Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Give me proper answer with full calculation and explanation otherwise i give multiple downvote

Note:-

Please avoid using ChatGPT and refrain from providing handwritten solutions; otherwise, I will definitely give a downvote. Also, be mindful of plagiarism.

Answer completely and accurate answer.

Rest assured, you will receive an upvote if the answer is accurate.

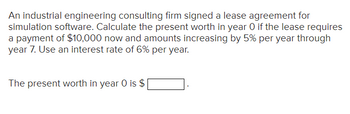

Transcribed Image Text:An industrial engineering consulting firm signed a lease agreement for

simulation software. Calculate the present worth in year O if the lease requires

a payment of $10,000 now and amounts increasing by 5% per year through

year 7. Use an interest rate of 6% per year.

The present worth in year 0 is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- it is not correct, some calculations are wrong, can you try againarrow_forward1. Choose the ethical considerations that Amahle Khumalo should recognize in deciding how to proceed. Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect. Check my work is not available. Khumalo should exercise initiative and good judgment in providing management with information having a potentially adverse economic impact Khumalo should determine whether the controller's request violates her professional or personal standards or the company's code of ethics. ? Khumalo should protect proprietary information and should not violate the chain of command by discussing this matter with the controller's superiors ?Khumalo should not try to convince the controller regarding the probable failure of reworks.arrow_forwardSearch Google images for bad data visualizations. Post a link to the image.Describe what is inaccurate or misleading about the visualization. Replace the inaccurate and misleading information with what you think makes the image a good visualization.arrow_forward

- Im having an issue with this problem. Thank you!arrow_forwardMatch each of the components of faithful representation with its definition.Faithful Representation Definition1 . Freedom from error a. All information necessary to describe an item is reported. 2. Neutrality b. Information that does not bias the decision maker. 3. Completeness c. Reported amounts reflect the best available information.arrow_forward1. Having a clean electronic image includes: A. Maintaining a professional voice mail message B. Maintaining a professional e-mail address C. Evaluating your Internet social networking sites D. All of these 2. Personal references should: A. Be included on a résumé and cover letter B. Not be included on a résumé or cover letter C. Only be listed on your résumé D. Only be listed on your cover letter 3. Self-discovery is the process of: A. Identifying your key selling points B. Identifying key skills C. Identifying key interests D. All of thesearrow_forward

- How would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardPlease do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forwardDuring the research process, if you are unsure whether or not you've found all the relevant literature, what should you do? A. Google it to see if there is anything else you've missed. B. Call your manager to verify that you've found it all. C. Use the search engine included in the Codification. D. Complain that it's too much work and call it a day.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education