ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

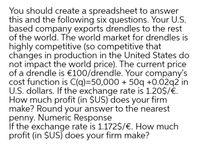

Transcribed Image Text:You should create a spreadsheet to answer

this and the following six questions. Your U.S.

based company exports drendles to the rest

of the world. The world market for drendles is

highly competitive (so competitive that

changes in production in the United States do

not impact the world price). The current price

of a drendle is €100/drendle. Your company's

cost function is C(q)=50,000 + 50q +0.02q2 in

U.S. dollars. If the exchange rate is 1.20$/€.

How much profit (in $US) does your firm

make? Round your answer to the nearest

penny. Numeric Response

If the exchange rate is 1.172$/€. How much

profit (in $US) does your firm make?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If TC = 297 +33Q, what is the marginal cost when Q=19? Enter as a value.arrow_forwardAn electric power plant uses solid waste for fuel in the production of electricity. The cost Y in dollars per hour to produce electricity is Y = 8 + 0.8X + 0.16 X^2, where X is in megawatts. Revenue in dollars per hour from the sale of electricity is 16X - 0.3X^2. Find the value of X that gives maximum profit.arrow_forwardfind optimal price to sell for maximum profit given demand(unit sale) = 100339.84-(310.1145939)*price(per unit) each unit cost 10 to producearrow_forward

- Road Runner Co is a Pakistani manufacturer making Bicycles. It exports to two markets,Bangladesh and Sri Lanka. Demand for Bicycles in thesetwo markets is given by the following Functions: Bangladesh Q1 = 12 – P1 Sri Lanka Q2 = 8 – P2 Where Q1 and Q2 are respective quantities sold (in thousands) andP1 and P2 are the respective prices (in Pak. Rupees per unit) in the two markets. Total cost function is C = 5 + 2 (Q1+ Q2) (i) Company is effectively able to price discriminate in the two markets. What will be the total profits? (ii) Suppose the company does not engage in price discrimination. By charging the same price in the two markets what are the profit maximizing levels of price, output, and the total profits? (iii) Analyze, with graphs, the two alternative pricing strategies available to the company.arrow_forwardFor the given cost function C(x)=250√x+ x^2/3375 -finda) The cost at the production level 1100 (ANSWERED, 8650.079) b) The average cost at the production level 1100 (ANSWERED, 7.86) c) The marginal cost at the production level 1100 (ANSWERED, 4.42) Since I have the answers for the three subparts above, how would I answer the two subparts: d) The production level that will minimize the average cost. e) The minimal average cost.arrow_forwardYou have charged your client $8,650 on a cost plus percentage purchase of two sofas, two lounge chairs, and three occasional tables. If the occasional tables were 30% of the total client cost, and all cost the same amount, what was the net price of these tables at a 15% markup? Explain.arrow_forward

- R(x)= -0.956x^2 + 157x C(x)= 50.8x + 73.4 P(x)= R(x) - C(x) P(x)= -0.956x^2 + 106.2x - 73.4 What are the break-even points? What is the profit at the break-even points? What number of widgets sold will yield positive profit? Determine the number of widgets that you should try to sell in order to maximize profit. What is the maximum profit?arrow_forwardAssume quantities need not be integers. Demand in a competitive market is Qd(P)=120 – (4/10)*P. If 20 units are transacted, what is the lowest marginal benefit (i.e., MWTP) at which an item is purchased? Round to two decimal places and do not enter a currency symbol. If your answer is $1.125, enter 1.13.arrow_forwardYou manufacture ceramic lawn ornaments. After several months your accountant tells you that your profit P(n) can be modeled by the function P(n)= -0.002n^2+5.2n-1208 where n is number of ornaments sold each month. A) How many ornaments must you make and sell to break even. B) How many ornaments must you make and sell to maximize profit. C) What is the maximum profit. D) How many ornaments must you make and sell in order to earn a profit of $1657.arrow_forward

- Suppose that you can sell as much of a product (in integer units) as you like at $60 per unit. Your marginal cost (MC) for producing the qth unit is given by: MC = 7q This means that each unit costs more to produce than the previous one (e.g., the first unit costs 7*1, the second unit (by itself) costs 7*2, etc.). If fixed costs are $80, what is the optimal integer output level? Please specify your answer as an integer. If fixed costs are $80, what is the profit at the optimal integer output level? Please specify your answer as an integer.arrow_forwardGiven a cost function: C(x) = x² - 200x - 3500 And the following revenue function: R(x) = 6x2-400x What level of production will yield a profit of $6,000? 40 or 50 units of production 60 units of production 30 or 60 units of production 30 units of production None of these options 50 units of productionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education