FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1

2345

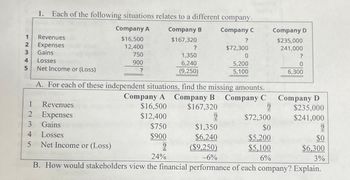

1. Each of the following situations relates to a different company.

Company B

Company C

$167,320

45

Revenues

Expenses

Gains

Losses

Net Income or (Loss)

1

Revenues

2 Expenses

3 Gains

4 Losses

Company A

$16,500

12,400

5 Net Income or (Loss)

750

900

?

1,350

6,240

(9,250)

A. For each of these independent situations, find the missing amounts.

Company A Company B Company C

$16,500

$167,320

?

$12,400

$750

$900

?

?

$1,350

$6,240

($9.250)

$72,300

0

5,200

5,100

$72,300

$0

$5,200

$5,100

6%

Company D

$235,000

241,000

?

0

6,300

Company D

$235,000

$241,000

?

$0

?

24%

-6%

B. How would stakeholders view the financial performance of each company? Explain.

$6,300

3%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- * 24 Study the below and answer the questions that follow. Table 2.4 (Millions Company A Company B / Company C Now- Current Assets R136 822 & 124 948 104 516 Total Asset R231945 8227291 256 718 Inventories R5412 26454 Rio 343 Non-Current Liabilities 245232 R34 142 R53 434 Total Liabilities R75231 285 010 R95 010 Calculate the quick ratio of all companies using tablearrow_forwardProblem 17-6AA (Algo) Income statement computations and format LO A2 [The following information applies to the questions displayed below] Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31 follow. Assume that the company's income tax rate is 40% for all items. a. Interest revenue. b. Depreciation expense-Equipment c. Loss on sale of equipment d. Accounts payable. e. Other operating expenses f. Accumulated depreciation-Equipment g. Gain from settlement of lawsuit h. Accumulated depreciation-Buildings i. Loss from operating a discontinued segment (pretax) j. Gain on insurance recovery of tornado damage k. Net sales 1. Depreciation expense-Buildings B. Correction of overstatement of prior year's sales (pretax) n. Gain on sale of discontinued segment's assets (pretax) o. Loss from settlement of lawsuit p. Income tax expense q. Cost of goods sold Debit $ 35,400 27,250 107,800 19,650 53,400 17,400 25,150 496,500 Credit $…arrow_forwardh9arrow_forward

- V13arrow_forwardThis chapter introduced the accounting equation as a mathematical formula (e.g., Assets = Liabilities + Stockholders' Equity). The information contained in the accounting equation can also be shown in the form of a data visualization aid in interpreting the equation. Accounting equations for three ice cream chains, Brewster, Dyno, and Mabel, have been presented below. A Tableau visualization of each company's accounting equation is presented using a bar chart. Use the Tableau dashboard to assist you in answering the questions. Element Accounting Equation - Bar Chart Asset Equity Brewster Dyno Mabel Liability 600K 550K 500K 450K 400K 350K Equity 430,000 300K Asset 580,000arrow_forwardA2 1ai Use the following information for Delta Corporation : Year 20X1 20X2 Net sales $1,500,000 $1,656,598 Cost of goods sold 675,000 745,469 Depreciation 270,000 298,188 Interest paid 43,600 44,000 Cash 127,500 140,811 Accounts receivable 450,000 496,980 Inventory 525,000 579,809 Net fixed assets 1,800,000 1,987,918 Accounts payable 375,000 414,150 Notes payable 45,000 50,000 Long-term debt 500,000 500,000 Common stock 1,000,000 1,000,000 Retained earnings 982,500 1,241,368 Tax rate 35% 35% Dividend payout 30% 30% Delta has 600,000 common shares outstanding. The firm is projecting a 20% increase in net sales for the coming year (20X3). Delta uses the percentage of sales approach to plan for its financing needs. In using this approach, the firm assumes that cost of goods sold, all assets (current and fixed), and accounts payable will all remain a…arrow_forward

- Exercise 10-9 (Static) Find missing amounts for retained earnings (LO10-5) Consider each of the following independent situations: Required: For each situation, calculate the missing amount. a. b. C. d. 69 69 69 $ $ Beginning Retained Earnings Net Income for Dividends for the Year the Year 320,000 $ 120,000 $ 540,000 $ 230,000 290,000 S LA 69 170,000 $ 20,000 $ 50,000 $ 30,000 69 Ending Retained Earnings 700,000 360,000 490,000arrow_forward8arrow_forwardnik.9arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education