ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

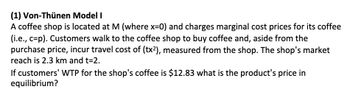

Transcribed Image Text:(1) Von-Thünen Model I

A coffee shop is located at M (where x=0) and charges marginal cost prices for its coffee

(i.e., c-p). Customers walk to the coffee shop to buy coffee and, aside from the

purchase price, incur travel cost of (tx²), measured from the shop. The shop's market

reach is 2.3 km and t=2.

If customers' WTP for the shop's coffee is $12.83 what is the product's price in

equilibrium?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The revenue generated by a food stand can be modeled by a Pareto distribution with a = 2 and 0 = 400. Total cost is 200 regardless of the amount of revenue generated. Calculate the expected profit of the food stand if the food stand is profitable. A 100 200 400 б00 E 800arrow_forwardTeascent is selling candles in Pleasantville. The incremental costs of wax, wick, and other materials for a candle are $0.80. The daily price- response function in Pleasantville is d(p) = 11000 - 980p. Teascent practices price differentiation and sells its candles for $5 to price-sensitive customers with coupons, and for $7 to quality- seekers. A: Find Teascent's daily total contribution based on the two-price policy. B: Find the total customer surplus based on the two-price policy.arrow_forwardIf the cost C (in dollars) of removing p percent of the particulate pollution from the exhaust gases at an industrial site is given by the equation shown below. 6100p C(p) = 100-p Find the rate of change of C with respect to p. C'(p) = Suppose the revenue (in dollars) from the sale of x units of a product is given by R(x) = 36x2 + 50x 2x + 2 Find the marginal revenue when 35 units are sold. (Round your answer to the nearest dollar.) $ Interpret your result. When 35 units are sold, the projected revenue from the sale of unit 36 would be $arrow_forward

- Assume the industrial conditions of red pepper production in the market for homogeneous products there are many manufacturers where each manufacturer has a market share (market share) the same, relatively small and can not affect the price of the change strategies carried out by these manufacturers in the market. If it is known that the function the demand is Q = 2000-P, and the total cost of each manufacturer is the same that is, TCi = 100 + 5q2i. Where Q = [2]I qi, where i is the producer of i and i is 1, 2, 3,..., n. Questions: - What is the number of companies in the long term of the competitive marketi perfect for this homogeneous product, where every company has the same market share? - What is the selling price of thi product in market? - Calculate the Herfindahl-Hirschman Index (HHI) of the red pepper producer industry here!arrow_forwardA firm uses the production technology q = (x{ + xP, where a is a constant and 0 # p< 1. (a) Derive the firm's cost function, c(w1,W2,9). (b) Derive the firm's profit, 7(p,w1,w2). (c) Derive the elasticity of scale for this production technology. (d) What restrictions must a satisfy to ensure that the profit function is well-defined? Explain.arrow_forwardYou manufacture ceramic lawn ornaments. After several months your accountant tells you that your profit P(n) can be modeled by the function P(n)= -0.002n^2+5.2n-1208 where n is number of ornaments sold each month. A) How many ornaments must you make and sell to break even. B) How many ornaments must you make and sell to maximize profit. C) What is the maximum profit. D) How many ornaments must you make and sell in order to earn a profit of $1657.arrow_forward

- Suppose that you can sell as much of a product (in integer units) as you like at $60 per unit. Your marginal cost (MC) for producing the qth unit is given by: MC = 7q This means that each unit costs more to produce than the previous one (e.g., the first unit costs 7*1, the second unit (by itself) costs 7*2, etc.). If fixed costs are $80, what is the optimal integer output level? Please specify your answer as an integer. If fixed costs are $80, what is the profit at the optimal integer output level? Please specify your answer as an integer.arrow_forwardWhy Can't We Be Friends? operates a conflict settlement service for distressed couples. If it has no fixed costs and its monthly average variable cost of cases is given by AVC = 250 - 500, the marginal cost at a caseload of 50 attempted reconciliations per month is:arrow_forwardThranduil company’s market research department is working on the pricing of a product. The field research shows that average demand is expected to be 8000 units at price 50 TL. From this point, each 1 TL change in price will negatively affect demand with a magnitude of 100 units. Fixed and variable costs are confronted for producing the product. According to the information obtained from the financial department, 200,000 TL is the estimate of fixed costs and 20 TL is the estimate of variable costs per unit produced. Assume that all units produced are sold.Which of the following prices is the one that maximizes the company's profit?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education