FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

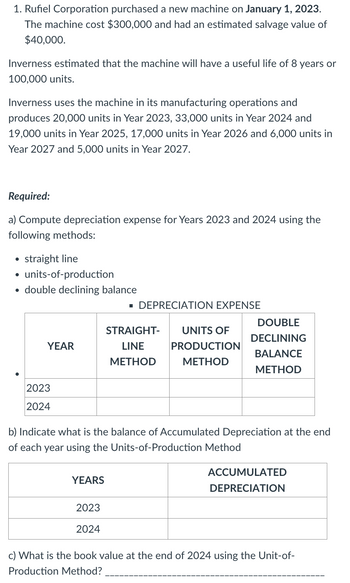

Transcribed Image Text:1. Rufiel Corporation purchased a new machine on January 1, 2023.

The machine cost $300,000 and had an estimated salvage value of

$40,000.

Inverness estimated that the machine will have a useful life of 8 years or

100,000 units.

Inverness uses the machine in its manufacturing operations and

produces 20,000 units in Year 2023, 33,000 units in Year 2024 and

19,000 units in Year 2025, 17,000 units in Year 2026 and 6,000 units in

Year 2027 and 5,000 units in Year 2027.

Required:

a) Compute depreciation expense for Years 2023 and 2024 using the

following methods:

• straight line

•

units-of-production

• double declining balance

■ DEPRECIATION EXPENSE

2023

DOUBLE

STRAIGHT-

YEAR

LINE

METHOD

UNITS OF

PRODUCTION

DECLINING

BALANCE

METHOD

METHOD

2024

b) Indicate what is the balance of Accumulated Depreciation at the end

of each year using the Units-of-Production Method

YEARS

ACCUMULATED

DEPRECIATION

2023

2024

c) What is the book value at the end of 2024 using the Unit-of-

Production Method?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- ! Required information [The following information applies to the questions displayed below.] Wardell Company purchased a minicomputer on January 1, 2022, at a cost of $40,000. The computer was depreciated using the straight-line method over an estimated five-year life with an estimated residual value of $4,000. On January 1, 2024, the estimate of useful life was changed to a total of 10 years, and the estimate of residual value was changed to $900. Required: 1. Prepare the year-end journal entry for depreciation on December 31, 2024. No depreciation was recorded during the year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to nearest whole dollar. View transaction list t 1 ences Journal entry worksheet 1 Record depreciation expense for 2024. Note: Enter debits before credits. Event 1 General Journal Debit Creditarrow_forwardOn April 17, 2024, the Loadstone Mining Company purchased the rights to a copper mine. The purchase price plus additional costs necessary to prepare the mine for extraction of the copper totaled $5,200,000. The company expects to extract 1,040,000 tons of copper during a four-year period. During 2024, 254,000 tons were extracted and sold immediately. Required: Calculate depletion for 2024. Is depletion considered part of the product cost and included in the cost of inventory?arrow_forwardGadubhaiarrow_forward

- On January 1, 2020, Northeast USA Transportation Company purchased a used aircraft at a cost of $64,400,000. Northeast USA expects the plane to remain useful for five years (6.000,000 miles) and to have a residual value of $6,400,000. Northeast USA expects to fly the plane 725,000 miles the first year, 1,300,000 miles each year during the second, third, and fourth years, and 1,375,000 miles the last year. Read the requirements 1. Compute Northeast USA's depreciation for the first two years on the plane using the straight-line method, the units-of-production method, and the double-declining balance method. a. Straight-line method Using the straight-line method, depreciation is for 2020 and for 2021.arrow_forwardVinubhaiarrow_forwardmgarrow_forward

- On March 1, 2024, a company entered into an agreement with the state to obtain the rights to operate a mineral mine for $6 million. The mine is expected to produce 155,000 tons of mineral. As part of the agreement, the company agrees to restore the land to its original condition after mining operations are completed in approximately five years. Management has provided the following possible outflows for the restoration costs that will occur five years from now: (PV of $1. PVA of $1) Cash Outflow $ 520,000 675,000 830,000 Probability 20% 30% 50% The company's credit-adjusted risk-free interest rate is 9%. During 2024, the company extracted 27,900 tons of ore from the mine. How much accretion expense will the company record in its income statement for the 2024 calendar year? Multiple Choicearrow_forwardreplace its current equipment with new high-tech equipment. The existing equipment was purchased 5 years ago at a cost of $121,000. At that time, the equipment had an expected life of 10 years, with no expected salvage value. The equipment is being depreciated on a straight-line basis. Currently, the market value of the old equipment is $42,900. The new equipment can be bought for $174,340, including installation. Over its 10-year life, it will reduce operating expenses from $190,000 to $145,400 for the first six years, and from $203,600 to $193,600 for the last four years. Net working capital requirements will also increase by $20,200 at the time of replacement. It is estimated that the company can sell the new equipment for $24,400 at the end of its life. Since the new equipment's cash flows are relatively certain, the project's cost of capital is set at 9%, compared with 15% for an average-risk project. The firm's maximum acceptable payback period is 5 years. Click here to view the…arrow_forwardDevon Manufacturing Company purchased a new canning machine on July 1, 2015, for $190,000. The estimated salvage value is $15,000. The company uses units-of-production depreciation and estimates the machine will produce 125,000 units during its useful life. In 2015, the company manufactured 5,000 units after acquiring the machine. Depreciation expense for 2015 will be $7,600 $6,500 $14,000 $7,000arrow_forward

- Vikarmbhaiarrow_forwardI want to answer the questionarrow_forwardRussell Industries is considering replacing a fully depreciated machine that has a remaining useful life of 10 years with a newer, more sophisticated machine. The new machine will cost $194,000 and will require $29,400 in installation costs. It will be depreciated under MACRS using a 5-year recovery period Percentage by recovery year* Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9% 7% 8 4% 6% 9 6% 10 6% 11 4% Totals 100% 100% 100% 100% A $30,000 increase in net working capital will be required to support the new machine. The firm's managers plan to evaluate the potential replacement over a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education