Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:**Mayo Clinic Overview**

**History and Expansion:**

- **1889:** Founded in Rochester, MN

- **1987:** Expanded to Jacksonville, FL

- **2016:** Over 50,000 employees

- **2018:** More than a million patients

**About Mayo Clinic:**

The Mayo Clinic is the world's largest integrated, not-for-profit medical group practice, with main facilities in Minnesota, Arizona, and Florida. It is recognized as one of the leading hospitals globally. The clinic’s mission is focused on people:

*To inspire hope and contribute to health and well-being by providing the best care to every patient through integrated clinical practice, education, and research.*

**Case Study: Darnell Johnson**

After obtaining a two-year degree in radiation therapy and accumulating three years of experience at a small hospital, Darnell Johnson began working at the Mayo Clinic with a salary of $63,500. The clinic contributes 6% of his salary to his retirement plan and allows him to contribute an additional 5% of his salary.

**Exercises:**

1. **Retirement Contribution Calculation:**

- Johnson decides to put 5% of his salary into his retirement plan in addition to the contribution by his employer. Find the total annual contribution into the retirement plan.

2. **Investment Growth Estimation:**

- Johnson decides to invest his retirement funds in a mutual fund with global stocks expected to yield 8% per year. Calculate the future value in his account after 12 years.

3. **Annual Payroll Estimation:**

- Assume the Mayo Clinic has exactly 55,000 employees, with the average salary per person, including physicians, being $87,300 per year (including health insurance costs). Estimate the annual payroll.

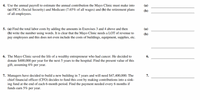

Transcribed Image Text:### Exercises on Financial Contributions and Calculations

4. **Calculate Annual Contributions:**

- Use the annual payroll to estimate the annual contribution the Mayo Clinic must make into:

- (a) FICA (Social Security) and Medicare, which is 7.65% of all wages.

- (b) The retirement plans of all employees.

- **Answer Spaces:**

- (a) ____________________

- (b) ____________________

5. **Determine Total Labor Costs:**

- (a) Find the total labor costs by adding the amounts in Exercises 3 and 4 above.

- (b) Write the number using words. It is evident that the Mayo Clinic requires a substantial amount of revenue to pay employees, not considering the costs of buildings, equipment, supplies, etc.

- **Answer Spaces:**

- (a) ____________________

- (b) ____________________

6. **Calculate Present Value of a Donation:**

- The Mayo Clinic saved the life of a wealthy entrepreneur who had cancer. He decided to donate $400,000 per year for the next 5 years to the hospital. Find the present value of this gift, assuming a 6% interest rate per year.

- **Answer Space:**

- 6. ____________________

7. **Funding for New Building:**

- Managers have decided to build a new building in 7 years and will need $47,400,000. The chief financial officer (CFO) decides to fund this cost by making contributions into a sinking fund at the end of each 6-month period. Find the payment needed every 6 months if the funds earn a 5% interest rate per year.

- **Answer Space:**

- 7. ____________________

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Jack, a stockbroker, was an inexperienced in tax. He has sought the advice of an independent designated tax professional to advise him on tax planning and tax shelter that he needs. Simon, who is a designated accountant who specialized in those areas, advised Jack to invest in a number of multiple unit residential building (MURBs), a real estate investment project as tax shelter, by the conventional wisdom, were safe and conservative. When the value of MURBs fell during a decline in the real estate market, Jack lost heavily in his investment. Though the advice was perfectly sound at the time it was given, but unknown to Jack, Simon was also acting as adviser for developers in restructuring the MURBs and did not disclose that fact to Jack. In the context of breach of contract, is Jack liable for the loss of investment? In the context of breach of fiduciary duty, is Jack liable as well? Does ethics issue involve? Please state your reasons. Mr. Hunt, who has just retired, set up an…arrow_forward3 00 Which of the following is/are fully exempt from Capital Gains Tax? Select one: O a. A family home which was owned for 15 years by the taxpayer and has been rented out for the last 7 years as the taxpayer relocated to the UK for work purposes. The owner, upon returning to Australia, has lived in the property for 2 months prior to selling the house (to fund the purchase of a new family home). There have been no other claims of main residence by the taxpayer. O b. A motor vehicle purchased by the taxpayer, held for 24 months then disposed of for a value above the cost base. c. O d. O e. A lottery win by a Uber driver. Two of the specific events are fully exempted from CGT. All of the specific events are fully exempted from CGT.arrow_forwardKayla took out an amortized loan of $240,000 with a 5% interest rate. Her monthly payment is $1,288.37. How much will she pay in interest on her first monthly payment? $900 $1.200 $1,150 $1.000arrow_forward

- David works for Wool garments company as a production manager. He often participates in the annual budgeting process of the company. David is requested by the Chief Executive Officer Linda to submit his department’s budgeted production for the following year. Linda reviews and typically adds 10 percent to the production budget provide by David. The new amount becomes David’s target production level for the following year. David can receive a cash bonus if his department exceeds the projected production level. 3. Suggest what should be done to prevent a manager from providing inaccurate budgets which can easily achieved.arrow_forwardJack, a stockbroker, was an inexperienced in tax. He has sought the advice of an independent designated tax professional to advise him on tax planning and tax shelter that he needs. Simon, who is a designated accountant who specialized in those areas, advised Jack to invest in a number of multiple unit residential building (MURBs), a real estate investment project as tax shelter, by the conventional wisdom, were safe and conservative. When the value of MURBs fell during a decline in the real estate market, Jack lost heavily in his investment. Though the advice was perfectly sound at the time it was given, but unknown to Jack, Simon was also acting as adviser for developers in restructuring the MURBs and did not disclose that fact to Jack. In the context of breach of contract, is Jack liable for the loss of investment? In the context of breach of fiduciary duty, is Jack liable as well? Does ethics issue involve? Please state your reasons. Mr. Hunt, who has just retired, set up an…arrow_forwardMishap has a gross income of $43,360. She owns a condominium and donates to charity, but there's no way her tax deductible expenses come close to the standard deduction of $12,000. During a cold snap in the winter she donates an extra $500 to the local homeless shelter, a registered charity. How much will this donation save her on her taxes?arrow_forward

- Gross profit from following income statementarrow_forwardThe purpose of this assignment is to evaluate the impact of a financial analysis on administrative decisions in a health care organization. Review Northwestern Memorial HealthCare's "Consolidated Financial Report" (Years Ended August 31, 2019 and 2018), and answer the following prompts. Discuss the importance of and need for a financial analysis within a health care organization. Explain the relationship between a health care organization's financial plan and debt policy to its strategic plan. Assess the financial position of Northwestern Memorial HealthCare in 2019 as compared to 2018. Give specific examples of areas where improvement is needed or areas that should be of concern in terms of financial viability. Based upon these observations, make recommendations that management should consider from a strategic standpoint (i.e., strategic budgeting methods).arrow_forwardJack, a stockbroker, was an inexperienced in tax. He has sought the advice of an independent designated tax professional to advise him on tax planning and tax shelter that he needs. Simon, who is a designated accountant who specialized in those areas, advised Jack to invest in a number of multiple unit residential building (MURBs), a real estate investment project as tax shelter, by the conventional wisdom, were safe and conservative. When the value of MURBs fell during a decline in the real estate market, Jack lost heavily in his investment. Though the advice was perfectly sound at the time it was given, but unknown to Jack, Simon was also acting as adviser for developers in restructuring the MURBs and did not disclose that fact to Jack. In the context of breach of contract, is Jack liable for the loss of investment? In the context of breach of fiduciary duty, is Jack liable as well? Does ethics issue involve? Please state your reasons. Mr. Hunt, who has just retired, set up an…arrow_forward

- Subject: acountingarrow_forwardCurrent liabilities Total assets Retained earnings The following data are for the A, B, and C Companies: Variables Current assets A $150,000 $ 60,000 $300,000 Company B $170,000 $ 50,000 $280,000 C $180,000 $ 30,000 $250,000 $ 60,000 $ 80,000 $ 90,000 Earnings before interest and taxes $ 70,000 $ 60,000 $ 50,000 Market price per share $ 20.00 $ 18.75 $ 16.50 Number of shares outstanding 9,000 9,000 9,000 Book value of total debt Sales $ 30,000 $430,000 $ 50,000 $ 80,000 $400,000 $200,000 REQUIRED: A. B. Using MS Excel, compute the Z score for each company. According to the Altman model, which of these firms is most likely to experience financial failure?arrow_forward29) Which of the following Capital Budgeting Method used to calculate using the condition of NPV being 0 for a project? a. None of the options b. Internal Rate of Return c. Accounting Rate of Return d. Payback periodarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.