bill

6 pcs.

10.00 coin

3 рcs.

200 bill

1 pcs.

9 pcs.

5.00 coin

100 bill

8 pcs.

1.00 coin

3 pcs.

50 bill

14 pcs.

.25 coin

2 pcs.

Checks to be deposited:

BDO Check Tanauan Branch Check No. 14578 amounting to P5,500

BPI Check Malvar Branch Check No. 454532 amounting to P9,000

Landbank Tanauan Bracnh Check No. 789923 amounting to P12,250

Requirement: Prepare the deposit slip/s for all the collections using the account

name of the owner with her account number of 0070425184882. (Remove the first

numbers if the spaces for account number is not enough)

Transcribed Image Text:A. Assuming the bank account is in Metrobank.

Metrobank

DEPOSIT SLIP

METROPOLITAN BANE A TRUSE COMPANT

ACCOUNT NUMBER

ACCOUNT NAME

O COLLECTION ITEM

DOTHERS

O POSTDATED CHECK

OSUBJECT TO LATER VERIFICATION (For Depost Pick-up Oniy)

THIS IS YOUR RECEIPT WHEN MACHNE VALIDATED

PLEASE USE ONE FORM FOR EACH CURRENCY TYPE OF DEPOSIT OR CHECK TYPE THIS S ACEPTED SUBJECT TO THE

TERMS AND CONDITIONS COVERING THIS ACCOUNT CHECKS ACCEPTED I RECEMED FOR COLLECTION WILL BE CREDITED

TO YOUR ACCOUNT ONLY UPON RECEPT OF PROCEEDS PLEASE DO NOT LEAVE YOUR DEPOSIT WITHOUT WITNESSING

THE ACTUAL COUNTING AND VALIDATION BY THE TELLER

CASH DENOMINATION BREAKDOWN

DENOMINATION

NO OF PIECES

AMOUNT

COINS

TOTAL CASH DEPOSIT

CHECK DEPOSIT

PLEASE LIST EACH CHECK AND ENDORSE PROPERLY, KINDLY MARK WITH () CCIGC/DO COLUMN IF

CHECK DEPOSIT MADE IS IN THE FORM OF CASHIER'S CHECKIGIFT CHECK OR LOCAL DEMAND DRAFT

CCIGC

DD

BANKBRANCH

CHECK NUMBER

AMOUNT

TOTAL CHECK DEPOSIT

NO OF CHECRS

TOTAL DEPOSIT

Signature/Conforme of Depositor

Date

Approved By

MB-DEPARev. Mat 11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Answer the balance...arrow_forward10:33 W n Learning Objective 6 1. Adjusted Balance $17,580 The May cash records of Donald Insurance follow: Date Cash Receipts May 4 9 14 17 31 Cash Debit $ 4,230 со 520 530 1,950 1,840 Check No. 1416 1417 1418 1419 1420 1421 1422 Cash Payments 424/ 1480 QAA ▶ICO Cash Credit Donald's Cash account shows a balance of $17,750 at May 31. On May 31, Donald Insurance received the following bank statement: 5G`ll 72% $890 120 630 1,090 1,420 900 670 ||| 0 < :arrow_forwards/ui/v2/assessment-player 80 F3 $ OCT 26 4 Q F4 Question 1 of 1 The statement from Jackson County Bank on December 31 showed a balance of $26,662. A comparison of the bank statement with the Cash account revealed the following facts. 1. 2 3. Your answer is incorrect. 4 The bank collected a note receivable of $2,500 for Sheffield Corp. on December 15 through electronic funds transfer. The December 31 receipts were deposited in a night deposit vault on December 31. These depasits were recorded by the bankid January Checks outstanding on December 31 totaled $1.200. On December 31, the bank statement showed an NSF charge of $630 for a check received by the company from L. Bryan, a customer on account Prepare a bank reconciliation as of December 31 based on the available information. (Hint: The cash balance per books is $26,292. This can be proved by finding the balance in the Cash account from parts (a) and (b)) (List items that increase cash balance first Reconcile cash balance per bank…arrow_forward

- The bank statement for Unique Fashion had an ending cash balance of $2,200 on April 30, 2022. On this date the cash balance in their general ledger was $3,678. After comparing the bank statement with the company records, the following information was determined. The bank returned an NSF cheque in the amount of $350 that Unique Fashion deposited on April 20. The NSF service fee was $9. A direct deposit received from a customer on April 29 in payment of their accounts totaling $3,780. This has not yet been recorded by the company. On April 29, the bank deposited $16 for interest earned. The bank withdrew $35 for bank service charges. Deposits in transit on April 30 totalled $4,880. Required Reconcile the ledger and bank statement and create the required journal entries. Do not enter dollar signs or commas in the input boxes. Do not use negative signs. Select the proper order for the headings of the Bank Reconciliation. Cash balance per bank statement Add Outstanding deposit Adjusted bank…arrow_forwardPlease Helparrow_forwardQUESTION 9 Assume thst the Polty Casdwor of a $400 potty cash fund has $40 in canh phs So0 in recopts at the end of then monh The entry to replereh mburse) the petty cns fund wi wude O A dobt to Cash for $00 O A crede to Cash for S00 O Ac to Cash for S40 O Adebit lo Cash kor $340arrow_forward

- A5arrow_forwardАсcount Typе Opening Deposit Rate(APR) APY Checking - Variable Rate $0 0.25% 0.25% Money Market - Variable Rate $250.00 1.00% 1.01% Summer Cash - Variable Rate $0 0.99% 1.00% Holiday Cash - Variable Rate $0 0.75% 0.75%arrow_forwardWhat is the journal entry to replenish the petty cash fund if expenses were Auto Expenses $75, Office Expenses $25, Postage $11. and cash on hand is $389. The Petty Cash fund started with $500. Edit View Insert Format Tools Table |BIUAv eu Ti v|: 12pt v Paragraph v hp 16 fa 19 ho 144 IOI 4 00arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education