FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

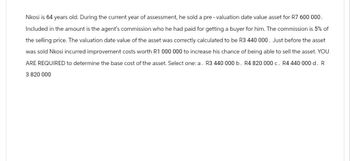

Transcribed Image Text:Nkosi is 64 years old. During the current year of assessment, he sold a pre- valuation date value asset for R7 600 000.

Included in the amount is the agent's commission who he had paid for getting a buyer for him. The commission is 5% of

the selling price. The valuation date value of the asset was correctly calculated to be R3 440 000. Just before the asset

was sold Nkosi incurred improvement costs worth R1 000 000 to increase his chance of being able to sell the asset. YOU

ARE REQUIRED to determine the base cost of the asset. Select one: a. R3 440 000 b. R4 820 000 c. R4 440 000 d. R

3 820 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- LC5Q5. In which of the following method of depreciation, the amount of depreciation remains constant? Reducing balance method Diminishing balance method Written down value method. Straight line methodarrow_forwardFor the composite method, the composite a. rate is the total cost divided by the total annual depreciation. b. rate is the total annual depreciation divided by the total depreciable cost. c. life is the total cost divided by the total annual depreciation. d. life is the total depreciable cost divided by the total annual depreciation.arrow_forwardConsider the following data on an asset:Cost of the asset, I $38.000Useful life. N 6 yearsSalvage value. S $0Compute the annual depreciation allowances and the resulting book values by using the DOB method and then switching to the SL method.arrow_forward

- 30-The book value of the asset sold is calculated as a. Book Value = Cost – Accumulated Depreciation b. Book Value = Cost – Sale Value c. Book Value = Cost – Depreciation for the year d. Book Value = Cost – Salvage Valuearrow_forwardFor each of the following depreciable assets determine the missing amount abbreviations for depreciation methods or SL for straight line and DDB for double declining balancearrow_forwardFor project A, what was the calculations for depreciation to get to the final answer of 720 000?arrow_forward

- Exercises E9.1 (LO 1), AP Writing The following expenditures relating to plant assets were made by Glenn Company during the first 2 months of 2022. Determine cost of plant acquisitions. 1. Paid $7,000 of accrued taxes at the time the plant site was acquired. 2. Paid $200 insurance to cover a possible accident loss on new factory machinery while the machinery was in transit. 3. Paid $850 sales taxes on a new delivery truck. 4. Paid $21,000 for parking lots and driveways on the new plant site. 5. Paid $250 to have the company name and slogan painted on the new delivery truck. 6. Paid $8,000 for installation of new factory machinery. 7. Paid $900 for a 2-year accident insurance policy on the new delivery truck. 8. Paid $75 motor vehicle license fee on the new truck.arrow_forwardUsing the Cost Approach to property appraisal, determine the final appraised value of a building and the land the bulding is on based upon the following: - Land Value-$6 million; > Building Cost (psf) - $250; > Total area (psf)-$100,000: > Developer's profit - S800,000; > Economic obsolescence - S1.5 million; > Functional obsolescence - $3 million; > Locational obsolescence - $2 million; > Curable depreciation - Si million; > Effective age -20 years: > Economic Age- 50 years. Oa $10.340,000 Ob.S14,380,000 OC S13,980.000 Od. 510,380,000 Oe. $8,380,000arrow_forward2arrow_forward

- Which depreciation method will compute the most depreciation expense over the life of the asset? O Declining-balance will produce the most depreciation expense. O Units-of-production will produce the most depreciation expense. O All methods will produce equal depreciation expense over the life of the asset. O Straight-line will produce the most depreciation expensearrow_forward(a) Provide a definition of the deprival value of an asset. (b) For a particular asset, suppose the three bases of valuation relevant to the calculation of its deprival value are (in thousands of pounds): £12, £10 and £8. Construct a matrix of columns and rows showing all the possible alternative situ- ations and, in each case, indicate the appropriate deprival value. (c) Justify the use of deprival value as a method of asset valuation, using the matrix in (b) above to illustrate your answer. ACCA Level 2, The Regulatory Framework of Accounting, December 1988arrow_forwardRefer to the highest and best use analysis in table below. Use (a)Year 1 NOI (b)(r−g) (c)R (a÷c = d)Implied Property Value (PV) (e)Construction Cost of Building (d) − (e)Implied Land Value(Residual) Office $ 510,000 0.13−0.03 0.10 $ 5,100,000 $ 4,000,000 1,100,000 Retail $ 610,000 0.12−0.04 0.08 7,625,000 $ 6,750,000 875,000 Apartment $ 415,000 0.12−0.03 0.09 4,611,111 $ 3,000,000 1,611,111 Warehouse $ 410,000 0.10−0.02 0.08 5,125,000 $ 4,000,000 1,125,000 Required: Suppose that the warehouse income would grow at 3 percent per year instead of 2 percent. a. Does this change the highest and best use of the site? multiple choice Yes No b. What is the new implied land value? (Do not round intermediate calculations. Round your final answer to the nearest dollar amount.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education