FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

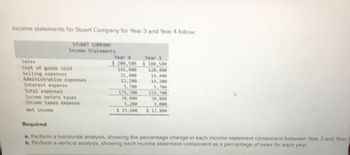

Transcribed Image Text:Income statements for Stuart Company for Year 3 and Year 4 follow:

STUART COMPANY

Income Statements

Sales

Cost of goods sold

Selling expenses

Administrative expenses

Interest expense

Total expenses

Income before taxes

Income taxes expense

Net income

Required

Year 4

$ 200,500

142,400

21.400

12,200

Year 3

$ 180,500

120,400

19,400

179,700

20,800

5,200

3.000

$ 15,600 $ 17.800

159,700

a. Perform a horizontal analysis, showing the percentage change in each income statement component between Year 3 and Year

b. Perform a vertical analysis, showing each income statement component as a percentage of sales for each year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Income statements for Walton Company for Year 3 and Year 4 follow: WALTON COMPANY Income Statements Sales Cost of goods sold Selling expenses Administrative expenses Interest expense Total expenses Income before taxes Income taxes expense Net income Required A Required B Year 4 $200, 300 143,300 20,900 12,900 3,200 Required a. Perform a horizontal analysis, showing the percentage change in each income statement component between Year 3 and Year 4. b. Perform a vertical analysis, showing each income statement component as a percentage of sales for each year. Sales Cost of goods sold Selling expenses Administrative expenses Interest expense Total expenses Income before taxes Complete this question by entering your answers in the tabs below. Income taxes expense Net income (loss) $180,300 $160,300 20,000 20,000 3,300 5,600 $ 14,400 $ 16,700 WALTON COMPANY Horizontal Analysis of Income Statements Perform a horizontal analysis, showing the percentage change in each income statement…arrow_forwardPrepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for the current year when compared with the previous year. If required, round to one decimal place. Yesarrow_forwardUsing the income statement for Times Mirror and Glass Co., compute the following ratios: TIMES MIRROR AND GLASS Co. Income Statement Sales Cost of goods sold Gross profit Selling and administrative expense Lease expense Operating profit* Interest expense Earnings before taxes Taxes (30%) Earnings after taxes *Equals income before interest and taxes. a.Compute the interest Interest coverage ge ratio. (Round yo times $ 223,000 130,000 $ 93,000 44,000 19,100 $ 29,900 10,600 times $ 19,300 7,720 $ 11,580 answer to 2 decimal places.) b.Compute the fixed charge coverage ratio. (Round your answer to 2 decimal places.) Fixed charge coveragearrow_forward

- CAN SOMEONE HELP ME WITH THE RATIOS? The comparative statements of Wahlberg Company are presented here. Wahlberg CompanyIncome StatementFor the Years Ended December 31 2020 2019 Net sales $1,813,600 $1,750,700 Cost of goods sold 1,007,100 978,000 Gross profit 806,500 772,700 Selling and administrative expenses 519,800 472,000 Income from operations 286,700 300,700 Other expenses and losses Interest expense 17,100 14,200 Income before income taxes 269,600 286,500 Income tax expense 80,015 77,500 Net income $ 189,585 $ 209,000 Wahlberg CompanyBalance SheetsDecember 31 Assets 2020 2019 Current assets Cash $60,600 $64,600 Debt investments (short-term) 69,100 50,300 Accounts receivable 117,500 102,800 Inventory 123,600 115,600 Total…arrow_forwardPrepare common size income statements Which company earns more net income? Which companies net income has a higher percentage of its net sales revenue?arrow_forwardCochran corporation, Inc. has the following income statement: Cochran corporation, Inc. Income statement For the year ended December 31, 2021 net sales $240 Cost of goods sold $150 gross profit $90 Operating expenses $65 Net income $25 Using vertical analysis, what percentage is assigned to operating expenses? a. 27,1% b. 43.3% c. 72.2% d. 260.0%arrow_forward

- Please do not give salutations in image formatarrow_forwardSome recent financial statements for Smolira Golf Corporation follow. Assets Current assets Cash Accounts receivable Inventory Total Total assets Fixed assets Net plant and equipment $336,695 Sales Cost of goods sold Depreciation Taxable income Taxes (22%) Net income SMOLIRA GOLF CORPORATION 2021 Income Statement Earnings before interest and taxes Interest paid Dividends Retained earnings a. Current ratio b. Quick ratio c. Cash ratio Short-term solvency ratios: Asset utilization ratios: d. Total asset turnover e. Inventory tumover 1. Receivables turnover 2020 $23,066 $25,300 13,648 16,400 27,152 28,300 $63,866 $70,000 g. Total debt ratio h. Debt-equity ratio I. Equity multiplier Long-term solvency ratios: Times Interest emned K Cash coverage ratio Profitability ratios: SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 $ 400,561 $ 434,000 1. Profit margin m. Return on assels n. Return on equity $ 364,000 $ 22,000 19,891 Find the following financial ratios for Smolira Golf…arrow_forwardSales. Costs and expenses Cost of goods sold. Operating expenses. Interest expense... Income before income taxes. Income tax expense.. Net income.. Statement of Income For the Year Ended December 31, 2020 $1,140,000 $1,700,000 364,800 37,800 1,542,600 157,400 55,090 $ 102,310 GEORGE INDUSTRIES Statement of Financial Position December 31, 2020 Total assets. Total liabilities.. Total shareholders' equity... 2020 2019 $842,110 $717,800 329,600 279,600 512,510 438,200 Calculate the Net profit margin ratio (use up to 2 decimal places and do not use a % sign)arrow_forward

- Current Attempt in Progress Operating data for Grouper Corp. are presented as follows. Net sales Cost of goods sold Selling expenses Administrative expenses Income tax expense Net income 2022 $840,000 540,120 133,560 57,120 31,920 77,280 2021 $610,000 405,650 80,520 46,970 26,840 50,020 Prepare a schedule showing a vertical analysis for 2022 and 2021. (Round percentages to 1 decimal place, e.g. 12.1%.)arrow_forwardHere are the comparative condensed income statements of Concord Corporation. Concord Corporation Condensed Income Statements For the Years Ended December 31 Net sales Cost of goods sold Gross profit Operating expenses Net income (a) 2022 Net sales $636,000 502,440 133,560 89,040 $44,520 2022 2021 $524,000 Cost of goods sold 502,440 435,444 Prepare a horizontal analysis of the income statement data for Concord Corporation, using 2021 as a base. (Show the amounts of increase or decrease.) (Enter negative amounts and percentages using either a negative sign preceding the number e.g. -45, -45% or parentheses e.g. (45), (45%). Round percentages to 1 decimal place, e.g. 12.3%.) 88,556 49,780 $38,776 2021 CONCORD CORPORATION Condensed Income Statements $636,000 $524,000 435,444 $ Increase or (Decrease) During 2022 Amount Percentage % %arrow_forwardNet sales Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense Net income Current assets Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders' equity Total assets Total stockholders' equity Current liabilities Target Corporation Income Statement Data for Year $65,357 45,583 15,101 707 (94) 1,384 $ 2,488 $18,424 26,109 Balance Sheet Data (End of Year) $44,533 $11,327 17,859 15,347 Walmart Inc. $44,533 $408,214 304,657 79,607 10,512 2,065 (411) 7,139 $ 14,335 $48,331 122,375 $170,706 $55,561 44,089 71,056 $170,706 Beginning-of-Year Balances $44,106 13,712 $163,429 65,682 55,390arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education