FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Ali is a student at the University. He recently purchased a car for OMRS,000 to use it for going to the University. Ali also expects that other friends might ask for

transportation from him. He expects a total monthly revenue of OMR60. He expects fuel cost to be OMR30 per month. One of Ali's friends is a taxi driver. He offered Ala

to take him to University for a monthly fee of OMR10. Because he does not have to drive, Ali believes that he can perform online work that would earn him a monthly

revenue of OMR10. What is the differential cost in this scenario?

Select one:

O a. OMR50

Ob.OMR1O

OCOMR4O

O d. OMR2O

Oe. OMRBO

Expert Solution

arrow_forward

Step 1

Definition:

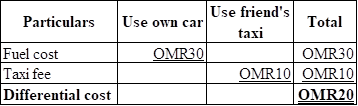

Differential analysis: Differential analysis refers to the analysis of differential revenue that could be gained or differential cost that could be incurred from the available alternative options of business by leaving out irrelevant information.

arrow_forward

Step 2

Identify the correct option:

From the above calculation, it is clear that option d is the correct answer.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Big Sean is buying a new truck from Willie’s Auto Sales, the dealer is providing the financing and he uses the discount method. If borrows $40,000 at 9% for 48 months, how much is his monthly payment?arrow_forwardWhile jogging around his suburb one morning, Pedro sees a speedboat parked outside a house. There is a sign posted on the boat’s windshield saying: “For sale $9,000, Text Andres on 0409876543. Direct buyers only!” A boat lover, Pedro calls the number advertised and leaves a voice message saying that he’s happy to buy the boat for $7,000. He also leaves his return number. Andres is busy all day, and only hears Pedro’s message the next morning. He calls Pedro back; he also leaves a voice message saying that Pedro’s price is too low, but he can get the boat for $8,000. That same day, however, another buyer sees the boat and makes a $9,000 cash offer to Andres on the spot. Andres takes the money, signs over the boat’s registration papers, and the buyer tows the boat away. Pedro passes by Andres’ house and sees that boat is gone. Panicking, he listens to his voice messages and hears Andres’ message for the first time. He calls Andres right away and told him in no uncertain words that he…arrow_forwardPlease answer all parts of the questionarrow_forward

- Hank has a $30,000.00 GIC which is locked in for the next 2 months at which time he can access his money. Today he was offered the opportunity to purchase his friends antique Harley Davidson motorcycle for $20,000.00 providing he can pay for it in the next few days or his friends is going to sell it on Kjiji. Hank really wants the motorcycle and has approached Everyday Bank about a loan noting that he can only afford a very small payment. What product would best meet Hank’s needs? a. A personal line of credit for $20,000.00 b. An interest only demand koan for $20,000.00 c. A fixed repayment Loan for $20,000.000 with a variable interest rate and fixed monthly payments. d. An Everyday Bank MasterCard with a limit of $20,000.00arrow_forwardGerry likes driving small cars and buys nearly identical ones whenever the old one needs replacing. Typically, he trades in his old car for a new one costing about $15,000. A new car warranty covers all repair costs above standard maintenance (standard maintenance costs are constant over the life of the car) for the first two years. After that, his records show an average repair expense (over standard maintenance) of $2500 in the third year (at the end of the year), increasing by 50 percent per year thereafter. If a 30 percent declining-balance depreciation rate is used to estimate salvage values and interest is 9 percent, how often should Gerry get a new car? Click the icon to view the table of compound interest factors for discrete compounding periods when i = 9%. Gerry should get a new car every years, which has the (Round to the nearest whole number as needed.) EAC of $arrow_forwardLori earns $3,898 per month. She has a monthly rent payment of $980 along with average credit card payments of $325 and student loan payments of $250. She wants to finance a car but needs to determine her maximum car payment to keep her back end DTI at 39%. What would this payment be?arrow_forward

- Mickey is a 12-year-old dialysis patient. Three times a week for the entire year, he and his mother, Sue, drive 20 miles one way to Mickey's dialysis clinic. On the way home, they go 10 miles out of their way to stop at Mickey's favorite restaurant. Their total round trip is 50 miles per day. Required: How many of those miles, if any, can Sue use to calculate an itemized deduction for transportation? Use the medical mileage rates in effect for 2022, 18 and 22 cents a mile per each half of the year, to determine the deduction, based upon their driving being accrued evenly throughout the year. Compute Itemized deduction. Note: Round your "Itemized deduction" answer to 2 decimal places. Number of miles to be used Itemized deduction X Answer is complete but not entirely correct. $ January through June July through December 6,240 x 1,123.20 S 6240 X 1,372.80 xarrow_forwardMarsha Jones has bought a used Mercedes horse transporter for her Connecticut estate. It cost $54,000. The object is to save on horse transporter rentals.Marsha had been renting a transporter every other week for $219 per day plus $1.95 per mile. Most of the trips are 80 or 100 miles in total. Marsha usually gives Joe Laminitis, the driver, a $30 tip. With the new transporter she will only have to pay for diesel fuel and maintenance, at about $0.64 per mile. Insurance costs for Marsha’s transporter are $2,150 per year.The transporter will probably be worth $34,000 (in real terms) after eight years, when Marsha’s horse Spike will be ready to retire. Assume a nominal discount rate of 7% and a 4% forecasted inflation rate. Marsha’s transporter is a personal outlay, not a business or financial investment, so taxes can be ignored.Calculate the NPV of the investment. (Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.)arrow_forwardJoe bob wants to buy a car and will need to take out a loan in order to make the purchase. His current monthly income is 3,500 per month. His mortgage payment is 900 per month, and his student loan payment is 350 per month according to the affordability formulas given can he afford to take out another loan? when should he follow the affordability formulas? In what case should he not? how could taking out the car loan impact his other priorities? what is the affordability formula I need to use as wellarrow_forward

- Sam can afford to spend $500 per month on a car. He figures he needs half of it for gas, parking, and insurance. He has been to the bank, and they will loan him 100% of the car’s purchase price. (Note: If he had a down payment saved, then he could borrow at a lower rate.) (a) If his loan is at a nominal 12% annual rate over 36 months, what is the most expensive car he can purchase? (b) The car he likes costs $14,000 and the dealer will finance it over 60 months at 12%. Can he afford it? If not, for how many months will he need to save his $500 per month? (c) What is the highest interest rate he can pay over 60 months and stay within his budget if he buys the $14,000 car now?arrow_forwardErnie Bilko has a business idea. He wants to rent an abandoned gas station for just the months of November and December. He will convert the gas station into a drive-through Christmas wrapping station. Customers will drive in, drop off their gifts, return the next day, and pick up their wrapped gifts. He needs $331,700 to rent the gas station, purchase wrapping paper, hire workers, and advertise. If he borrows this amount at 6.5 interest for those two months, what size lump sum payment will he have to make to pay off the loan? (Round your answer to the nearest cent.) $ _______arrow_forwardFiona has a four-year contract to sell coffee in a local office building. After two years in business, she wants to move on. Kurt wants to buy out the last two years of Fiona’s contract. He estimates he can make $7,500 in the first year and $7,800 in the second year. If the discount rate is 8%, what is the maximum amount Kurt should be willing to pay?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education