FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

1. Should SS upgrade its production line or replace it? Show your calculations

2. Suppose the one-time equipment cost to replace the production equipment is negotiable.

All other data are as given previously. What is the maximum one-time equipment cost that SS

would be willing to pay to replace the old equipment rather than upgrade it?

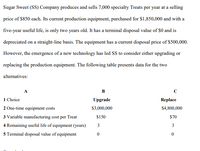

Transcribed Image Text:Sugar Sweet (SS) Company produces and sells 7,000 specialty Treats per year at a selling

price of $850 each. Its current production equipment, purchased for $1,850,000 and with a

five-year useful life, is only two years old. It has a terminal disposal value of $0 and is

depreciated on a straight-line basis. The equipment has a current disposal price of $500,000.

However, the emergence of a new technology has led SS to consider either upgrading or

replacing the production equipment. The following table presents data for the two

alternatives:

A

в

1 Choice

Upgrade

Replace

2 One-time equipment costs

$3,000,000

$4,800,000

3 Variable manufacturing cost per Treat

$150

$70

4 Remaining useful life of equipment (years)

3

3

5 Terminal disposal value of equipment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the alternatives do you think Barry should select? Why? (Select the best choice below.) A. Alternative B should be selected because it has the highest NPV. B. This cannot be determined from the information provided. C. Alternative B should be selected because its equivalent annual cost is less per year than the annual equivalent cost for Alternative A. D. Alternative A should be selected because its equivalent annual cost is less per year than the annual equivalent cost for Alternative B.arrow_forwardThe lower the MARR (minimum attractive rate of return), the higher the price that a company should be willing to pay for equipment that reduces annual operating expenses. A) True (B) Falsearrow_forward12. Which of the following will increase a company's overall equipment effectiveness (OEE)? Decrease in Machine Time Available Decrease in Ideal Run Rate Yes Yes A) B) C) D) Yes No No Yes No No A. Choice A B. Choice B C. Choice C D. Choice Darrow_forward

- If, for competitive reasons, Washburn eventually has to move all its product ion back to Asia, (a) which specific fixed and variable costs might be lowered and (b) what additional fixed and variable costs might it expect to incur?arrow_forwardAssuming that all other factors remain unchanged, determine how a firm’s breakeven point is affected by each of the following: a. The firm finds it necessary to reduce the price per unit because of increased foreign competition. b. The firm’s direct labor costs are increased as the result of a new labor contract. c. The Occupational Safety and Health Administration (OSHA) requires the firm to install new ventilating equipment in its plant. (Assume that this action has no effect on worker productivity.)arrow_forwardREQUIRED Use the information provided below to answer the following questions: 3.1. Calculate the Payback period for the HMC. 3.2. Calculate the Net Present Value for both the HMC and VMC. 3.3. Calculate the Internal Rate of Return (IRR) for the HMC and VMC. 3.4. Which configuration of the CNC machining centres should SMT purchase, if any? Motivate your answer by referring to the answers obtained in questions 3.3 and 3.4. INFORMATION Southern Manufacturing Tools Limited (SMT) is considering the purchase of a Computer Numerical Control (CNC) machining centre for its operations. Two configurations of the CNC machining centres are available: horizontal CNC machining centre (HMC) and vertical CNC machining centre (VMC). Both the HMC and VMC will require an initial investment of R10 000 000, will have a useful life of 7 years and a residual value of R1 500 000. SMT uses the straight-line method of depreciation. The expected net cash inflows of the VMC are expected to be R2 100 000…arrow_forward

- Can you help me solve this?arrow_forwardI also have some confuse for the decision: system B is more beneficial then system A due to lower negative NPV from system A. Should we need compare with negative NPV or cost per year? For negative NPV, system A ($541,843)is lower negative NPV than system B($706,984.82). On the other hand, system B ($167,116.14) is lower cost of each year than system A ($174,652.85). Thank you ~arrow_forwardplease help me, thank youarrow_forward

- When evaluating if a company should accept a new contract to produce more product it should: Evaluate all possible fixed cost of accepting the contract. Evaluate the propose contract using a contribution margin approach. Accept the new contract if the sales price for the product is equal to or higher than the current sale price. Accept the new contract if fixed costs will remain the same.arrow_forwardThe purchase or construction of specialized equipment such as a nuclear power plant is considered O none of these answers is correct an average cost O a non recoverable cost O a marginal cost O a recoverable costarrow_forwardWhich of the following is not considered a capital investment? 18 Multiple Cholce Ask The development of a new product line. The purchase of a large machine. The acquisition of a subsidlary company. The purchase of a large order of raw materlals used In the production process.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education