ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ok

nces

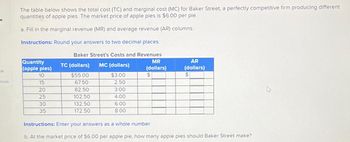

The table below shows the total cost (TC) and marginal cost (MC) for Baker Street, a perfectly competitive firm producing different

quantities of apple pies. The market price of apple pies is $6.00 per pie.

a. Fill in the marginal revenue (MR) and average revenue (AR) columns.

Instructions: Round your answers to two decimal places.

Baker Street's Costs and Revenues

MR

(dollars)

$

Quantity

(apple pies)

10

15

20

25

30

35

TC (dollars) MC (dollars)

$55.00

$3.00

67.50

2.50

3.00

4.0

6.00

8.00

82.50

102.50

132.50

172.50

AR

(dollars)

$

Instructions: Enter your answers as a whole number.

b. At the market price of $6.00 per apple pie, how many apple pies should Baker Street make?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose Felix runs a small business that manufactures frying pans. Assume that the market for frying pans is a competitive market, and the market price is $20 per frying pan. The following graph shows Felix's total cost curve. Use the blue points (circle symbol) to plot total revenue and the green points (triangle symbol) to plot profit for frying pans quantities zero through seven (inclusive) that Felix produces. TOTAL COST AND REVENUE (Dollars) 200 175 150 125 100 75 50 25 0 -25 0 1 ● ^ 2 O ☐ A ☐ A 3 4 5 QUANTITY (Frying pans) O ☐ 6 Total Cost ☐ 7 8 o Total Revenue Profit ? image 1 Calculate Felix's marginal revenue and marginal cost for the first seven frying pans he produces, and plot them on the following graph. Use the blue points (circle symbol) to plot marginal revenue and the orange points (square symbol) to plot marginal cost at each quantity.arrow_forward3. The components of marginal revenue Asim's HockNLadder is the only company selling fire engines in the fictional country of Alexandrina. Asim initially produced seven trucks, but then decided to increase production to eight trucks. The following graph gives the demand curve faced by Asim's HookNLadder. As the graph shows, in order to sell the additional fire truck, Asim must lower the price from $100,000 to $50,000 per truck. Notice that Asim gains revenue from the sale of the additional engine, but at the same time, he loses revenue from the initial seven engines because they are all sold at the lower price. use the purple rectangle (diamond symbols) to shade the area representing the revenue lost from the initial seven engines by selling at $50,000 rather than $100,000. Then use the green rectangle (triangle symbols) to shade the area representing the revenue gained from selling an additional engine at $50,000. PRICE (Thousands of dollars per fire engine) 250 221 200 179 150 125…arrow_forwardhelparrow_forward

- (Figure: Profit-Maximization for Fabulous Finn's Flower Firm in the Short Run) Use Figure: Profit- Maximization for Fabulous Finn's Flower Firm in the Short Run. The MC curve is represented by: Price, ATC, AVC, and MC (per unit) O a) P₁ P3 P₂ N P₁ curve N b) none of the curves. c) curve 0. d) curve M. M 91 92 93 94 95 Quantity (per period)arrow_forwardAnswer question 6C onlyarrow_forwardQUESTION 10 Jack sells water bottles. Assume the market for water bottles is perfectly competitive. Jack sells his water bottles at the market price of $9.00. At the profit-maximising output level of 51 water bottles, Jack's average total cost is $4.40 per water bottle. The minimum average variable cost is $3.90 per water bottle. Answer the following questions: a. Jack's economic profit or loss is decimal places (ie: to the nearest cent). (use a negative value if a loss). Answer in dollars, rounded to two b. State whether the following statement is true or false: "At the profit-maximising quantity, Jack is making an economic profit of $4.60 per water bottle." Type T for true, or F for false c. State whether the following statement is true or false: "Jack should shut down if the market price is $3.85 per water bottle." Type T for true, or F for falsearrow_forward

- Solve all this question..arrow_forwarda. Find total revenues and marginal revenues for each of the quantities. b. What quantity of CDs would maximize profit? What would the price be? 2.) Charlies's lawn-mowing service is a profit-maximizing.competitive firm. Bob mows lawns for $27 each. His total cost each day is $280, of which $30 is a fixed cost. He mows 10 lawns a day. What can you say about Charlies's short-run decision regarding shutdown and his long-run decision regarding exit?arrow_forwardNEED HELP! I am absolutely bad at graphs I need help with A through F and can you please explain. Draw the MR, MC, AVC, ATC, Demand, supply, MC and MR for the following situations. For each of these situations show the total revenue, total cost area, and shade the profit or loss area, and if the situation is a shut down state why it should shutdown. a. A perfectly competitive firm showing a profitb. A perfectly competitive firm showing a loss but not a shut-downc. A perfectly competitive firm at a break-even pointd. A monopolist showing a profite. A monopolist showing a loss but not a shut-downf. A monopolist at a break-even pointg. Difference between a monopolist and a perfectly competitive firm for a profit situation on the same graph space.arrow_forward

- Nonearrow_forwardHow do I do this?arrow_forwardThe cost data in the following table are for Marshall’s Meats, a perfectly competitive firm. Round your answers to 2 decimal places. Output Average Variable Cost AverageTotal Cost MarginalCost Total Cost 0 / / / $ 95 1 $ $ $ 115 2 125 3 150 4 200 5 270 6 350 7 450 a. Complete above the table. b. What is the break-even price? Break-even price: $ c. What is the shutdown price? Shutdown price: $ d. If the market price of the product is $50, what quantity will Marshall’s Meats produce? What will be its profit or loss? Quantity: ; : $ e. If the market price of the product is $100, what quantity will Marshall’s Meats produce? What will be its profit or loss? Quantity: ; : $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education