Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

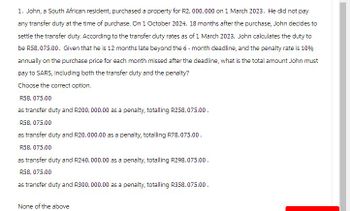

Transcribed Image Text:1. John, a South African resident, purchased a property for R2,000,000 on 1 March 2023. He did not pay

any transfer duty at the time of purchase. On 1 October 2024, 18 months after the purchase, John decides to

settle the transfer duty. According to the transfer duty rates as of 1 March 2023, John calculates the duty to

be R58, 075.00. Given that he is 12 months late beyond the 6-month deadline, and the penalty rate is 10%

annually on the purchase price for each month missed after the deadline, what is the total amount John must

pay to SARS, including both the transfer duty and the penalty?

Choose the correct option.

R58, 075.00

as transfer duty and R200,000.00 as a penalty, totalling R258,075.00.

R58, 075.00

as transfer duty and R20,000.00 as a penalty, totalling R78,075.00.

R58, 075.00

as transfer duty and R240,000.00 as a penalty, totalling R298, 075.00.

R58, 075.00

as transfer duty and R300,000.00 as a penalty, totalling R358, 075.00.

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sarah purchased a warehouse for £420,000 in September 2020. She sold a retail premises to Bettina for £152,000 in November 2020. How much Stamp Duty is payable on these transactions and by whom? £10,540 by Sarah O £21,000 by Sarah and £3,040 by Bettina O £10,500 by Sarah and E40 by Bettina O £24,040 by Saraharrow_forwardOn 1 December 2016 Dheshnie Singh, a resident of the republic, purchased a primary residence for R2 300 000. She used the granny flat portion of her primary residence as her consulting rooms. (In other words, she traded from a portion of her primary residence. The granny flat portion of this primary residence comprises 20% of the total primary residence. She lived in this primary residence, and practiced from its granny flat, for the 14 month period from 1 December 2016 until 31 January 2018. On 1 February 2018 she sold her primary residence for R4 000 000. Required Determine the capital gains tax consequences that result from the purchase and sale by Dheshnie Singh of her primary residence.arrow_forwardJim, a US individual, purchases a certain rental real estate property in 2014 and leases it out producing a taxable loss of ($10,000) each year from 2014-2017. Jim has no other sources of income during any of these years. Jim sells the real estate in 2017 recognizing only a $30,000 gain on the sale. How much income (loss) does Jim report on his tax return in each of the tax years? If Jim is a real estate professional: 2014 ___________ 2015 ____________ 2016 ____________ If Jim is a not real estate professional: 2014 ___________ 2015 ____________ 2016 ____________arrow_forward

- Nkosi is 64 years old. During the current year of assessment, he sold a pre- valuation date value asset for R7 600 000. Included in the amount is the agent's commission who he had paid for getting a buyer for him. The commission is 5% of the selling price. The valuation date value of the asset was correctly calculated to be R3 440 000. Just before the asset was sold Nkosi incurred improvement costs worth R1 000 000 to increase his chance of being able to sell the asset. YOU ARE REQUIRED to determine the base cost of the asset. Select one: a. R3 440 000 b. R4 820 000 c. R4 440 000 d. R 3 820 000arrow_forwardPaige is a commissioned Navy officer and a lifelong Oregon resident. In 2021, she earned $8,400 in nontaxable combat pay while stationed overseas in a combat zone. She earned an additional $9,800 while stationed in South Korea. In May, she was transferred back to Oregon where she earned $29,000. Paige included $38,800 of her military pay in her federal AGI. How much is Paige's military pay subtraction on her Oregon return? $9,800 $15,800 $18,200 $38,800arrow_forwardXavier bought furniture and fixtures (7-year property) on September 15, 2019 for $1,025,000. He elects to expense as much as possible under Section 179 but does not elect the 100% bonus. Xavier's earned income for the year is $1,200,000. What is the maximum deduction Xavier can take in 2019 for the equipment? (Round answers to the nearest dollar)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education