Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter C, Problem 23E

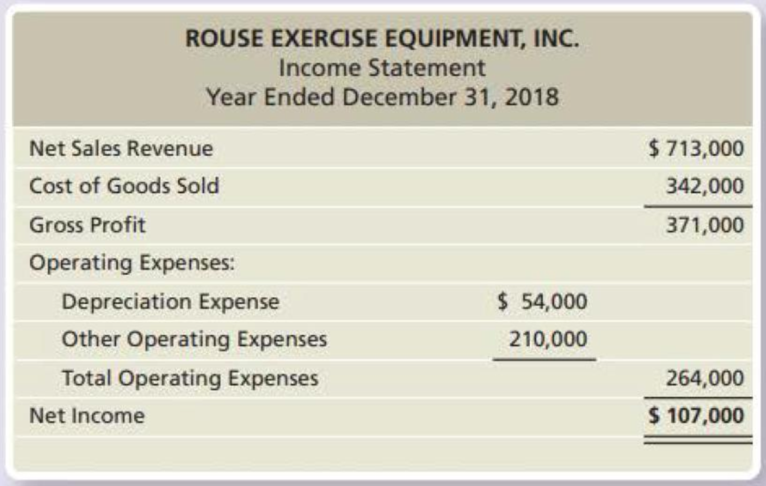

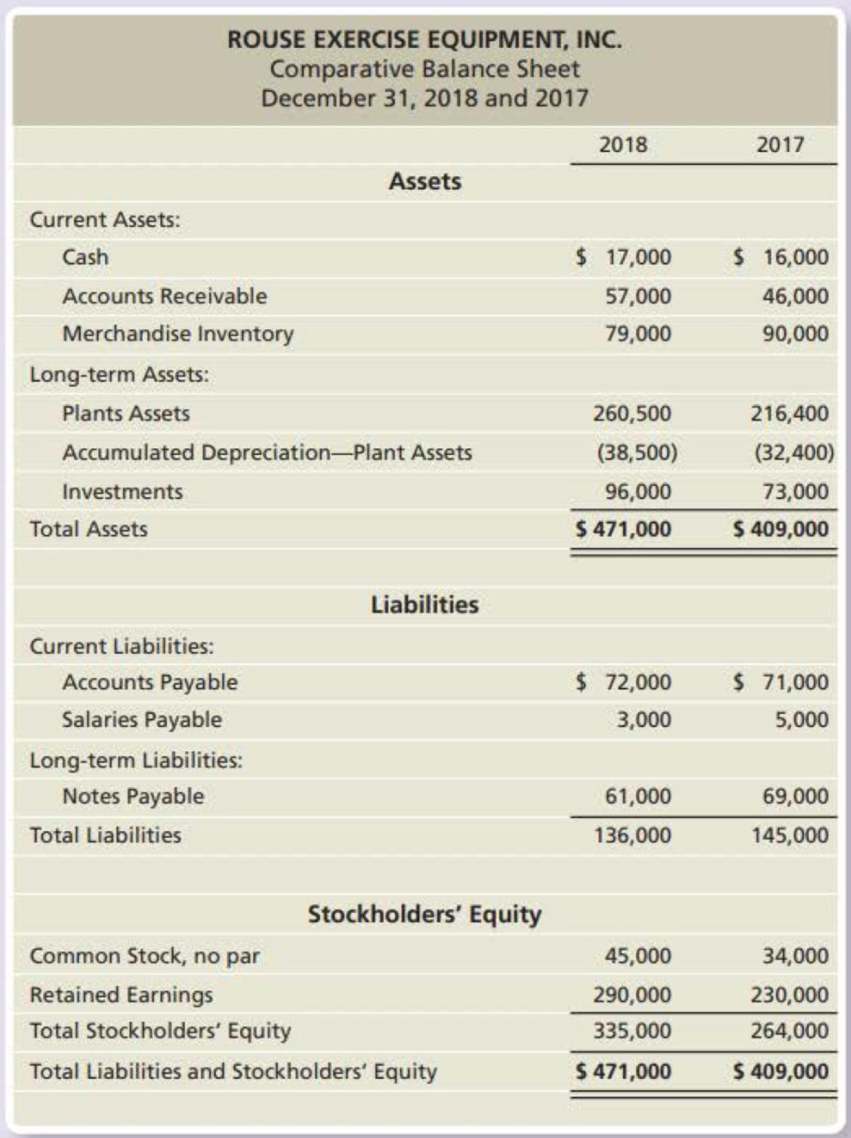

Rouse Exercise Equipment, Inc. reported the following financial statements for 2018:

Requirements

- 1. Compute the amount of Rouse Exercise’s acquisition of plant assets. Assume the acquisition was for cash. Rouse Exercise disposed of plant assets at book value. The cost and

accumulated depreciation of the disposed asset was $47,900. No cash was received upon disposal. - 2. Compute new borrowing or payment of long-term notes payable, with Rouse Exercise having only one long-term notes payable transaction during the year.

- 3. Compute the issuance of common stock with Rouse Exercise having only one common stock transaction during the year.

- 4. Compute the payment of cash dividends.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Stock market that day? General accounting

Financial accounting

Stock market that day?

Chapter C Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. C - Identify each item as operating (O), investing...Ch. C - Identify each item as operating (O), investing...Ch. C - Identify each item as operating (O), investing...Ch. C - Identify each item as operating (O), investing...Ch. C - Identify each item as operating (O), investing...Ch. C - Prob. 6TICh. C - Prob. 7TICh. C - Prob. 8TICh. C - Muench Inc.s accountant has partially completed...Ch. C - Prob. 1QC

Ch. C - Prob. 2QCCh. C - Prob. 3QCCh. C - Prob. 4QCCh. C - Prob. 5QCCh. C - Prob. 6QCCh. C - Prob. 7QCCh. C - Prob. 8QCCh. C - Prob. 9QCCh. C - Prob. 10QCCh. C - Prob. 1RQCh. C - Prob. 2RQCh. C - Prob. 3RQCh. C - Prob. 4RQCh. C - Prob. 5RQCh. C - Prob. 6RQCh. C - Prob. 7RQCh. C - If a company experienced a loss on disposal of...Ch. C - Prob. 9RQCh. C - Prob. 10RQCh. C - Prob. 11RQCh. C - Prob. 12RQCh. C - Prob. 13RQCh. C - Prob. 14RQCh. C - How does the direct method differ from the...Ch. C - Prob. 16RQCh. C - Prob. 1SECh. C - Prob. 2SECh. C - Prob. 3SECh. C - DVR Equipment, Inc. reported the following data...Ch. C - Prob. 5SECh. C - Prob. 6SECh. C - Prob. 7SECh. C - Prob. 8SECh. C - Prob. 9SECh. C - Julie Lopez Company expects the following for...Ch. C - Prob. 11SECh. C - Prob. 12SECh. C - Prob. 13SECh. C - Prob. 14SECh. C - Prob. 15SECh. C - Prob. 16ECh. C - Prob. 17ECh. C - Prob. 18ECh. C - Prob. 19ECh. C - Prob. 20ECh. C - The income statement of Boost Plus, Inc. follows:...Ch. C - Prob. 22ECh. C - Rouse Exercise Equipment, Inc. reported the...Ch. C - Use the Rouse Exercise Equipment data in Exercise...Ch. C - Prob. 25ECh. C - Prob. 26ECh. C - Prob. 27ECh. C - Prob. 28ECh. C - Prob. 29ECh. C - Prob. 30ECh. C - Prob. 31ECh. C - American Rare Coins (ARC) was formed on January 1,...Ch. C - Prob. 33APCh. C - Prob. 34APCh. C - Prob. 35APCh. C - Boundary Rare Coins (BRC) was formed on January 1,...Ch. C - Use the Rolling Hills, Inc. data from Problem...Ch. C - Prob. 38APCh. C - Classic Rare Coins (CRC) was formed on January 1,...Ch. C - Accountants for Benson, Inc. have assembled the...Ch. C - Prob. 41BPCh. C - Prob. 42BPCh. C - Prob. 43BPCh. C - Use the Sweet Valley data from Problem P14-41B....Ch. C - Prob. 45BPCh. C - Prob. 47PCh. C - Before you begin this assignment, review the Tying...Ch. C - Prob. 1DCCh. C - Prob. 1EICh. C - Details about a companys cash flows appear in a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Chapter 19 Accounting for Income Taxes Part 1; Author: Vicki Stewart;https://www.youtube.com/watch?v=FMjwcdZhLoE;License: Standard Youtube License