FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

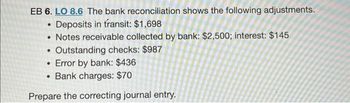

Transcribed Image Text:EB 6. LO 8.6 The bank reconciliation shows the following adjustments.

Deposits in transit: $1,698

• Notes receivable collected by bank: $2,500; interest: $145

●

Outstanding checks: $987

• Error by bank: $436

• Bank charges: $70

Prepare the correcting journal entry.

.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bank Reconciliation The following data were gathered to use in reconciling the bank account of Azalea Company: Balance per bank $ 17,300 Balance per company records 9,455 Bank service charges 35 Deposit in transit 3,700 Note collected by bank with $100 interest 5,350 Outstanding checks 6,230 a. What is the adjusted balance on the bank reconciliation? b. Journalize any necessary entries for Azalea Company based on the bank reconciliation. f an amount box does not require an entry, leave it blank. Cash Accounts Receivable Miscellaneous Expense Casharrow_forwardPROBLEM 4: MULTIPLE CHOICE-COMPUTATIONAL 1. In preparing its August 31, 2004 bank reconciliation, Cloud Corp. has made available the following information: P25,650 Balance per bank statement, 8/31/04 Deposit in transit, 8/31/04 5,900 600 Return of customer's check for insufficient funds Outstanding checks, 8/31/04 750 100 Bank service charges for August Erroneous credit by bank 2,000 At August 31, 2004, Cloud's correct cash balance is a. P28,800. b. P28,200. c. P28,100. d. P26,500. (Adapted)arrow_forwardEB7. LO 8.6Using the following information, prepare a bank reconciliation. Bank balance: $4,021 Book balance: $2,928 Deposits in transit: $1,111 Outstanding checks: $679 Bank charges: $35 Notes receivable: $1,325; interest: $235arrow_forward

- QUESTION 4 E8.9 E8.9 (LO 3) Don Wyatt is unable to reconcile the bank balance at January 31. Don's reconciliation is as follows. Prepare bank reconciliation and adjusting entries. Cash balance per bank $3,560.20 Add: NSF check 490.00 Less: Bank service charge 25.00 Adjusted balance per bank $4,025.20 $3,875.20 Cash balance per books Less: Deposits in transit Add: Outstanding checks 530.00 730.00 Adjusted balance per books $4,075.20 Instructions a. Prepare a correct bank reconciliation. b. Journalize the entries required by the reconciliation.arrow_forwardneed answer pleasearrow_forwardN3. Accountarrow_forward

- Requirement 1. Prepare White Photography's bank reconciliation at November 30, 2024. Prepare the bank portion of the reconciliation, followed by the book portion of the reconciliation. (If a box is not used in the table leave the box empty; do not select a label or enter a zero.) White Photography 1 Bank Statement Bank Reconciliation i Checkbook November 30, 2024 Balance 535 Bank: Deposits 105 Date Check No. Item Check Deposit Balance Checks: No. Amount ADD: Nov. 1 $ 535 622 $ 25 Nov. 4 622 Quick Mailing $ 25 510 623 45 LESS: Nov. 9 Service Revenue $ 105 615 624 95 Nov. 13 623 Photo Supplies 45 570 70 Nov. 14 Utilities 65 625 (235) 624 505 Nov. 18 625 Cash 70 Other charges: 435 Printed checks $ 30 Nov. 26 626 Office Supplies 80 355 Nov. 28 Service charge 35 (65) 627 Upstate Realty Co. 255 100 O Requirements $ 340 Nov. 30 Service Revenue 1,200 1,300 Balance "This is the correct amount for check number 624. 1. Prepare White Photography's bank reconciliation at November 30, 2024. Print…arrow_forward6. After comparing your bank statement, canceled checks, and checkbook register, complete the reconciliation statement shown below. What are the new and adjusted balances? Reconciliation Statement Check Register Balance Service Charge NEW BALANCE> 285.14 -8.10 Reconciliation statement Provided for your convenience Statement Balance Outstanding Checks # 202 # 203 $35.92 $28.75 Total Checks > (-) Outstanding Deposits 4/8 4/16 $129.08 $30.00 Total Deposits> (+) ADJUSTED BALANCE 182.63arrow_forwardUsing the following information, prepare a bank reconciliation. • Bank balance: $4,687 • Book balance: $5,690 • Deposits in transit: $1,546 • Outstanding checks: $956 • Interest income: $53 • NSF check: $466 Bank Reconciliation Bank Statement Balance at (date) Add: Less: Adjusted Bank Balance Book Balance at (date) Add: Less: Adjusted Book Balancearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education