Microeconomics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN: 9781305506893

Author: James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Don't use Ai

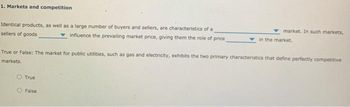

Transcribed Image Text:1. Markets and competition

Identical products, as well as a large number of buyers and sellers, are characteristics of a

sellers of goods

influence the prevailing market price, giving them the role of price

market. In such markets,

in the market.

True or False: The market for public utilities, such as gas and electricity, exhibits the two primary characteristics that define perfectly competitive

markets.

True

False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If you were developing a product (like a web browser) for a market with significant barriers to entry, how would you try to get your product into the market successfully?arrow_forwardMay and Raj me the only two growers who provide organically grown corn to a local grocery store. They know that if they cooperated and produced less corn, they could raise the price of the com. If they work independently, they will each earn 100. If they decide to work together and both lower their output, they call each earn 150. If one person lowers output and the other does not, the person who lowers output will earn $1 and the other person will capture the entire market and will earn 200. Table 10.6 represents the choices available to Mary and Raj. What is the best choice for Raj if he is sole that Mary will cooperate? If Mary thinks Raj will cheat, what should Mary do and why? What is the prisoners dilemma result? What is the preferred choice if they could ensure cooperation? A = Work independently; B = Cooperate and Lower Output. (Each results entry lists Rajs earnings first, and Marys earnings second.)arrow_forwardWonopoly and natural resource prices Suppose that a firm is the sole owner of a stock of a natural resource. a. How should the analysis of the maximization of the discounted profits from selling this resource (Equation 17.63 be modified to take this fact into account? b. Suppose that the demand for the resource in question had a constant elasticity form q(t)=a[p(t)]b . How would this change the price dynamics shown in Equation 17.67? c. How would the answer to Problem 17.7 be changed if the entire crude oil supply were owned by a single firm?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax