FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Absorption and variable costing. (CMA) Miami, Inc., planned and actually manufactured 250,000 units of its single product in 2017, its rst year of operation. Variable manufacturing cost was $19 per unit produced. Variable operating (nonmanufacturing) cost was $13 per unit sold. Planned and actual xed

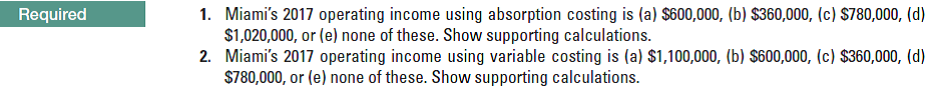

Transcribed Image Text:1. Miami's 2017 operating income using absorption costing is (a) $600,000, (b) $360,000, (c) $780,000, (d)

$1,020,000, or (e) none of these. Show supporting calculations.

2. Miami's 2017 operating income using variable costing is (a) $1,100,000, (b) $600,000, (c) $360,000, (d)

$780,000, or (e) none of these. Show supporting calculations.

Required

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Grey Inc. has been purchasing a component, Z for $85 a unit. The company is currently operating at 75% of full capacity, and no significant increase in production is anticipated in the near future. The cost of manufacturing a unit of Z, determined by absorption costing method, is estimated as follows: Direct materials $30 Direct labor 15 Variable factory overhead 26 Fixed factory overhead 10 Total $81 Prepare a differential analysis report, dated March 12 of the current year, on the decision to make or buy Part Z. Grey Inc. Proposal to Manufacture Part Z March 12, 20XX Purchase price of Part Z Differential cost to manufacture Z: Direct materials X Direct labor X Variable factory overhead X Cost savings from manufacturing Part Zarrow_forwardNonearrow_forwardKidsPlay, Inc., manufactures and sells table sets. In 2016, it reported the following: Units Produced and sold 3,000 Operating income per unit ($450,000 ¸ 3,000) $150 Selling price ($1,500 + $150) $1,650 Full cost per unit (150 ÷ 0.10) $1,500 Variable Costs per unit $600 Markup percentage on variable cost ($1,050 ¸ $600) 175% KidsPlay is considering increasing the annual spending on advertising by $200,000. The managers believe that the investment will translate into a 10% increase in unit sales. Should the company make the investment? What is the change in operation income? Group of answer choices a) Yes, $45,000 b) Yes, $115,000 c) Yes,…arrow_forward

- Laser Cast Inc. manufactures color laser printers. Model J20 presently sells for $325 and has a product cost of $260, as follows: Line Item Description Amount Direct materials $190 Direct labor 50 Factory overhead 20 Total $260 It is estimated that the competitive selling price for color laser printers of this type will drop to $310 next year. Laser Cast has established a target cost to maintain its historical markup percentage on product cost. Engineers have provided the following cost-reduction ideas: 1. Purchase a plastic printer cover with snap-on assembly, rather than with screws. This will reduce the amount of direct labor by 9 minutes per unit.2. Add an inspection step that will add six minutes per unit of direct labor but reduce the materials cost by $7 per unit.3. Decrease the cycle time of the injection molding machine from four minutes to three minutes per part. Thirty percent of the direct labor and 45% of the factory overhead are related to running injection…arrow_forwardBridgeport sells its product for $82 per unit. During 2025, it produced 120400 units and sold 105100 units. Costs per unit are: direct materials $25, direct labor $9, variable overhead $4, and variable operating expenses $2. Fixed costs are $722400 manufacturing overhead, and $77500 operating expenses. Assuming no variances were reported, no beginning inventory exists, and the company uses absorption costing, what will be reported as operating income? O $3211200. ○ $3706100. O $3421400. O $3601000. iarrow_forward! Required information [The following information applies to the questions displayed below.] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense 2. For financial accounting purposes, what is the total amount of period costs incurred to sell 10,000 units? (Do not round intermediate calculations.) X Answer is complete but not entirely correct. $ 65.000 x Average Cost Per Unit $ 6.30 $ 3.80 $ 1.50 $ 4.00 $ 3.30 $ 2.00 $ 1.00 $ 0.50 Total period costarrow_forward

- Steel Metals Ltd manufactures and sells iron rods that is used in the construction of roads. The product is manufactured and sold in 20' long rods. The product is generally produced and sold to match customer demand, and there is not a significant amount of finished goods inventory at any point in time. Summary information for 2020 is as follows: Sales were $20,000,000, consisting of 5,000,000 rods. Total variable costs were $11,000,000. Total fixed costs were $8,000,000. Net income was $1,000,000. The general economic conditions appear to be deteriorating heading into 2021, and there is some concern about a reduction in sales volume. The following questions should each be answered independent of one another. Required: a) What is the company's break-even point in 20' long rods? b) Can the company sustain a 30% reduction in total volume, and remain profitable? c) The company's sole shareholder, Pant Sharma, generally lives off dividends paid by the business. The business typically…arrow_forwardNeed help pleasearrow_forwardSagararrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education