Concept explainers

Comprehensive Problem

INSTRUCTIONS: Solve the problem below clearly, orderly, accurately, and completely using Excel. (You may use a pencil/paper T account General Ledger, if you prefer.)

Pacheco Inc. is a merchandising business headquartered in the U.S. and selling primarily to wholesalers. The

Principles (GAAP). Business activity is recorded on an accrual basis. The company employs the perpetual inventory system in accounting for its merchandise inventory. Sales revenue is recorded net of sales

discounts. Purchases of inventory are also recorded net of purchases discounts. The company operates using a January through December fiscal year. The balances of the accounts in the general ledger as of

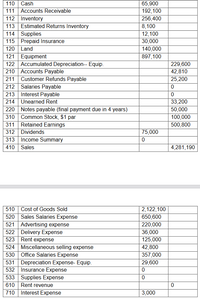

November 30 of the current fiscal year are as follows: SEE ATTACHED IMAGES FOR ACCOUNTS

There are 100,000 shares of common stock outstanding. During December, the last month of the fiscal year, the following transactions were completed:

-Dec 3 Purchased $24,500 of merchandise on account, FOB shipping point, terms

2/10,n/30.

-Dec 4 Paid transportation costs of $475 on the December 3 purchase.

-Dec 7 Returned $4,000 of the merchandise purchased on December 3.

-Dec 11 Sold merchandise on account, $12,700, FOB destination, 1/15,n/30. The cost of the merchandise

sold was $7,600.

-Dec 12 Paid transportation charges of $300 for the merchandise sold on December 11.

-Dec 13 Paid for the purchase of December 3 less the return and the discount.

-Dec 15 Received payment from customers on account, $8,430. Amount received is net of discount.

-Dec 22 Received payment on account for the sale of December 11, less the discount.

-Dec 23 Purchased supplies on account, n/30 $500.

-Dec 26 Paid amounts owed to creditors on account, $9,040. Amount paid was net of discount.

-Dec 27 Paid sales salaries, $2,300, and office salaries, $1,400.

-Dec 28 Sold merchandise for cash, $16,500. The cost of the merchandise sold was $11,200.

-Dec 29 Paid customer a cash refund of $2,210 for returned merchandise from the sale of Dec. 11. The cost

of the returned merchandise was $1,212.

-Dec 30 Paid rent for store equipment for December, $1,000.

-Dec 31 Paid cash for a web page advertisement, $400

1. Enter the balances of each of the accounts as of November 30 in the appropriate balance column of a T account (use account names and numbers) or a four-column account. [You are creating the General

Ledger.]

2. Journalize (using the General Journal) the transactions for December.

3. Post the December

posting is completed.

4. Prepare an Unadjusted

5. Analyze the following adjustment data assembled at the end of December. Use the adjustment data to journalize, then post, the necessary

-a. Merchandise inventory on hand at December 31, per physical count, $248,315.

-b. Insurance coverage expired during the year, $12,350.

-c. Supplies on hand at December 31, $2,100.

-d. Additional

-e. Accrued sales salaries $1,800 and accrued office salaries $890 on December 31

-f. Accrued interest on the note payable as of December 31, $240.

-g. Unearned Rent at December 31 is $8,300.

-h. Company estimates that customers will request an additional $12,830 of refunds related to current year

sales and the related merchandise to be costing $5,900 will be returned.

6. Prepare an Adjusted Trial Balance as of December 31.

7. Prepare, in good form, a multiple-step Income Statement, a

8. Journalize and post the necessary closing entries.

9. Prepare a Post-Closing Trial Balance as of December 31.

Trending nowThis is a popular solution!

Step by stepSolved in 9 steps with 12 images

- Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Balance Sheets for 2020 & 2021.arrow_forwardProblem 84 (LAA) Summa Company revealed the following account balances on December 31, 2020 Accota payable Accounta receivable, net of allowance for doubtful accounts PS0.000 Accrued taxes Aecrued interest receivable Autherined sbare capital, 60,000 aharea. P100 par Building, net ofaccumulated depreciation of P500,000 3,000.000 Cash on hand Cash in bank Bond sinking fund Furniture and equipment, net ofaccumulated depreciation of P900,000 Iaventory Investment property Land Deferred tax liability Bonds payable due June 30, 2021 Notes payable Notes reoeivable Patent Ocher accrued liabilities Prepaid expenses Share premium Retained earninge appropristed for contingencies Retained eantings Share ubecription receivable Subscribed share capital E000 shares Unianoed share capital 1000,000 50.000 30,000 5,000.000 50.000 650.000 2000.000 1,500,000 1,200,000 700.000 1,000,000 650.000 2.000.000 850.000 200,000 370,000 150,000 100,000 300,000 200,000 2.700,000 500,000 L000,000 2.000,000 Required:…arrow_forwardLife-Positive’s Account Balances 2021 ($) 2022 ($) Accounts Payable 24,600.00 21,250.00 Accounts receivable 15,700.00 12,340.00 Cash 23,450.00 28,600.00 Cost of goods sold 19,700.00 23,000.00 Depreciation 3,090.00 4,590.00 Dividends 5,800.00 10,800.00 Interest 2,340.00 2,890.00 Inventory 7,050.00 8,640.00 Long-term debt 28,000.00…arrow_forward

- Print item The following information was extracted from the records of Rampage Company as of December 31, 2021: Carrying amount Other receivables (NRV) 150,000 Prepaid rent 30,000 Motor vehicles 165,000 * Accumulated depreciation 61,875 Provisions for warranty 12,000 Deposits received in advance 15,000 The depreciation rates for accounting and taxation are 15% and 20% respectively. Deposits are taxable when received while rentals and warranty costs are deductible when paid. An allowance for doubtful debts of P25,000 has been raised against other receivables for accounting purposes, but such debts are deductible only when written off as uncollectible. The rate applicable was 30%. Round off answers into whole number a) What is the Deferred Tax Asset of Rampage Company as of December 31, 20217 Answer: a) What is the Deferred Tax Liability of Rampage Company as of December 31, 20217 Answer:arrow_forwardA company collects an honored note with a maturity date of 24 months from establishment, a 10% interest rate, and an initial loan amount of $30,000. Which accounts are used to record collection of the honored note at maturity date? A. Interest Revenue, Interest Expense, Cash B. Interest Receivable, Cash, Notes Receivable C. Interest Revenue, Interest Receivable, Cash, Notes Receivable D. Notes Receivable, Interest Revenue, Cash, Interest Expensearrow_forwardhello, I need help pleasearrow_forward

- ! Required information Exercise 9-24 (Algo) Complete the accounting cycle using long-term liability transactions (LO9-2, 9-8) [The following information applies to the questions displayed below.] On January 1, 2024, the general ledger of Freedom Fireworks includes the following account balances: Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Debit $ 11,300 34,200 Credit $ 1,900 152,100 Land Buildings Accumulated Depreciation Accounts Payable Common Stock Retained Earnings Totals 68,300 121,000 9,700 18,800 201,000 155,500 $ 386,900 $ 386,900 During January 2024, the following transactions occur: January 1 Borrow $101,000 from Captive Credit Corporation. The installment note bears interest at 6% annually and matures in 5 years. Payments of $1,953 are required at the end of each month for 60 months. January 4 January 10 Pay cash on accounts payable, $12,000. Receive $31,100 from customers on accounts receivable. January 15 Pay cash for salaries, $29,000.…arrow_forwardCategory Prior Year Current Year Accounts payable ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 431,516.41 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 55,946.66 Interest expense 40,500 41,874.31 Inventories 279,000 288,000 Long-term debt 336,467.85 401,942.46 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 161,499.58 Retained earnings 306,000 342,000 Sales 639,000 854,554.01 Taxes 24,750 48,384.56 ??? What is the current year's return on equity (ROE)? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign re rounded to 4 decimal places (ex: 0.0924))arrow_forwardDetail of Certain Balance Sheet Accounts Current receivables September 30, 2023 October 1, 2022 Accounts receivable $ 10,179 $ 10,811 Other 2,266 1,999 Allowance for credit losses (115) (158) $ 12,330 $ 12,652 Parks, resorts and other property Attractions, buildings and improvements $ 35,255 $ 33,795 Furniture, fixtures and equipment 26,358 24,409 Land improvements 7,419 7,757 Leasehold improvements 1,058 1,037 70,090 66,998 Accumulated depreciation (42,610) (39,356) Projects in progress 6,285 4,814 Land 1,176 1,140 $ 34,941 $ 33,596arrow_forward

- i need the answer quicklyarrow_forwardProblem 10-34 (Algo)arrow_forwardMirror Mart uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. 0-30 days 31-90 days Over 90 days past due past due past due Accounts receivable amount $55,000 $33,000 $17,000 Percent uncollectible 8% 15% 30% Total per category ? Total uncollectible ? To manage earnings more efficiently, Mirror Mart decided to change past-due categories as follows. 0-60 days 61-120 days Over 120 days past due past due past due Accounts receivable Amount $84,000 $11,000 $7,000 Percent uncollectible 8% 15% 30% Total per category ? ? ? Total uncollectible ? Complete the following. A. Complete each table by filling in the blanks. 0-30 days 31-90 days Over 90 days past due past due past due Accounts receivable amount $55,000 $33,000 $17,000 Percent uncollectible 8% 15% 30% Total per category Total uncollectiblearrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College