FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

E24-2B

Transcribed Image Text:ent ratio

(g) Working capital

(h) Receivables turnover and average collection period (Net receivables on January 1,

(i) Merchandise inventory turnover and average number of days to sell inventory

20-1, were $39,800.)

(Merchandise inventory on January 1, 20-1, was $48,970.)

(j) Debt-to-equity ratio

(k) Asset turnover (Assets on January 1, 20-1, were $175s50.)

(1) Times interest earned ratio

(m) Profit margin ratio

(n) Assets-to-equity ratio

(o) Price-earnings ratio (The market price of the common stock was $100.00 and

$85.00 on December 31, 20-2 and 20-1, respectively.)

00

000A

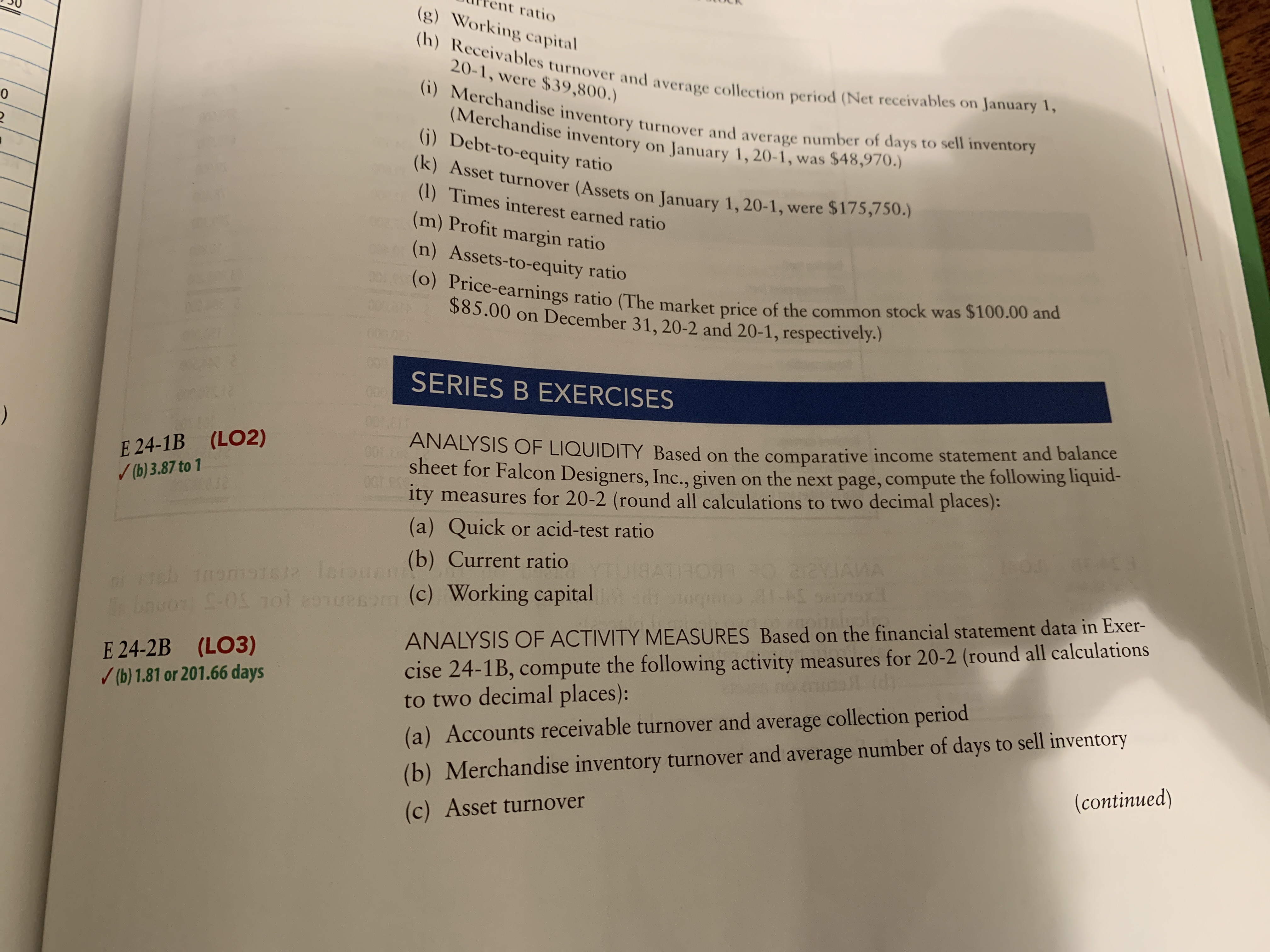

SERIES B EXERCISES

0000

E 24-1B (LO2)

/ (b) 3.87 to 1

ANALYSIS OF LIQUIDITY Based on the comparative income statement and balance

sheet for Falcon Designers, Inc., given on the next page, compute

ity measures for 20-2 (round all calculations to two decimal places):

the following liquid-

(a) Quick or acid-test ratio

(b) Current ratio

18ATHORT O 22YJAMA

bovon -05 1o1 2onuenom (c) Working capital

cise 24-1B, compute the following activity measures for 20-2 (round all calculations

to two decimal places):

ANALYSIS OF ACTIVITY MEASURES Based on the financial statement data in Exer-

E 24-2B (LO3)

(b) 1.81 or 201.66 days

(b) Merchandise inventory turnover and average number of days to sell inventory

(continued)

(a) Accounts receivable turnover and average collection period

(c) Asset turnover

Transcribed Image Text:E 24-4E

/ (b) 28.5

Accounting for Corporations and Manufacturing Businesses

PARTS

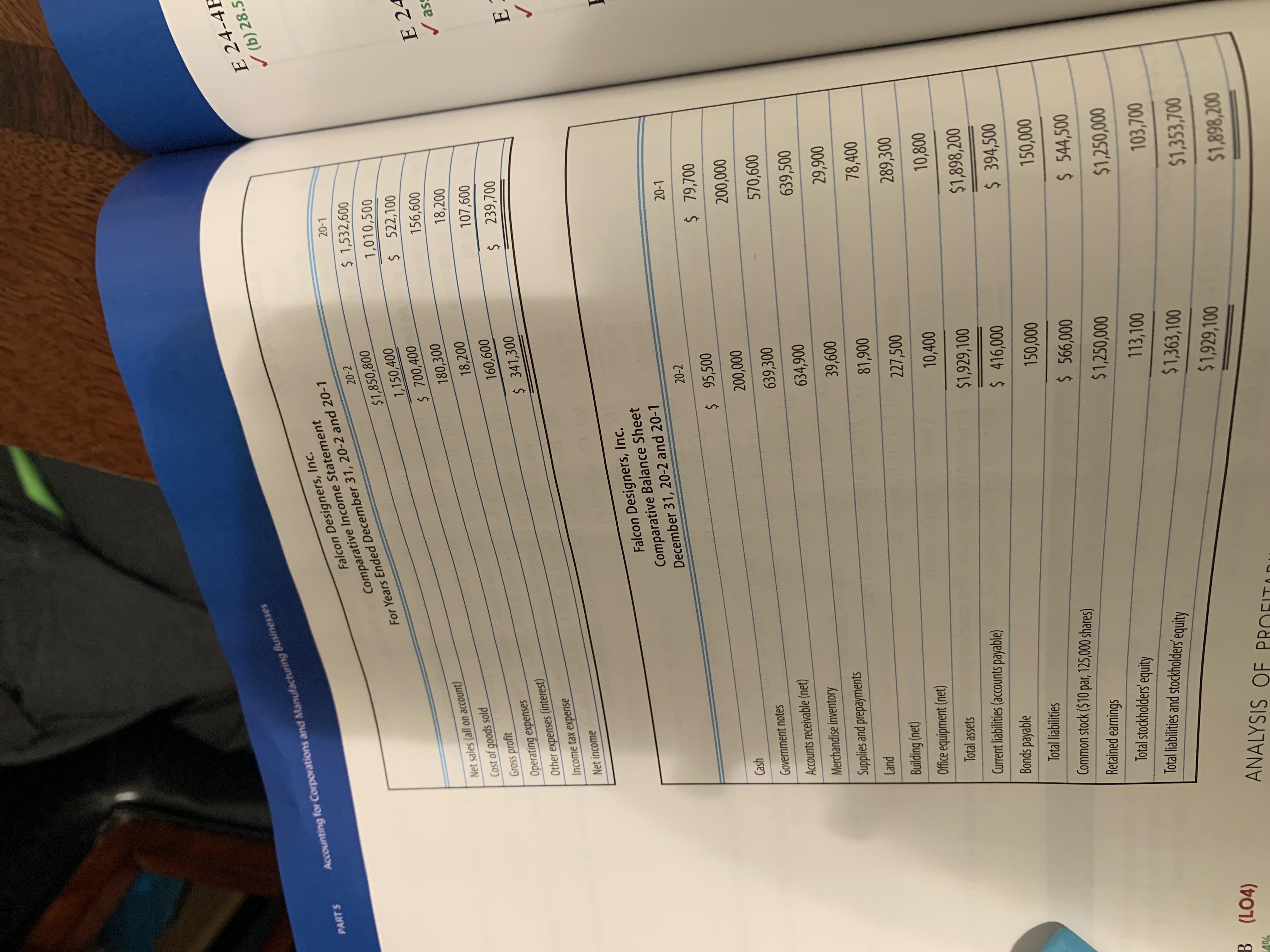

For Years Ended December 31, 20-2 and 20-1

$1,850,800

Falcon Designers, Inc.

20-1

Comparative Income Statement

20-2

$ 1,532,600

1,010,500

1,150,400

$ 522,100

$ 700,400

156,600

Net sales (all on account)

E 24

180,300

Cost of goods sold

Gross profit

18,200

18,200

ass

107,600

160,600

Operating expenses

$ 239,700

Other expenses (interest)

$ 341,300

Income tax expense

E

Net income

Falcon Designers, Inc.

Comparative Balance Sheet

December 31, 20-2 and 20-1

20-2

20-1

$ 95,500

$ 79,700

Cash

200,000

200,000

Government notes

Accounts receivable (net)

639,300

570,600

Merchandise inventory

634,900

639,500

Supplies and prepayments

39,600

29,900

Land

81,900

78,400

Building (net)

227,500

Office equipment (net)

289,300

Total assets

10,400

10,800

Current liabilities (accounts payable)

$1,929,100

$1,898,200

Bonds payable

$ 416,000

$ 394,500

Total liabilities

150,000

Common stock ($10 par, 125,000 shares)

$ 566,000

150,000

Retained earnings

$ 544,500

Total stockholders' equity

$1,250,000

$1,250,000

Total liabilities and stockholders' equity

113,100

103,700

$1,363,100

B (LO4)

$1,929,100

$1,353,700

40%

ANALYSIS OF PROFITO

$1,898,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Data: So 101; X= 114; 1+r= 1.12. The two possibilities for sr are 143 and 85.arrow_forward10078+0987=arrow_forward102. Four capacitors C1-1uF, C2=2uF, C3=3uF and C4-4uF are connected as given in figure. The potential of junction O is A. 16.5 V B. 18 V C. 15.5 V D. 18.5 V 10 V 5V C₁ # H C3+ CA 20 V 30 Varrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education