Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

a) Explain the principles behind lifecycle costing and briefly state why Fisher in particular should consider these lifecycle principles.

b) Produce the budgeted results for the game 'Stealth' and briefly assess the game's expected performance, taking into account the whole lifecycle of the game.

c) Explain why incremental budgeting is a common method of budgeting and outline the main problems with such an approach.

d) Discuss the extent to which a meaningful

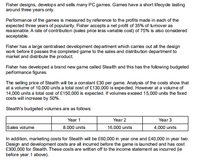

Transcribed Image Text:Fisher designs, develops and sells many PC games. Games have a short lifecycle lasting

around three years only.

Perfomance of the games is measured by reference to the profits made in each of the

expected three years of popularity. Fisher accepts a net profit of 35% of tumover as

reasonable. A rate of contribution (sales price less variable cost) of 75% is also considered

acceptable.

Fisher has a large centralised development department which caries out all the design

work before it passes the completed game to the sales and distribution department to

market and distribute the product

Fisher has developed a brand new game called Stealth and this has the following budgeted

performance figures.

The selling price of Stealth will be a constant £30 per game. Analysis of the costs show that

at a volume of 10,000 units a total cost of £130,000 is expected. However at a volume of

14,000 units a total cost of £150,000 is expected. If volumes exceed 15,000 units the fixed

costs will increase by 50%.

Stealth's budgeted volumes are as follows:

Year 2

16,000 units

Year 3

Year 1

Sales volume

8,000 units

4,000 units

In addition, marketing costs for Stealth will be £60,000 in year one and £40,000 in year two.

Design and development costs are all incurred before the game is launched and has cost

£300,000 for Stealth. These costs are written off to the income statement as incurred (ie

before year 1 above).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, management and related others by exploring similar questions and additional content below.Similar questions

- How does the master budget for a service company differ from a master budget for a manufacturing company? Which (if any) operating budgets differ and how, specifically, do they differ? Which (if any) financial budgets differ and how, specifically, do they differ?arrow_forwardFinancial ratio analysis is conducted by three main groups of analysts: credit analysts, stock analysts, and managers. What is the primary emphasis of each group, and how would that emphasis affect the ratios on which they focus? Why would the inventory turnover ratio be more important for someone analyzing a grocery store chain than an insurance company? Over the past year, M.D. Ryngaert & Co. had an increase in its current ratio and a decline in its total asset’s turnover ratio. However, the company’s sales, cash, and equivalents, DSO, and fixed assets turnover ratio remained constant. What balance sheet accounts must have changed to produce the indicated changes? Profit margins and turnover ratios vary from one industry to another. What differences would you expect to find between the turnover ratios, profit margins, and DuPont equations for a grocery store and a steel company? How does inflation distort ratio analysis comparisons for one company over time (trend analysis) and…arrow_forwardDr. Jones recently asked Lucy to develop a fee schedule for the office. Some physician practices bill at rates from 100% to 500% of Medicare. However, both percentages have disadvantages. Lucy must determine the best approach for the practice to ensure profitability. Select an appropriate percent, between 100% to 500%, that Lucy should use when setting the in-office fees. Explain why Lucy should choose this percentage. Explain how the conversion factor for the fee schedule is determined. Discuss two disadvantages of setting the office fee schedule at 100% or 500% of Medicare.arrow_forward

- Your CEO wants to divest the Northern business unit because unit sales are decreasing. She directs you to evaluate a potential sale. Which of the following analyses should you conduct? A. Identify buyers that might value the business unit more than your company does. B. Calculate the NPV of the unit's future projected cash flows. O C. Identify which of the company's other business units rely on the unit for sales leads. O D. A, B and C. O E. A and C.arrow_forwardWhich type of preliminary estimate would be the best in each of the following situations and explain your answer rationale. a. Decide whether it is feasible to proceed with constructing a new small office building. b. Establish the budget for a bond issue to build three new elementary schools. c. Evaluate which of three alternate designs best fits the budget for a new clinic.arrow_forwardImagine that you work for Puma and are tasked with producing an IMCcampaign with a goal of increasing market share by three percent. First,you decide to use traditional and online advertising and public relationsto achieve this goal. Finally, you determine the cost of each product todetermine the communications budget. What type of IMC budgetingprocess are you using? Evaluate your strategy compared to acompetitive parity budgeting process.arrow_forward

- Compare and contrast the role and preparation of a master budget in a company's financial planning process, and discuss how it can be used to coordinate the activities of different departments and improve decision-making.arrow_forwardIn basketball, what are the goals of the allocation regarding the rules of trading? Give a brief descriptionarrow_forwardSWOT analysis is a strategic planning technique used to help a person or organization identify strengths, weaknesses, opportunities, and threats related to business competition or project planning. Please explain firms may leverage their understanding of RBV when planning ahead through SWOT analysis. Internal External Strengths Internal capabilities that may help a company reach its objectives Opportunities External factors that the company may be able to exploit to its advantage Positive Weaknesses Internal limitations that may interfere with a company's ability to achieve its objectives Threats Current and emerging external factors that may challenge the company's performance Negativearrow_forward

- 29) Which of the following Capital Budgeting Method used to calculate using the condition of NPV being 0 for a project? a. None of the options b. Internal Rate of Return c. Accounting Rate of Return d. Payback periodarrow_forwardWhat is the relative tax advantage of corporate debt if the corporate tax rate is Tc=0.21 , the personal tax rate on interest is TpD=0.37 , but all equity income is received as capital gains and escapes tax entirely ( TpE=0 )? How does the relative tax advantage change if the company decides to pay out all equity income as cash dividends that are taxed at 20%? Note: Do not round intermediate calculations. Round your answers to 4 decimal places.arrow_forwardMuriel likes her job, but her boss gives lousybonuses. Muriel was recently offered a new jobwith better rewards, and her friend wants to knowif she intends to take it. “It depends on whetherthe bonus this year is generous. Let’s wait and see.We’ll find out next week.” Explain why Muriel islikely to be accepting the new job. How could sheimprove her strategy if she wants to stay at her current job and be better rewarded?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON