Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

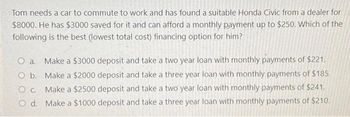

Transcribed Image Text:Tom needs a car to commute to work and has found a suitable Honda Civic from a dealer for

$8000. He has $3000 saved for it and can afford a monthly payment up to $250. Which of the

following is the best (lowest total cost) financing option for him?

O a. Make a $3000 deposit and take a two year loan with monthly payments of $221.

O b. Make a $2000 deposit and take a three year loan with monthly payments of $185.

O c. Make a $2500 deposit and take a two year loan with monthly payments of $241.

O d. Make a $1000 deposit and take a three year loan with monthly payments of $210.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- If this family of 4 wants to save up for a vacation in 2 years, how much should they deposit each month into a savings account earning 1.85% annual interest? iF THEY HAVE TO SAVE UP $4580 (Round your answer to the nearest DOLLAR and type it without any commas, dollar signs, ect) If instead they decide to take the vacation now and put it on a credit card, how much would they need to pay each month to cover the cost of this credit card charge after 2 years if their credit card charges an APR of 19% (which is the average APR for new credit cards currently)? (Round your answer to the nearest DOLLAR and type it without any commas, dollar signs, ect) $ How much more will this family pay for their vacation using their credit card instead of saving?arrow_forwardBarry Wood wants to buy a used car that costs $5000. He has two possible loans in mind. One loan is through the car dealer; it is a three-year add-on interest loan at 6% and requires a down payment of $300. The second is through his credit union; it is a three-year simple interest amortized loan at 7.5% and requires a 10% down payment. (a) Find the monthly payment for each loan. (Give your answer to the nearest cent.) Dealer $ Credit Union $ (b) Find the total interest paid for each loan. (Give your answer to the nearest cent.) Dealer $ Credit Union $arrow_forwardRick wishes to purchase a new car and can afford monthly payments of up to $275 per month. Finance is available and the terms are that the loan lasts for 6 years, and the annual interest rate is 8%. What is the maximum price for a car that Ryan's budget can afford?Round your answer to the nearest hundred dollars.arrow_forward

- Dan is planning to buy a new home that costs $130000 Find the following if Dan make a 5% downpayment. How much will Dan's down payment be? (Round to the nearest cent) How much will Dan owe after he makes the down payment? (Round to the nearest cent)arrow_forward6) Susan is looking to purchase her first home five years from today. The house costs $1,550,000. She will have to make a down payment of 10% of this amount and plans to take a loan from the bank for the difference. Bank charges are approximately 15% of the loan amount. She plans to start saving from today to cover both the down payment and the bank charges. a. How much will she need to save to cover both the down payment and bank charges? b. If she currently has $195,000 in her account and will make no further deposits over the next five years, what rate of interest must she earn on this account in order to achieve the savings target calculated in part (a) above?arrow_forwardArnold has determined that he can afford a monthly payment of $325 for a car. If he can obtain a 4 year car loan at an annual interest rate of 3.1%, what is the maximum amount (in dollars) he can finance? Round your answer to the nearest cent. arrow_forward

- Mike and Terri estimate that they want to buy a house for $186,000.00, and they need to make a down payment of 17.5% of the cost of their house. If they have 18 months to save for the down payment, how much do they need to invest into an account earning 4.518% compounded monthly so that they can reach their goal? Mike and Terri need to invest (Note: Your answer should have a dollar sign and be accurate to two decimal places) Preview My Answers Submit Answers You have attempted this problem 0 times. You have 6 attempts remaining. Email Instructorarrow_forwardJana has $2.000 saved but doesn’t want to spend it on a down payment. She wants to keep it in her emergency fund, in savings. She wants to buy a car and thinks she can afford monthly payments of $300. If she can finance a vehicle with a 6%, 5-year loan from a credit society, what is the maximum loan amount Jana can afford? (Round to the nearest dollar.) Question 31 options: $12,528 $14,218 $15,518 $16,218 $18,028arrow_forwardHank has a $30,000.00 GIC which is locked in for the next 2 months at which time he can access his money. Today he was offered the opportunity to purchase his friends antique Harley Davidson motorcycle for $20,000.00 providing he can pay for it in the next few days or his friends is going to sell it on Kjiji. Hank really wants the motorcycle and has approached Everyday Bank about a loan noting that he can only afford a very small payment. What product would best meet Hank’s needs? a. A personal line of credit for $20,000.00 b. An interest only demand koan for $20,000.00 c. A fixed repayment Loan for $20,000.000 with a variable interest rate and fixed monthly payments. d. An Everyday Bank MasterCard with a limit of $20,000.00arrow_forward

- Philip works at a nursing home as an aide and earns $27,000 a year. IF he went to school to get a nursing degree he could earn $50,000 in the first year. Philip knows this but he also knows that tuition and fees at a nearby college could cost about $45,000(total). He can get a student loan for 5% with 10 years to repay the loan. What is the total cost of the student loans?arrow_forwardAfter deciding to acquire a new car, you realize you can either lease the car or purchase it with a two-year loan. The car you want costs $34,000. The dealer has a leasing arrangement where you pay $97 today and $497 per month for the next two years. If you purchase the car, you will pay it off in monthly payments over the next two years at an APR of 6 percent. You believe that you will be able to sell the car for $22,000 in two years. What is the present value of purchasing the car? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present value of lease $ What is the present value of leasing the car? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present value of purchase $ What break-even resale price in two years would make you indifferent between buying and leasing? (Do not round intermediate calculations and round your answer to 2…arrow_forwardKat is looking to but her first car. She has figured that she can afford to make up to a $388 monthly payment to the bank for a car loan. She plans to pay off the car loan in 5 years and the bank is willing to give her a 6% interest rate, compounded monthly. What is the maximum amount she can borrow to purchase a car? (How expensive of a car can she afford) Round to the dollar $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education