Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 3E

Differential analysis for a discontinued product

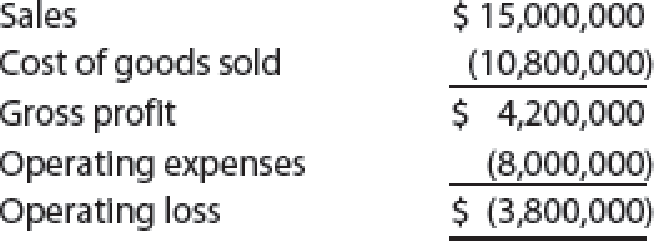

A condensed income statement by product line for Warrick Beverage Inc. indicated the following for Mango Cola for the past year:

It is estimated that 30% of the cost of goods sold represents fixed

- a. Prepare a differential analysis dated February 29 to determine whether Mango Cola should be continued (Alternative 1) or discontinued (Alternative 2).

- b. Should Mango Cola be retained? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A condensed income statement by product line for Warrick Reverage Inc.indicated the following for mango Cola for the past years

It is estimated that 30% of the cost of goods sold represents fixed factory overhead costs and that 25% of the opening expenses are fixed.because Mango Cola is only one of many products ,fixed costs will not be materially affected if the product is discontinued.

a. Prepare a differential analysis dated February 29 to determine whether Mango Cola should be continued (alternative 1) or discontinued (alternative 2)

b. Should Mango Cola be retained? Explain

Differential Analysis for a Discontinued Product

A condensed income statement by product line for

Warrick Beverage Inc. indicated the following for Mango

Cola for the past year:

Sales

Cost of goods sold

Gross profit

Operating expenses

Operating loss

It is estimated that 14% of the cost of goods sold

represents fixed factory overhead costs and that 18% of

the operating expenses are fixed. Because Mango Cola is

only one of many products, the fixed costs will not be

materially affected if the product is discontinued.

$236,700

(108,000)

$128,700

(144,000)

$(15,300)

a. Prepare a differential analysis dated February 29 to

determine whether Mango Cola should be continued

(Alternative 1) or discontinued (Alternative 2). If an

amount is zero, enter "0". If required, use a minus sign

to indicate a loss.

Differential Analysis

Continue (Alt. 1) or Discontinue (Alt. 2) Mango

Revenues

Costs:

Variable cost of goods sold

Variable operating expenses

Fixed costs

Profit (Loss)

Cola

February 29

Continue…

Differential analysis for a discontinued product

The condensed product-line income statement for Rhinebeck Company for the month of

October is as follows: (Refer the image )

Fixed costs are 20% of the cost of goods sold and 30% of the selling and administrative expenses. Rhinebeck Company assumes that fixed costs would not be materially affected if the Gloves line were discontinued.

a. Prepare a differential analysis dated October 31 to determine if Mufflers should be continued (Alternative 1) or discontinued (Alternative 2).b. Should the Mufflers line be retained? Explain.

Chapter 11 Solutions

Managerial Accounting

Ch. 11 - Explain the meaning of (A) differential revenue,...Ch. 11 - A company could sell a building for 250,000 or...Ch. 11 - A chemical company has a commodity-grade and...Ch. 11 - A company accepts incremental business at a...Ch. 11 - Prob. 5DQCh. 11 - Prob. 6DQCh. 11 - Prob. 7DQCh. 11 - Although the cost-plus approach to product pricing...Ch. 11 - How does the target cost method differ from...Ch. 11 - Prob. 10DQ

Ch. 11 - Lease or sell Plymouth Company owns equipment with...Ch. 11 - Prob. 2BECh. 11 - Make or buy A company manufactures various-sized...Ch. 11 - Replace equipment A machine with a book value of...Ch. 11 - Prob. 5BECh. 11 - Prob. 6BECh. 11 - Prob. 7BECh. 11 - Prob. 8BECh. 11 - Differential analysis for a lease or sell decision...Ch. 11 - Prob. 2ECh. 11 - Differential analysis for a discontinued product A...Ch. 11 - Differential analysis for a discontinued product...Ch. 11 - Prob. 5ECh. 11 - Prob. 6ECh. 11 - Make-or-buy decision Somerset Computer Company has...Ch. 11 - Prob. 8ECh. 11 - Machine replacement decision A company is...Ch. 11 - Differential analysis for machine replacement...Ch. 11 - Sell or process further Calgary Lumber Company...Ch. 11 - Sell or process further Dakota Coffee Company...Ch. 11 - Prob. 13ECh. 11 - Accepting business at a special price Box Elder...Ch. 11 - Prob. 15ECh. 11 - Prob. 16ECh. 11 - Product cost method of product costing Smart...Ch. 11 - Target costing Toyota Motor Corporation (TM) uses...Ch. 11 - Prob. 19ECh. 11 - Prob. 20ECh. 11 - Prob. 21ECh. 11 - Total cost method of product pricing Based on the...Ch. 11 - Variable cost method of product pricing Based on...Ch. 11 - Differential analysis involving opportunity costs...Ch. 11 - Differential analysis for machine replacement...Ch. 11 - Differential analysis for sales promotion proposal...Ch. 11 - Prob. 4PACh. 11 - Product pricing and profit analysis with...Ch. 11 - Product pricing using the cost-plus approach...Ch. 11 - Prob. 1PBCh. 11 - Differential analysis for machine replacement...Ch. 11 - Prob. 3PBCh. 11 - Prob. 4PBCh. 11 - Prob. 5PBCh. 11 - Prob. 6PBCh. 11 - Analyze Pacific Airways Pacific Airways provides...Ch. 11 - Service yield pricing and differential equations...Ch. 11 - Prob. 3MADCh. 11 - Prob. 4MADCh. 11 - Aaron McKinney is a cost accountant for Majik...Ch. 11 - Prob. 3TIFCh. 11 - Decision on accepting additional business A...Ch. 11 - Accepting service business at a special price If...Ch. 11 - Identifying product cost distortion Peachtree...Ch. 11 - Prob. 1CMACh. 11 - Prob. 2CMACh. 11 - Aril Industries is a multiproduct company that...Ch. 11 - Oakes Inc. manufactured 40,000 gallons of Mononate...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- When prices are falling (deflation), which costing method would produce the highest gross margin for the following? Choose first-in, first-out (FIFO); last-in, first-out (LIFO); or weighted average, assuming that B62 Company had the following transactions for the month. Calculate the gross margin for each of the following cost allocation methods, assuming B62 sold just one unit of these goods for $400. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forwardUsing the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forwardWest Island distributes a single product. The companys sales and expenses for the month of June are shown. Using the information presented, answer these questions: A. What is the break-even point in units sold and dollar sales? B. What is the total contribution margin at the break-even point? C. If West Island wants to earn a profit of $21,000, how many units would they have to sell? D. Prepare a contribution margin income statement that reflects sales necessary to achieve the target profit.arrow_forward

- Diff Analysis & Product Pricing:arrow_forwardDifferential Analysis for a Discontinued Product A condensed income statement by product line for Lavonia Beverage Inc. indicated the following for Vim Cola for the past year: Sales Cost of goods sold $233,400 (111,000) Gross profit Operating expenses Operating loss $122,400 (143,000) $(20,600) It is estimated that 14% of the cost of goods sold represents fixed factory overhead costs and that 18% of the operating expenses are fixed. Because Vim Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis dated November 2 to determine whether Vim Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to indicate a loss. Differential Analysis Continue (Alt. 1) or Discontinue (Alt. 2) Vim Cola Line Item Description November 2 Continue Vim Cola Discontinue Vim Cola Differential Effects Revenues Costs: Variable cost of…arrow_forwardDifferential Analysis for a Discontinued Product A condensed income statement by product line for Lavonia Beverage Inc. indicated the following for Vim Cola for the past year: Line Item Description Amount Sales $237,700 Cost of goods sold (110,000) Gross profit $127,700 Operating expenses (144,000) Operating loss $(16,300) It is estimated that 15% of the cost of goods sold represents fixed factory overhead costs and that 23% of the operating expenses are fixed. Because Vim Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. Question Content Area a. Prepare a differential analysis dated November 2 to determine whether Vim Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to indicate a loss. Differential AnalysisContinue (Alt. 1) or Discontinue (Alt. 2) Vim ColaNovember 2 Line Item Description ContinueVim…arrow_forward

- Differential Analysis Report for a Discontinued Product A condensed income statement by product line for Crown Beverage Inc. indicated the following for King Cola for the past year: Sales Cost of goods sold $235,900 (109,000) Gross profit $126,900 Operating expenses (144,000) Operating loss $(17,100) It is estimated that 15% of the cost of goods sold represents fixed factory overhead costs and that 18% of the operating expenses are fixed. Since King Cola is only one of many products, the fixed costs will not be significantly affected if the product is discontinued. < a. Prepare a differential analysis report for the proposed discontinuance of King Cola. Crown Beverage Inc. Proposal to Discontinue King Cola Differential Analysis Report Differential revenue from annual sales of King Cola: Revenue from sales Differential cost of annual sales of King Cola: Variable cost of goods sold Variable operating expenses ? 100 3_E begarrow_forwardDifferential Analysis for a Discontinued Product A condensed income statement by product line for Warrick Beverage Inc. indicated the following for Mango Cola for the past year: Sales $15,000,000 Cost of goods sold (10,800,000) Gross profit $4,200,000 Operating expenses (8,000,000) Operating loss $(3,800,000) It is estimated that 30% of the cost of goods sold represents fixed factory overhead costs and that 25% of the operating expenses are fixed. Because Mango Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis dated February 29 to determine whether Mango Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to indicate a loss. Differential Analysis Continue (Alt. 1) or Discontinue (Alt. 2) Mango Cola February 29 ContinueMango Cola(Alternative 1) DiscontinueMango…arrow_forwardDifferential analysis for a discontinued product A condensed income statement by product line for Lavonia Beverage Inc. indicated the following for Vim Cola for the past year: Sales $232,900 Cost of goods sold (109,000) Gross profit Operating expenses Operating loss $123,900 (144,000) $(20,100) It is estimated that 16% of the cost of goods sold represents fixed factory overhead costs and that 21% of the operating expenses are fixed. Because Vim Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis dated November 2 to determine whether Vim Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to indicate a loss. Differential Analysis Continue (Alt. 1) or Discontinue (Alt. 2) Vim Cola November 2 Continue Discontinue Line Item Description Vim Cola Vim Cola Differential Effects (Alternative 1) (Alternative 2)…arrow_forward

- Differential Analysis for a Discontinued Product A condensed income statement by product line for Lavonia Beverage Inc. indicated the following for Vim Cola for the past year: Sales $234,600 Cost of goods sold (111,000) Gross profit $123,600 (144,000) $(20,400) Operating expenses Operating loss It is estimated that 15% of the cost of goods sold represents fixed factory overhead costs and that 23% of the operating expenses are fixed. Because Vim Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis dated November 2 to determine whether Viem Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to indicate a loss. Differential Analysis Continue (Alt. 1) or Discontinue (Alt. 2) Vim Colo November 2 Line Item Description Revenues Costs: Variable cost of goods sold Variable operating expenses Fixed costs Profit…arrow_forwardDifferential Analysis for a Discontinued Product A condensed income statement by product line for Warrick Beverage Inc. indicated the following for Mango Cola for the past year: Sales $15,000,000 Cost of goods sold (10,800,000) Gross profit $4,200,000 Operating expenses (8,000,000) >) Operating loss $(3,800,000) It is estimated that 30% of the cost of goods sold represents fixed factory overhead costs and that 25% of the operating expenses are fixed. Because Mango Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis dated February 29 to determine whether Mango Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to indicate a loss. Differential Analysis Continue (Alt. 1) or Discontinue (Alt. 2) Mango Cola February 29 Continue Discontinue Differential Mango Cola Effects Mango Cola (Alternative 1) (Alternative…arrow_forwardDifferential Analysis for a Discontinued Product A condensed income statement by product line for Lavonia Beverage Inc indicated the following for Vim Cola for the past year: Sales $236,400 Cost of goods sold (110,000) Gross profit $126,400 Operating expenses (145,000) Operating loss $(18,500). It is estimated that 13% of the cost of goods sold represents fixed factory overhead costs and that 18% of the operating expenses are fixed. Because Vim Cola is only one of many products, the fixed costs will not be materially affected if the product is discontinued. a. Prepare a differential analysis dated November 2 to determine whether Vim Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter "0", if required, use a minus sign to indicate a loss. Differential Analysis Continue (Alt. 1) or Discontinue (Alt. 2) Vim Cola November 2 Line Item Description Revenues Costs: Variable cost of goods sold. Variable operating expenses Fixed costs Profit…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY