ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

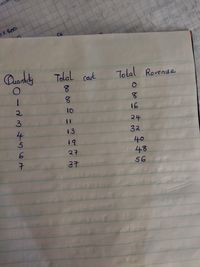

a. Calculate profit for each quantity. How much should the firm produce to maximize profut ?

b. Calculate marginal revenue and marginal cost for each quantity. Graph

them. (Hint: Put the points between whole numbers. For example, the

marginal cost between 2 and 3 should be graphed at ) At what quantity do these

c. Can you tell whether this firm is in a competitive industry? If so, can you

tell whether the industry is in a long-run equilibrium?

Transcribed Image Text:X 400

Co

Tokal cart

Tolal

Rovenue

8.

10

16

131

24

13

32

19

40

48

27

37

LEGO

3456et

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose she runs a small business that manufactures teddy bears. Assume that the market for teddy bears is a competitive market, and the market price is $20 per teddy bear.arrow_forwardNEED HELP! I am absolutely bad at graphs I need help with A through F and can you please explain. Draw the MR, MC, AVC, ATC, Demand, supply, MC and MR for the following situations. For each of these situations show the total revenue, total cost area, and shade the profit or loss area, and if the situation is a shut down state why it should shutdown. a. A perfectly competitive firm showing a profitb. A perfectly competitive firm showing a loss but not a shut-downc. A perfectly competitive firm at a break-even pointd. A monopolist showing a profite. A monopolist showing a loss but not a shut-downf. A monopolist at a break-even pointg. Difference between a monopolist and a perfectly competitive firm for a profit situation on the same graph space.arrow_forwardUSE THE GRAPH TO ANSWER THE FOLLOWING QUESTIONS: (IF REQUIRED, USE THE DISCREET NUMBER OF BARRELS). ANSWERS IN WHOLE NUMBER a. How many barrels of natural-organic oil reflect the lowest minimum average variable cost?b. How much is the price of the natural-organic oil per barrel?c. How much is the fixed cost to produce the natural-organic oil?d. How many barrels of natural-organic oil should the firm produce to maximize its profit?e. At what production level would the marginal cost exceed the average cost?arrow_forward

- How do I do this?arrow_forwarda.Suppose a perfectly competitive firm can produce10000 bushels of corn a year at an output at which marginal revenue is equal to marginal cost. The market price of corn per bushel is $2. The firm's total costs per year are $30000 and fixed costs per year are $15000. Show and explain which of the following is true: In the short run, this firm should a) Produce 20000 bushels to try to increase economic profit. b) Produce 10000 bushels of corn because, although they are losing money, they are losing less than if they shut down. c)Shut down. d) Continue producing until the price of corn increases. b.A perfectly competitive firm, with MC=q operates in a market character,zed by the following market demand and supply conditions: Demand: Q=20000-100P Supply: Q=100P How much output does this competitive firm produce to maximize profit? Show your work graphically and algebraically.arrow_forwardyou've been learning about what makes a market perfectly competitive, how a firm in a perfectly competitive market makes profit-maximizing decisions, and how a perfectly competitive market moves towards equilibirium. But how applicable is this to real life? For this discussion, try to think of a market (for a product or service) that is perfectly competitive or very close to it. What characteristics of the market make it like perfect competition? Are there factors that keep it from being perfectly competitive? If so, what are they? How close do you think the firms in this market are to perfectly competitive firms in choosing equilibrium price and quantity?arrow_forward

- Lisa lawn company (LLC) is a lawn mowing business in a perfectly competitive market for lawn moving services. The following tables set out Lisa's costs Quantity(lawn per hour) Total Cost(dollars per lawn) 0 $30 1 $40 2 $55 3 $75 4 $100 5 $130 6 $165 A. If the market price is $30 per lawn, How many lawns per hour does Lisa's LLC now? B. If the market price is 30 per lawn, What is Lisa"s profit in the short run? C. if the market price falls to $20 per lawn, how many lawns per hour does Lisa's LLC now? D. if the market price falls to $20 per lawn, what is Lisa's profit in the short run? E. At What market price will Lisa shut down?arrow_forwardBrody's firm produces trumpets in a perfectly competitive market. The table below shows Brody's total variable cost. He has a fixed cost of $240, and the price per trumpet is $60.-Calculate the average total cost of producing 6 trumpets. Show your work. -Calculate the marginal cost of producing the 11th trumpet. -What is Brody's profit-maximizing quantity? Use marginal analysis to explain your answer. -At the profit-maximizing quantity you determined in part (c), calculate Brody's profit or loss. Show your work. -Brody also produces saxophones at a loss in a perfectly competitive market. Draw a correctly labeled graph for Brody's firm showing the following at a market price of $200. -Brody's profit-maximizing quantity of saxophones -Brody's loss, completely shaded Quantity Total Variable cost 6 $120 7 $145 8 $165 9 $220 10 $290 11 $390arrow_forwardNeed help with top half of attached picturearrow_forward

- A firm is selling apples is profit-maximizing, but they're in a constant cost industry. The industry is perfectly competitive and currently in long-run equilibrium. Assume apples are a normal good and consumer income falls, and the firm continues to produce. 1. Illustrate the decrease in income in the short run with a cost curves graph. Make sure to highlight the area of loss.arrow_forwardA profit-maximizing firm in a competitive market is currently producing 500 units of output. It has average revenue of $10, average total cost of $8, and fixed costs of $200. a. What is its profit? b. What is its marginal cost? c. What is its average variable cost? d. Is the efficient scale of the firm more than, less than, or exactly 100 units?arrow_forwardUse a graph to demonstrate the scenario where a competitive firm would be earning positive profit in the short run. Can this scenario be maintained in the long run? Why? What are the ‘shutdown point’ and ‘break even point’ of a competitive firm . Explain with diagram. A competitive market starts in a situation of long run equilibrium. Then there is an increase in demand. Explain what happens in the short run and long run, using necessary diagrams.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education