Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

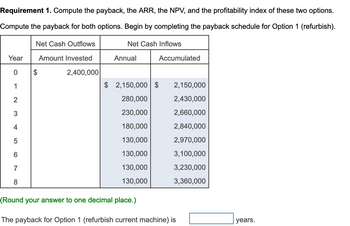

Transcribed Image Text:Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options.

Compute the payback for both options. Begin by completing the payback schedule for Option 1 (refurbish).

Year

0

1

2

3

5

6

7

8

Net Cash Outflows

Amount Invested

$

2,400,000

Net Cash Inflows

Annual

Accumulated

$ 2,150,000 $

280,000

230,000

180,000

130,000

130,000

130,000

130,000

2,150,000

2,430,000

2,660,000

2,840,000

2,970,000

3,100,000

3,230,000

3,360,000

(Round your answer to one decimal place.)

The payback for Option 1 (refurbish current machine) is

years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Problem 7: NPV versus IRR. Consider the following two mutually exclusive projects: Year Cash flow Cash flow (X) (Y) O 1 2 3 -9500 5800 4000 4000 PART 7A: The NPV for X is $ Answer: 2083.77 -9500 3500 5000 6000 if the required rate of return is 10%.arrow_forwardCompute the Internal Rate of Return for a project with the following cash flows: Year Cash Flow 0 ($2,000) 1 $500 2 $400 3 $400 4 $1,500 Question 7 options: 7% 40% 12% 8%arrow_forwardNet Present Value Method, Internal Rate of Return Method, and Analysis for a Service Company The management of Advanced Alternative Power Inc. is considering two capital investment projects. The estimated net cash flows from each project are as follows: Biofuel Equipment Year 1 2 3 4 Year 1 2 The wind turbines require an investment of $513,900, while the biofuel equipment requires an investment of $1,093,320. No residual value is expected from either project. Present Value of an Annuity of $1 at Compound Interest 12% 0.893 1.690 2.402 3.037 3.605 3 4 5 Wind Turbines 6 7 8 9 10 Required: $180,000 180,000 180,000 180,000 6% 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 $360,000 360,000 360,000 360,000 5.759 6.145 4.111 4.564 4.968 5.328 5.650 15% 0.870 1.626 2.283 2.855 3.353 3.785 4.160 4.487 4.772 5.019 20% 0.833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 1a. Compute the net present value for each project. Use…arrow_forward

- Question content area top Part 1 (Related to Checkpoint 6.6) (Present value of annuities and complex cash flows) You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: Investment Alternatives End of Year A B C 1 $ 14,000 $ 14,000 2 14,000 3 14,000 4 14,000 5 14,000 $ 14,000 6 14,000 70,000 7 14,000 8 14,000 9 14,000 10 14,000 14,000 (Click on the icon in order to copy its contents into a spreadsheet.) Assuming an annual discount rate of 15 percent, find the present value of each investment. Question content area bottom Part 1 a. What is the present value of investment A at an annual discount rate of 15 percent?…arrow_forwardPls show proper steps correctly with explanation.arrow_forwardPlease Need Correct Answer with Explanation with calculationarrow_forward

- Assuming a 1-year, money market account investment at 2.282.28 percent (APY), a 1.391.39 percent inflation rate, a 2525 percent marginal tax bracket, and a constant $50 comma 00050,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Question content area bottom Part 1 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax rate of return is 1.711.71%. (Round to two decimal places.) Part 2 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax monetary return is $855855. (Round to the nearest dollar.) Part 3 Given an after-tax return of 1.711.71% and an inflation rate of 1.391.39%, the after-tax real rate…arrow_forwardN2. Accountarrow_forward1.4 The table represents the cash flows received from the investments at the end year. Each investment requires an initial investment of $1000. Answer the questions related to the two investment opportunities in the table below. Year 1 2 3 4 5 Investment A 225 215 250 225 205 Investment B 220 225 250 250 210 There are two approaches to evaluate this investment. Show the necessary calculations. • Assume the interest rate ot 4.33%. Use present value analysis to determine which investment you should choose? Calculating the rate of returns of the investment, which investment would you choose and why?arrow_forward

- Typed plz and asap please provide a quality solution take care of plagiarismarrow_forwardWhat is the present value of an investment with the following cash flows? Year 1 $14,000 Year 2 $20, 000 Year 3 $30,000 Year 4. $ 43,000 Year 5. $ 57,000 Use a 7% discount rate, and round your answer to the nearest $1. a. $128, 487 b. $107, 328 c. $112, 346 d. $ 153, 272arrow_forwardAssuming a 1-year, money market account investment at 2.282.28 percent (APY), a 1.391.39 percent inflation rate, a 2525 percent marginal tax bracket, and a constant $50 comma 00050,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Question content area bottom Part 1 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax rate of return is 1.711.71%. (Round to two decimal places.) Part 2 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax monetary return is $855855. (Round to the nearest dollar.) Part 3 Given an after-tax return of 1.711.71% and an inflation rate of 1.391.39%, the after-tax real rate…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education