FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

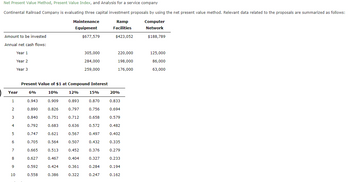

Transcribed Image Text:Net Present Value Method, Present Value Index, and Analysis for a service company

Continental Railroad Company is evaluating three capital investment proposals by using the net present value method. Relevant data related to the proposals are summarized as follows:

Ramp

Computer

Facilities

Network

$423,052

Amount to be invested

Annual net cash flows:

Year 1

Year 2

Year 3

Year

1

2

3

4

5

6

7

8

9

10

6%

Present Value of $1 at Compound Interest

0.943

0.890

0.840

0.792

0.747

0.705

0.665

0.627

0.592

0.558

10%

0.909

0.826

0.751

0.683

0.621

0.564

0.513

0.467

Maintenance

Equipment

$677,579

0.424

0.386

12%

0.893

0.797

0.712

0.636

0.567

0.507

0.452

0.404

305,000

284,000

259,000

0.361

0.322

15%

0.870

0.756

0.658

0.572

0.497

0.432

0.376

0.327

0.284

0.247

220,000

198,000

176,000

20%

0.833

0.694

0.579

0.482

0.402

0.335

0.279

0.233

0.194

0.162

$188,789

125,000

86,000

63,000

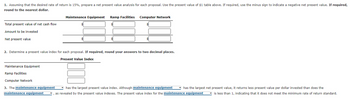

Transcribed Image Text:1. Assuming that the desired rate of return is 15%, prepare a net present value analysis for each proposal. Use the present value of $1 table above. If required, use the minus sign to indicate a negative net present value. If required,

round to the nearest dollar.

Total present value of net cash flow

Amount to be invested

Net present value

2. Determine a present value index for each proposal. If required, round your answers to two decimal places.

Present Value Index

Maintenance Equipment

Maintenance Equipment Ramp Facilities Computer Network

Ramp Facilities

Computer Network

3. The maintenance equipment

maintenance equipment

has the largest present value index. Although maintenance equipment has the largest net present value, it returns less present value per dollar invested than does the

as revealed by the present value indexes. The present value index for the maintenance equipment

is less than 1, indicating that it does not meet the minimum rate of return standard.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help answer From Question 3.1 to 3.5 REQUIREDStudy the information provided below and calculate the following:3.1 Payback Period of Project A (answer expressed in years, months and days). 3.2 Accounting Rate of Return (on average investment) of Project B (answer expressed totwo decimal places).3.3 Net Present Value of both projets (amounts rounded off to the nearest Rand). 3.4 Benefit Cost Ratio of Project A (answer expressed to three decimal places). 3.5 Internal Rate of Return of Project B (answer expressed to two decimal places). INFORMATIONThe following information relates to two possible capital expenditure projects being considered by EdamLtd. Because of capital rationing, only one project can be accepted.Project A Project BInitial cost R800 000 R800 000Expected useful life 5 years 5 yearsAverage annual profit R80 000 R80 000Expected net cash inflows: R RYear 1 240 000 240 000Year 2 260 000 240 000Year 3 280 000 240 000Year 4 220 000 240 000Year 5 200 000 240 000The…arrow_forward1. Accounting Rate of Return on average investment of Project A (expressed to twodecimal places). 1.2 Net Present Value of both projects. 1.3 Internal Rate of Return of Project B (expressed to two decimal places) usinginterpolationarrow_forwardNonearrow_forward

- Net Present Value Method, Present Value Index, and Analysis for a service companyarrow_forwardChoices for the last requirement, "determine the approximate internal rate of return from the choicies (pick the closest answer. a. 29% b. 20% c. 26% d. 22%arrow_forwardThe net present value for Proposals X and Y has been calculated on the basis of the data given below. Proposal X Proposal Y Amount to be invested $145,000 $280,000 Total present value of net cash flow 172,000 320,000 Net present value 27,000 40,000 Determine the present value index for each proposal. Round your answers to two decimal places. Present Value Index Proposal X $fill in the blank 1 Proposal Y $fill in the blank 2arrow_forward

- Find the future value of the following annuities. The first payment in these annuities is made at the end of Year 1, so they are ordinary annuities. (Notes: If you are using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in many situations, to see how changes in input variables affect the output variable. Also, note that you can leave values in the TVM register, switch to Begin Mode, press FV, and find the FV of the annuity due.) Do not round intermediate calculations. Round your answers to the nearest cent. $200 per year for 10 years at 8%. $ $100 per year for 5 years at 4%. $ $200 per year for 5 years at 0%. $ Now rework parts a, b, and c assuming that payments are made…arrow_forwardDetermine the future value of the following single amounts (FV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) (Round your final answers to nearest whole dollar amount.): Invested Amount Future Value 1. 14,000 7% 15 2. 21,000 6% 16 3. 33,000 12% 15 54,000 5% 11 4.arrow_forwardAnswer the following questions including the one on the image provided 2. What is the present values of Team's Offer using a 14 percent discount rate? (Round answer to 2 decimal places, e.g. 15.25.) 3.What is the present values of Counteroffer using a 14 percent discount rate? (Round answer to 2 decimal places, e.g. 15.25.) 4. Which of the three contacts has the highest present value?arrow_forward

- Compute the net present value for each project. (Round answers to 0 decimal places, e.g. 125. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Project Bono Project Edge Project Clayton Net present value $enter a dollar amount rounded to 0 decimal places $enter a dollar amount rounded to 0 decimal places $enter a dollar amount rounded to 0 decimal places Save for Laterarrow_forwardHow would i solve number 2 on this problemarrow_forwardAverage Rate of Return, Cash Payback Period, Net Present Value Method for a Service Company Spanish Peaks Railroad Inc. is considering acquiring equipment at a cost of $288,000. The equipment has an estimated life of 10 years and no residual value. It is expected to provide yearly net cash flows of $36,000. The company's minimum desired rate of return for net present value analysis is 12%. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Compute the following: a. The average rate of return, giving effect to straight-line depreciation on the investment. If required, round your answer to one decimal place. 8 X %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education