Contemporary Engineering Economics (6th Edition)

6th Edition

ISBN: 9780134105598

Author: Chan S. Park

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 19P

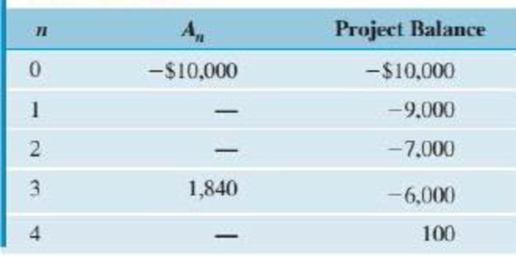

Consider the project balances in Table P5.19 for a typical investment project with a service life of four years.

TABLE P5.I9

- (a) Determine the interest rate used in computing the project balance.

- (b) Reconstruct the original cash flows of the project.

- (c) Would the project be acceptable at i = 15%?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Consider the cashflow (n = 10 years, MARR = e = 14%)

Cash Flow A

Investment

P 180,000

Revenues

P 350,000 per year

Expenses

P 400,000 per year

for the first 3 years,

decreasing by P

50,000 per year

thereafter

a. Determine the Annual Worth (AW) of each project.

b. Determine the Internal Rate of Return (IRR) of each project.

c. Determine the External Rate of Return (ERR) of each project.

Salvage

Value

P 40,000

Brown Corporation recently purchased a new machine for $339,013.20 with a ten-year life. The old equipment has a remaining life of ten years and no disposal value at the time of replacement. Net cash flows will be $60,000 per year. What is the internal rate of return?A) 12%B) 16%C) 20%D) 24%

If mutually exclusive projects with normal cash flows are being analyzed, the net present value (NPV) and internal rate of return (IRR) methods

always

agree.

Projects Y and Z are mutually exclusive projects. Their cash flows and NPV profiles are shown as follows.

Year

Project Y Project Z

0

-$1,500

-$1,500

1

$200

$900

2

$400

$600

3

$600

$300

4

$1,000

$200

NPV (Dollars)

800

600

Project Y

400

Project Z

200

-200

0246

8

10 12 14 16 18 20

COST OF CAPITAL (Percent)

If the weighted average cost of capital (WACC) for each project is 14%, do the NPV and IRR methods agree or conflict?

O The methods agree.

O The methods conflict.

Chapter 5 Solutions

Contemporary Engineering Economics (6th Edition)

Ch. 5 - Prob. 1PCh. 5 - Prob. 2PCh. 5 - If a project costs 100,000 and is expected to...Ch. 5 - Refer to Problem 5.2, and answer the following...Ch. 5 - Prob. 5PCh. 5 - Prob. 6PCh. 5 - Prob. 7PCh. 5 - Prob. 8PCh. 5 - Consider the cash flows from an investment...Ch. 5 - Prob. 10P

Ch. 5 - Prob. 11PCh. 5 - Prob. 12PCh. 5 - Prob. 13PCh. 5 - Prob. 14PCh. 5 - Prob. 15PCh. 5 - Prob. 16PCh. 5 - Prob. 17PCh. 5 - Prob. 18PCh. 5 - Consider the project balances in Table P5.19 for a...Ch. 5 - Your RD group has developed and tested a computer...Ch. 5 - Prob. 21PCh. 5 - Prob. 22PCh. 5 - Prob. 23PCh. 5 - Prob. 24PCh. 5 - Prob. 25PCh. 5 - Prob. 26PCh. 5 - Prob. 27PCh. 5 - Prob. 28PCh. 5 - Prob. 29PCh. 5 - Prob. 30PCh. 5 - Prob. 31PCh. 5 - Prob. 32PCh. 5 - Geo-Star Manufacturing Company is considering a...Ch. 5 - Prob. 34PCh. 5 - Prob. 35PCh. 5 - Prob. 36PCh. 5 - Prob. 37PCh. 5 - Prob. 38PCh. 5 - Prob. 39PCh. 5 - Prob. 40PCh. 5 - Prob. 41PCh. 5 - Prob. 42PCh. 5 - Two methods of carrying away surface runoff water...Ch. 5 - Prob. 44PCh. 5 - Prob. 45PCh. 5 - Prob. 46PCh. 5 - Prob. 47PCh. 5 - Prob. 48PCh. 5 - Prob. 49PCh. 5 - Prob. 50PCh. 5 - Prob. 51PCh. 5 - Prob. 52PCh. 5 - Prob. 53PCh. 5 - Prob. 54PCh. 5 - Prob. 55PCh. 5 - Prob. 56PCh. 5 - Prob. 57PCh. 5 - Prob. 58PCh. 5 - Prob. 59PCh. 5 - Prob. 1STCh. 5 - Prob. 2ST

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider the cashflow (n = 10 years, MARR = e = 14%) Cash Flow A Investment Revenues P 180,000 P 350,000 per year a. Calculate the annual worth (AW) of the project Expenses P 400,000 per year for the first 3 years, decreasing by P 50,000 per year thereafter Salvage Value P 40,000arrow_forwardThe International Parcel Service has installed a new radio frequency identification system to help reduce the number of packages that are incorrectly delivered. The capital investment in the system is $65,000, and the projected annual savings are tabled below. The system’s market value at the EOY five is negligible, and the MARR is 18% per year. Calculate the payback period of the project.arrow_forwardYou are faced with a decision on an investment proposal. Specifically, the estimated additional income from the investment is $125,000 per year; the investment cost is $400,000; and the first year estimated expense of $20,000 and will increase a rate of 5% per year. Assume an 8-year analysis period, no salvage value, and MARR = 15% per year. a. Calculate the PW and FW of this proposal? b. What is the ERR ( Ԑ=MARR) of this proposal? c. What is the Simple and Discounted payback? (Upload the picture of your complete solutions including the correct cash flow diagram and your conclusion.)arrow_forward

- You are faced with a decision on an investment proposal. Specifically, the estimated additional income from the investment is $125,000 per year; the investment cost is $400,000; and the first year estimated expense of $20,000 and will increase a rate of 5% per year. Assume an 8-year analysis period, no salvage value, and MARR = 15% per year. a. Calculate the PW and FW of this proposal? b. What is the ERR ( Ԑ=MARR) of this proposal? c. What is the Simple and Discounted payback? include the cash flow diagram and conclusionarrow_forwardA project your firm is considering for implementation has these estimated costs and revenues: an investment cost of $50,000; maintenance costs that start at $5,000 at the end of year (EOY) 1 and increase by $500 each year until year 10 ; savings of $20,000 per year (EOY 1–10); and finally a resale value of $35,000 at the EOY 10. If the project has a 10-year life and the firm’s MARR is 10% per year a) what is the present worth of the project? PW = $___ b) What is the Future Worth of this project? FW = $___ c) What is IRR ? IRR = ___ % d) Is it a sound investment opportunity? YES or NO e) Determine the Discounted Payback? ____ 5 yearsarrow_forwardConsider the cashflow (n = 10 years, MARR = e = 14%) Cash Flow A Investment Revenues P 180,000 P 350,000 per year Expenses P 400,000 per year for the first 3 years, decreasing by P 50,000 per year thereafter a. Calculate the Internal Rate of Return (IRR) of each project. b. Calculate the External Rate of Return (ERR) of each project. Salvage Value P 40,000arrow_forward

- Are the investment decisions based solely on an estimate of a project's profitability?arrow_forwardA company purchases manufacturing equipment for $3,872,200. The company produces 1808 units of production per year. The revenue associated with each production unit is $1,245. The cost per production unit is $562 a) What is the non-discounted payback period? b) What is the payback period if the MARR = 13.00%? Use goal seek or interest tables & linear interpolation to solve part b.arrow_forwardThe Mowbot company wants to add a new product line. This will require spending $750,000 on new equipment and tooling. The new product line is expected to sell 1,500 units per year for five years. Each unit will generate $180 in gross profit. At the end of five years, the equipment will be sold for an estimated salvage value of $120,000.The Mowbot company evaluates projects using a minimum rate of return (MARR) of 18%. Use present worth analysis to determine whether this is a viable project. Show the equivalence formula(s) you use as well as your final solution.arrow_forward

- Another method to deal with the unequal life problem of projects is the equivalent annual annuity (EAA) method. In this method the annual cash flows under the alternative investments are converted into a constant cash flow stream whose NPV is equivalent to the NPV of the comparative project's Initial stream. Consider the case of Three Waters Boatbuilders: Three Waters Boatbuilders is considering a three-year project that has a weighted average cost of capital of 10% and a net present value (NPV) of $85,647. Three Waters Boatbuilders can replicate this project indefinitely. The equivalent annual annuity (EAA) for this project is The EAA approach to evaluating projects with unequal lives does not do a good job of taking inflation into account.arrow_forwardTwo investment projects are being evaluated based on their payback periods. The first alternative requires an initial investment of $300,000, has gross revenues of $55,000, annual O&M costs of $11,000 and a service life of 15 years What is the project's discounted payback period if the MARR is 8% per year? OA. 12.6 years OB. 74 years OC. 6.3 years OD. 102 years If the second alternative has a payback period of 6 years, which alternative should be preferred based on the payback period? OA. The first alternative OB. The second alternativearrow_forwardThe construction of a volleyball court for the employees of a highly successful mid-sized publishing company in California is expected to cost $1200 and have an annual maintenance costs of $300. At an effective annual interest of 5%, what is the project's capitalized cost($)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

Break Even Analysis (BEP); Author: Tutorials Point (India) Ltd.;https://www.youtube.com/watch?v=wOEkc3O_Q_Y;License: Standard YouTube License, CC-BY

Cost Volume Profit Analysis (CVP): calculating the Break Even Point; Author: Edspira;https://www.youtube.com/watch?v=Nw2IioaF6Lc;License: Standard Youtube License