Concept explainers

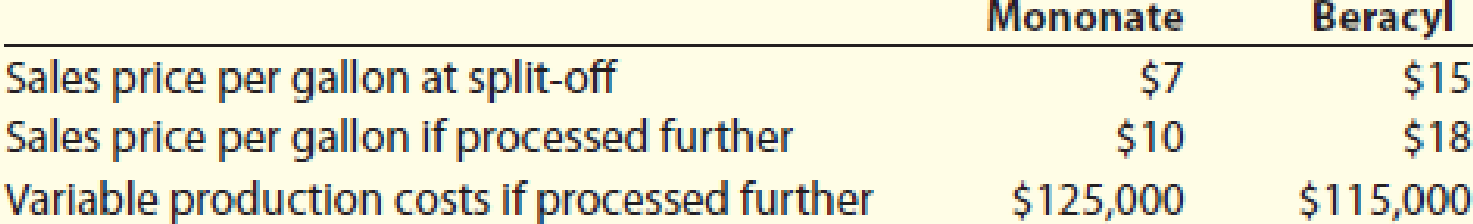

Oakes Inc. manufactured 40,000 gallons of Mononate and 60,000 gallons of Beracyl in a joint production process, incurring $250,000 of joint costs. Oakes allocates joint costs based on the physical volume of each product produced. Mononate and Beracyl can each be sold at the split-off point in a semifinished state or, alternatively, processed further. Additional data about the two products are as follows:

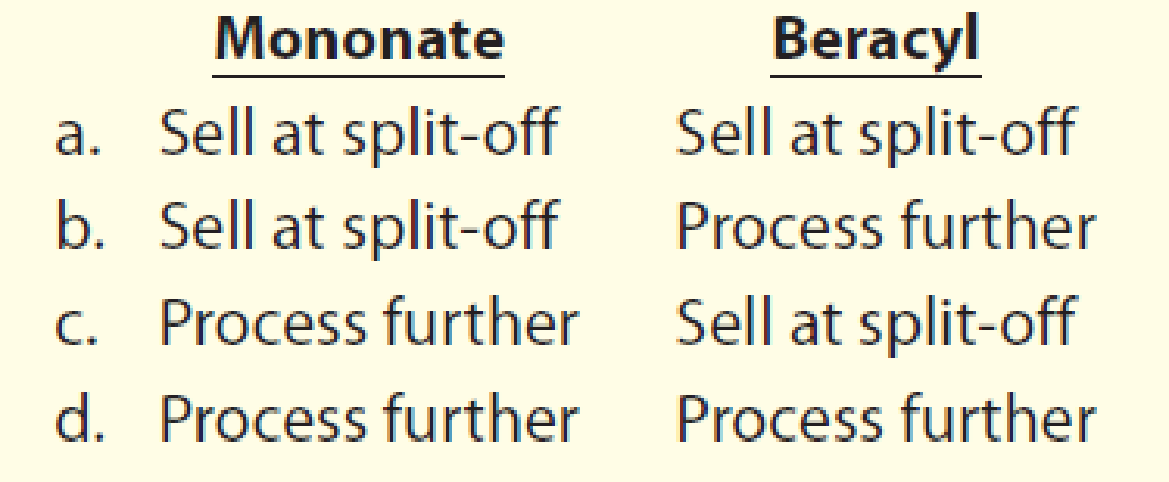

An assistant in the company’s cost accounting department was overheard saying “...that when both joint and separable costs are considered, the firm has no business processing either product beyond the split-off point. The extra revenue is simply not worth the effort.” Which of the following strategies should be recommended for Oakes?

Trending nowThis is a popular solution!

Chapter 25 Solutions

Financial And Managerial Accounting

- Pacheco, Inc., produces two products, overs and unders, in a single process. The joint costs of this process were 50,000, and 14,000 units of overs and 36,000 units of unders were produced. Separable processing costs beyond the split-off point were as follows: overs, 18,000; unders, 23,040. Overs sell for 2.00 per unit; unders sell for 3.14 per unit. Required: 1. Allocate the 50,000 joint costs using the estimated net realizable value method. 2. Suppose that overs could be sold at the split-off point for 1.80 per unit. Should Pacheco sell overs at split-off or process them further? Show supporting computations.arrow_forwardTucariz Company processes Duo into two joint products, Big and Mini. Duo is purchased in 1,000-gallon drums for 2.000. Processing costs are 3,000 to process the 1,000 gallons of Duointo 800 gallons of Big and 200 gallons of Mini. The selling price is 9 per gallon for Big and4 per gallon for Mini. If the physical units method is used to allocate joint costs to the finalproducts, the total cost allocated to produce Mini is: a. 500. b. 4,000. c. 1,000. d. 4,500.arrow_forwardMan OFort Inc. produces two different styles of door handles, standard and curved. The door handles go through a joint production molding process costing 29,000 per batch and producing 2,000 standard door handles and 1,000 curved door handles at the split-off point. Both door handles undergo additional production processes after the split-off point, but could be sold at that point: the standard style for 4 per door handle and the curved style for 2 per door handle. Determine the amount of joint production costs allocated to each style of door handle using the market value at split-off method.arrow_forward

- Venezuela Oil Inc. transports crude oil to its refinery where it is processed into main products gasoline, kerosene, and diesel fuel, and by-product base oil. The base oil is sold at the split-off point for $1,000,000 of annual revenue, and the joint processing costs to get the crude oil to split-off are $10,000,000. Additional information includes: Required: Determine the allocation of joint costs using the net realizable value method, rounding the sales value percentages to the nearest tenth of a percent. (Hint: Reduce the amount of the joint costs to be allocated by the amount of the by-product revenue.)arrow_forwardLeMoyne Manufacturing Inc.’s joint cost of producing 2,000 units of Product X, 1,000 units of Product Y, and 1,000 units of Product Z is $50,000. The unit sales values of the three products at the split-off point are Product X–$30, Product Y–$100, and Product Z–$90. Ending inventories include 200 units of Product X, 300 units of Product Y, and 100 units of Product Z. Compute the amount of joint cost that would be included in the ending inventory valuation of the three products on the basis of their sales values at split-off. Assume that Product Z can be sold for $120 a unit if it is processed after split-off at a cost of $10 a unit. Compute the amount of joint cost that would be included in the ending inventory valuation of the three products on the basis of their net realizable values.arrow_forwardThe Marshall Company has a joint production process that produces two joint products and a by-product. The joint products are Ying and Yang, and the by-product is Bit. Marshall accounts for the costs of its products using the net realizable value method. The two joint products are processed beyond the split-off point, incurring separable processing costs. There is a $2,000 disposal cost for the by- product. A summary of a recent month's activity at Marshall is shown below: Yang 80,000 80,000 Separable processing costs-variable $ 86,000 Separable processing costs-fixed Sales price $ 14,000 $ 20,000 $6.00 $ 12.50 $ 1.50 Total joint costs for Marshall in the recent month are $268,000, of which $115.240 is a variable cost Units sold Units produced Manufacturing cost per unit t Total gross margin Required: 1. Calculate the manufacturing cost per unit for each of the three products. (Round manufacturing cost per unit answers to 2 decimal places.) 2. Calculate the total gross margin for each…arrow_forward

- Pharoah Minerals processes materials extracted from mines. The most common raw material that it processes results in three joint products: Spock, Uhura, and Sulu. Each of these products can be sold as is, or each can be processed further and sold for a higher price. The company incurs joint costs of $182,100 to process one batch of the raw material that produces the three joint products. The following cost and sales information is available for one batch of each product. Spock Uhura Sulu Sales Value at Split-Off Point $209,600 299,800 455,800 Allocated Joint Costs $40,200 60,900 81,000 Cost to Process Further $109,700 84,700 250,200 Sales Value of Processed Product $300,900 400,600 799,600 Determine the incremental profit or loss that each of the three joint products. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses e.g. (45))arrow_forwardKirk Minerals processes materials extracted from mines. The most common raw material that it processes results in three joint products: Spock, Uhura, and Sulu. Each of these products can be sold as is, or each can be processed further and sold for a higher price. The company incurs joint costs of $179,400 to process one batch of the raw material that produces the three joint products. The following cost and sales information is available for one batch of each product. Sales Value atSplit-Off Point AllocatedJoint Costs Cost to ProcessFurther Sales Value ofProcessed Product Spock $209,700 $40,000 $109,600 $300,900 Uhura 300,000 60,200 84,900 399,900 Sulu 455,500 79,200 249,500 800,500 Determine the incremental profit or loss that each of the three joint products. Spock Uhura Sulu Incremental profit (loss) $ $ $ Indicate whether each of the three joint products should be sold as…arrow_forwardKirk Minerals processes materials extracted from mines. The most common raw material that it processes results in three joint products: Spock, Uhura, and Sulu. Each of these products can be sold as is, or each can be processed further and sold for a higher price. The company incurs joint costs of $178,600 to process one batch of the raw material that produces the three joint products. The following cost and sales information is available for one batch of each product. Sales Value atSplit-Off Point AllocatedJoint Costs Cost to ProcessFurther Sales Value ofProcessed Product Spock $209,500 $39,200 $110,100 $300,900 Uhura 299,900 59,100 85,100 400,900 Sulu 454,000 80,300 249,500 800,700 Determine the incremental profit or loss that each of the three joint products. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Spock Uhura Sulu…arrow_forward

- Kirk Minerals processes materials extracted from mines. The most common raw material that it processes results in three joint products: Spock, Uhura, and Sulu. Each of these products can be sold as is, or each can be processed further and sold for a higher price. The company incurs joint costs of $178,800 to process one batch of the raw material that produces the three joint products. The following cost and sales information is available for one batch of each product. Spock Uhura Sulu Sales Value at Split-Off Point $211,000 299,200 455,600 Allocated Joint Costs Incremental profit (loss) $ $39,700 59,800 79,300 Cost to Process Further $110,800 Spock 85,200 250,000 Sales Value of Processed Product $300,100 400,200 Determine the incremental profit or loss that each of the three joint products. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) 800,800 Uhura Suluarrow_forwardTwo products, QI and VH, emerge from a joint process. Product QI has been allocated $24,300 of the total joint costs of $45,000. A total of 3,100 units of product QI are produced from the joint process. Product QI can be sold at the split-off point for $15 per unit, or it can be processed further for an additional total cost of $11,100 and then sold for $17 per unit. If product QI is processed further and sold, what would be the financial advantage (disadvantage) for the company compared with sale in its unprocessed form directly after the split-off point?arrow_forwardThe joint process from which Ple'egrea, Inc. obtains both Nuts and Bolts has a total cost of $74,000 per batch. From each batch, 2,400 pounds of Nuts and 18,600 pounds of Bolts are obtained. These can be sold at the split-off point for $38 and $14 respectively. For product costing purposes Ple'egrea allocates joint costs using the relative sales value method. The amount of joint cost allocated to Nuts would be, to the nearest dollar:arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning