Concept explainers

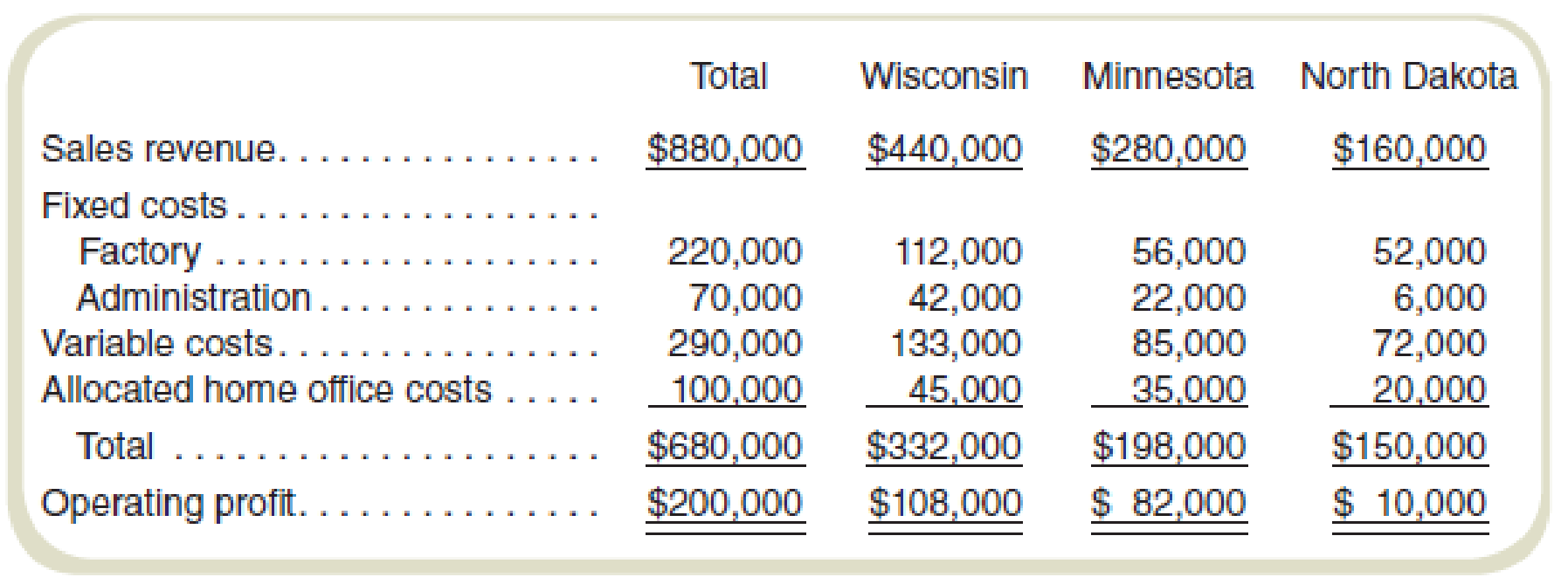

You have been asked to assist the management of Ironwood Corporation in arriving at certain decisions. Ironwood has its home office in Michigan and leases factory buildings in Wisconsin, Minnesota, and North Dakota, all of which produce the same product. Ironwood’s management provided you a projection of operations for next year follow:

The sales price per unit is $5.

Due to the marginal results of operations of the factory in North Dakota, Ironwood has

decided to cease its operations and sell that factory’s machinery and equipment by the end of this year. Ironwood expects that the proceeds from the sale of these assets would equal all termination costs. Ironwood, however, would like to continue serving most of its customers in that area if it is economically feasible and is considering one of the following three alternatives:

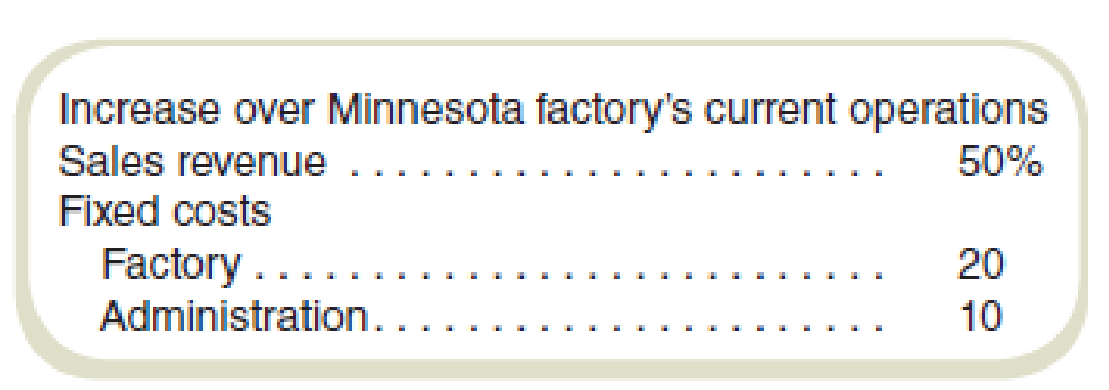

- Expand the operations of the Minnesota factory by using space presently idle. This move would result in the following changes in that factory’s operations:

Under this proposal, variable costs would be $2 per unit sold.

- Enter into a long-term contract with a competitor that will serve that area’s customers. This competitor would pay Ironwood a royalty of $1 per unit based on an estimate of 30,000 units being sold.

- Close the North Dakota factory and not expand the operations of the Minnesota factory.

Total home office costs of $100,000 will remain the same under each situation.

Required

To assist the management of Ironwood Corporation, prepare a schedule computing Ironwood’s estimated operating profit from each of the following options:

- a. Expansion of the Minnesota factory.

- b. Negotiation of the long-term contract on a royalty basis.

- c. Shutdown of the North Dakota operations with no expansion at other locations.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Pet Hotel, Inc. operates three luxury pet boarding facilities and expects the following results for the coming year. {picture} Answer each of the following questions independently. 1. Fixed costs are all allocated and unavoidable. What will happen to profit if Pet Hotel discontinues operations at Pet Spa? 2. Suppose now that $25,000 of the fixed costs shown for Pet Spa is avoidable. What will happen to total profits if Pet Hotel discontinues operations at Pet Spa?arrow_forwardIn the last 6 months, demand for one of Appleby Company's products has dropped off considerably, due mainly to it becoming obsolescent as a result of technological change. Knowing that the equipment used in the manufacture of this product may not be easy to sell, Appleby spent $50,000 on consultants to determine whether it could use the equipment to produce a new product under license by another company. The consultant has determined that this product would have variable production costs of $65 per unit and should sell at a price of $90/unit. The licensing royalty is 5% of gross product revenue. Estimated annual demand is 20,000 units per year. Additional annual operating costs related to this product are $30,000/year (excluding depreciation). Depreciation on the equipment is $15,000. Annual depreciation expense is a: O a. Sunk cost O b. Relevant cost O c. Both sunk and Irrelevant cost Od. Irrelevant costarrow_forwardManuel Inc. produces textiles in many different forms. After recording lower than anticipated profits last year, Manuel has decided to shut down one of its divisions that is not performing well. The accounting manager has compiled the following data on the two divisions being considered for closing and has asked you to evaluate the short-term and long-term effects on profits of closing each division. Which division should be closed if Manuel is most concerned with increasing long-run profits? Winter Outerwear High-End Suits Net revenues $ 1,200,000 $ 5,200,000 Variable costs 660,000 2,160,000 Contribution margin 540,000 3,040,000 Controllable fixed costs 0 2,020,000 Controllable margin 540,000 1,020,000 Noncontrollable fixed costs 770,000 1,540,000 Contribution by division $ (230,000 ) $ (520,000 ) multiple choice Winter Outerwear High-End Suits Closing either would have the same…arrow_forward

- Cornell Enterprises currently produces several products. Model L78 is showing a net operating loss as indicated by the following condensed income statement prepared for the year ended December 31. You have been hired by Cornell Enterprises to help analyze the decision as to whether to eliminate Model L78. Upon investigation, you discover that if Model L78 is eliminated, $20,000 of the fixed costs shown on the above condensed income statement can be eliminated. The rest of the fixed costs allocated to Model L78 are common fixed costs that will be allocated to the remaining two products produced by Cornell Enterprises. Determine if Cornell Enterprises should discontinue Model L78.arrow_forwardCari Heat (CH) Ltd. is currently faced with a critical decision regarding its productionequipment. Cari Heat (CH) is evaluating two options for its production equipment:upgrading or replacing. The company manufactures and sells 7,500 heaters every year, eachpriced at $920. The current production equipment, which was acquired at a cost of$2,150,000, has been in use for just two years and is subject to straight-line depreciation overa five-year useful life. Furthermore, it possesses no terminal disposal value, but it can becurrently sold for $650,000.The following table presents data for the two alternatives:A B C1 Choice Upgrade Replace2 One-time equipment costs $3,500,000 $5,200,0003 Variable manufacturing cost per Heater $180 $904 Remaining useful life of equipment (years) 3 35 Terminal disposal value of equipmentRequired0 01. Prepare a schedule, for the remaining 3 years, reflecting whether CH should upgrade itsproduction line or replace it? 2. Assuming that all other data are as…arrow_forwardTwo alternative locations are under consideration for a new plant: Jackson, Mississippi, and Dayton, Ohio. The Jackson location is superior in terms of costs. However, management believes that sales volume would decline if this location were chosen because it is farther from the market, and the firm's customers prefer local suppliers. The selling price of the product is $350 per unit in either case. Use the following information to determine which location yields the higher total profit per year: Location Jackson Dayton The annual profit from Jackson is $ Annual Fixed Cost $2,100,000 $3,000,000 Variable Cost per Unit 45 $95 Forecasted Demand per Year 35,000 units 39,000 units (Enter your response as an integer.) ..arrow_forward

- Sophia & More Company sells clothing, shoes and accessories at a city location near you. Information for the just concluded calendar year follows. Management is considering closing the Shoe segment because of the operating loss and is thinking about expanding the space that is currently devoted to the Accessories segment. A salaried salesperson in the Shoe segment who earns $45,000 will be terminated; however, all other segmental fixed costs will continue to be incurred. Sophia & More will spend $16,000 on remodeling costs and anticipates that sales in the Accessories segment will increase by $70,000. This additional sales revenue is expected to generate a 35% contribution margin for the company. Finally, because clothing customers often purchased shoes and feel strongly about "one-stop shopping," clothing sales are expected to fall by 15% if the Shoe segment is closed. Required: Using incremental analysis, determine whether the Shoe segment should be closed and if so, what…arrow_forwardA study has been conducted to determine if one of the departments in Your Company should be discontinued. The contribution margin in the department is $50,000 per year. Fixed expenses charged to the department are $65,000 per year. It is estimated that $40,000 of these fixed expenses could be eliminated if the department is discontinued. Discontinuing this product would result in a $120,000 increase in the contribution margin of other product lines. If the department is discontinued, what would be the annual change in the company's overall net operating? It the change is a decrease, enter your number with a – in front. Otherwise, just enter the number. ENTER YOUR ANSWER WITHOUT DOLLAR SIGNS OR OTHER DISCRIPTIONSarrow_forwardThe Monroe Forging Company sells a corrugated steel product to the Standard Manufacturing Company and is in competition on such sales with other suppliers of the Standard Manufacturing Co. The vice president of sales of Monroe Forging Co. believes that by reducing the price of the product, a 40% increase in the volume of units sold to the Standard Manufacturing Co. could be secured. As the manager of the cost and analysis department, you have been asked to analyze the proposal of the vice president and submit your recommendations as to whether it is financially beneficial to the Monroe Forging Co. You are specifically requested to determine the following: (a) Net profit or loss based on the pricing proposal. (b) Unit sales volume under the proposed price that is required to make the same $40,000 profit that is now earned at the current price and unit sales volume. Use the following data in your analysis:arrow_forward

- A study has been conducted to determine if one of the departments in Your Company should be discontinued. The contribution margin in the department is $50,000 per year. Fixed expenses charged to the department are $65,000 per year. It is estimated that $40,000 of these fixed expenses could be eliminated if the department is discontinued. Discontinuing this product would result in a $120,000 increase in the contribution margin of other product lines. If the department is discontinued, what would be the annual change in the company's overall net operating?arrow_forwardComfy Corporation manufactures furniture in several divisions, including the patio furniture division. The manager of the patio furniture division plans to retire in two years. The manager receives a bonus based on the division’s ROI, which is currently 7%. One of the machines that the patio furniture division uses to manufacture the furniture is rather old, and the manager must decide whether to replace it. The new machine would cost $35,000 and would last 10 years. It would have no salvage value. The old machine is fully depreciated and has no trade-in value. Comfy uses straight-line depreciation for all assets. The new machine, being new and more efficient, would save the company $5,000 per year in cash operating costs. The only difference between cash flow and net income is depreciation. The internal rate of return of the project is approximately 7%. Comfy Corporation’s weighted-average cost of capital is 5%. Comfy is not subject to any income taxes. Q. Assume that “investment” is…arrow_forwardComfy Corporation manufactures furniture in several divisions, including the patio furniture division. The manager of the patio furniture division plans to retire in two years. The manager receives a bonus based on the division’s ROI, which is currently 7%. One of the machines that the patio furniture division uses to manufacture the furniture is rather old, and the manager must decide whether to replace it. The new machine would cost $35,000 and would last 10 years. It would have no salvage value. The old machine is fully depreciated and has no trade-in value. Comfy uses straight-line depreciation for all assets. The new machine, being new and more efficient, would save the company $5,000 per year in cash operating costs. The only difference between cash flow and net income is depreciation. The internal rate of return of the project is approximately 7%. Comfy Corporation’s weighted-average cost of capital is 5%. Comfy is not subject to any income taxes. Q. Should Comfy Corporation…arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning