Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN: 9781305627734

Author: Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't used hand raiting

Transcribed Image Text:←

08:51

docs.google.com

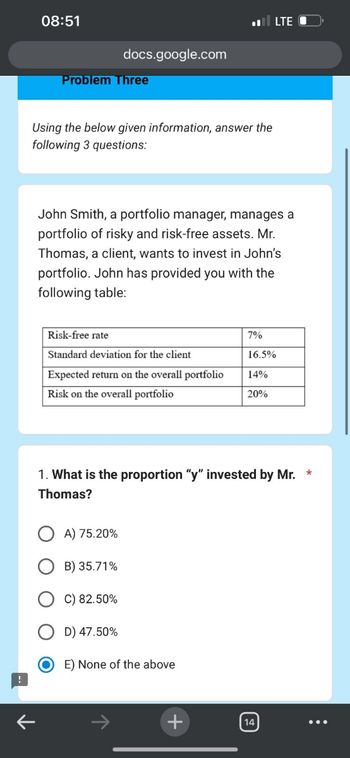

Problem Three

Using the below given information, answer the

following 3 questions:

LTE

John Smith, a portfolio manager, manages a

portfolio of risky and risk-free assets. Mr.

Thomas, a client, wants to invest in John's

portfolio. John has provided you with the

following table:

Risk-free rate

7%

Standard deviation for the client

16.5%

Expected return on the overall portfolio

14%

Risk on the overall portfolio

20%

1. What is the proportion "y" invested by Mr. *

Thomas?

A) 75.20%

B) 35.71%

C) 82.50%

D) 47.50%

E) None of the above

+

14

☑J

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Can you answer please and kindly show detailed human working.arrow_forwardYou are an employee at XYZ Bank. Your Bank is trying the construct an investment portfolio that matches its resources and goals. To do so, you and your team are required to evaluate the investment options available for your Bank and decide what is the best option to choose. A B C D E Value of the 1,400,500 1,370,050 750,000 450,300 1,700,650 position Duration 5 4 6 YTM 4% 3% 7% 8% 5.50% Potential adverse move 0.30% 0.26% 0.43% 0.56% 0.37% in yield Correlation A. В D E A 1. 0.5 0.3 0.1 -0.2 B 1 0.2 -0.3 0.4 1 0.2 -0.3 D 1. -0.4 E Weight А В D E Scenario I 30.00% 10.00% 60.00% Scenario II 50.00% 30.00% 20.00% Scenario III 50.00% 50.00%arrow_forwardCan you please answer and kindly show detailed human working.arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working!arrow_forwardPlease correct answer and don't use hand ratingarrow_forwardH1. Accountarrow_forward

- 5arrow_forwardIntegrative―Risk, return, and CAPM Wolff Enterprises must consider one investment project using the capital asset pricing model (CAPM). Relevant information is presented in the following table. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Item Risk-free asset Market portfolio Project 4% Rate of return Beta, b 0.00 12% 1.00 1.28 a. Calculate the required rate of return for the project, given its level of nondiversifiable risk. b. Calculate the risk premium for the project, given its level of nondiverisifiable risk. a. The required rate of return for the project is %. (Round to two decimal places.) b. The risk premium for the project is %. (Round to two decimal places.)arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working!arrow_forward

- Hi there, I am trying to solve this corporate finace question. I have attached a photo of the data below. ρ23 is +1.0 and the portfolio includes securities B and C. How do I calculate the feasible set of portfolios for these securities? I would like to know how to calculate this problem as well as how to represent it on a graph using excel Thank youarrow_forwardHi there help me with this its kinda easy for you please cross check once after doing ( by eyes only)arrow_forward9.2- Use the diagrams to answer the question q3- This question relates to Diagrams 6 - 9 from the Online Quiz 9.2 diagrams, each of which shows a set of portfolios plotted on a set of risk/return axes. Which diagram shows (in red) the set of efficient portfolios in the presence of a risk-free asset? Select one: a. Diagram 6 b. Diagram 7 c. Diagram 8 d. Diagram 9arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning