FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

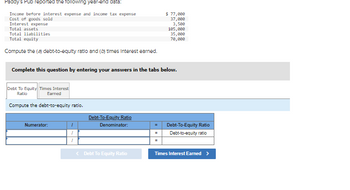

Transcribed Image Text:Paddy's Pub reported the following year-end data:

Income before interest expense and income tax expense

Cost of goods sold

Interest expense

Total assets

Total liabilities

Total equity

Compute the (a) debt-to-equity ratio and (b) times Interest earned.

Complete this question by entering your answers in the tabs below.

Debt To Equity Times Interest

Ratio

Earned

Compute the debt-to-equity ratio.

Numerator:

1

1

Debt-To-Equity Ratio

Denominator:

< Debt To Equity Ratio

$ 77,000

37,000

3,500

105,000

35,000

70,000

=

Debt-To-Equity Ratio

Debt-to-equity ratio

Times Interest Earned >

II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Balance Sheet Prepare a vertical analysis of the balance sheets for Year 4 and Year 3. Note: Percentages may not add exactly due to rounding. Round your answers to 2 decimal places. (L.e., .2345 should be entered as 23.45). Assats Current assets Cash Income Statement Marketable securities Accounts receivable (net) Inventories Prepaid Items Total current assets Investments Plant (net) Land Total long-term assets Total assets Liabilities and stockholders' equity Liabilities Current liabilities Notes payable Accounts payable Salaries payable Total current liabilities Noncurrent liabilities Bonds payable Other FANNING COMPANY Vertical Analysis of Balance Sheeta Year 4 Total noncurrent liabilales Total abilities Stockholders' equity Preferred stock (par value $10, 4% cumulative, nonparticipating: 6,600 shares authorized and issued) Common stock (no par; 50,000 shares authorized; 10,000 shares issued) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity…arrow_forwardCalculate net debt. Cash and cash equivalents Short term borrowings Long term borrowings Commercial paper (liability) Capital / finance lease Accounts receivable Total liabilities Inventory Select one: 2,108.0 2,103.0 2,025.0 14,132.0 3,176.0 419.0 2,883.0 331.0 1,651.0 83.0 17,308.0 5.0arrow_forwardIs the balance column for profit and loss (capital equity) a CR or DR?arrow_forward

- Assume you are given the following relationships for the Haslam Corporation: Sales/total assets 1.7 Return on assets (ROA) 4% Return on equity (ROE) 6% Calculate Haslam's profit margin and liabilities-to-assets ratio. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: % Liabilities-to-assets ratio: % Suppose half of its liabilities are in the form of debt. Calculate the debt-to-assets ratio. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardFinance Questionarrow_forwardPlease do not give solution in image format thankuarrow_forward

- Please answer fast I will rate for you sure....arrow_forwardFor Financial year 2021: Current ratio = Current assets / Current liabilities = 43.133 / 29.613 = 1.46 (2.d.p) Debt-to-equity = Total liabilities / Total equity = (29.613 + 25.382) / 47.069 = 1.17 (2.d.p) Return on total assets = Net profit / Average total assets = (-11.195) / 101.964 = -0.11 (2.d.p) Profit margin ratio = Net profit / Net sales = (-11.195) / 81.79 = -0.14 (2.d.p) Debt-to-asset = Total liabilities / Total assets = (29.613 + 25.382) / 101.964 = 0.54 (2.d.p) Cash flow on total assets = Net cash flow from operating activities / Average total assets = 4.717 / 101.964 = 0.05 (2.d.p) For Financial year 2022: Current ratio = Current assets / Current liabilities = 49.476 / 32.754 = 1.51 (2.d.p) Debt-to-equity = Total liabilities / Total equity = (32.754 + 27.625) / 46.732 = 1.29 (2.d.p) Return on total assets = Net profit / Average total assets = (-0.336) / 107.111 = -0.003 (3.d.p) Profit margin ratio = Net profit / Net sales = (-0.336) / 115.56 = -0.003 (3.d.p) Debt-to-asset…arrow_forwardNeed help with this Question please providearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education