FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

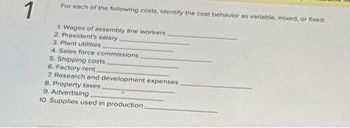

Transcribed Image Text:1

For each of the following costs, identify the cost behavior as variable, mixed, or fixed:

1. Wages of assembly line workers

2. President's salary.

3. Plant utilities,

4. Sales force commissions

5. Shipping costs

6. Factory rent.

7. Research and development expenses

8. Property taxes

9. Advertising.

10. Supplies used in production

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The plant manager's salary * Product Cost Period Costarrow_forwardIndicate whether each cost is: A. Fixed or Variable b. Selling, General/Administrative, or Manufacturingarrow_forwardNumber the following in the order of the flow of manufacturing costs for a company: a. Closing under/overapplied factory overhead to cost of goods sold b. Materials purchased c. Factory labor used and factory overhead incurred in production d. Completed jobs moved to finished goods e. Factory overhead applied to jobs according to the predetermined overhead rate f. Materials requisitioned to jobs g. Selling of finished product h. Preparation of financial statements to determine gross profitarrow_forward

- 5arrow_forwardFor apparel manufacturer Abercrobmie & Fitch, Inc., classify each of the following costs as either a product cost or a period cost: Research and development costs Depreciation on sewing machines Fabric used during production Depreciation on office equipment Advertising expenses Repairs and maintenance costs for sewing machines Salary of production quality control supervisor Utility costs for office building Sales commissions Salaries of distribution center personnel Wages of sewing machine operators Factory janitorial supplies Chief financial officer’s salary Travel costs of media relations employees Factory supervisors’ salaries Oil used to lubricate sewing machines Property taxes on factory building and equipmentarrow_forwardWhich one of the following represents a period cost? 1) The VP of Sales' salary and benefits 2) Overhead allocated to the manufacturing operations 3) Labor costs associated with quality control 4) Fringe benefits associated with factory workersarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education