Financial Accounting

3rd Edition

ISBN: 9780133791129

Author: Jane L. Reimers

Publisher: Pearson Higher Ed

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

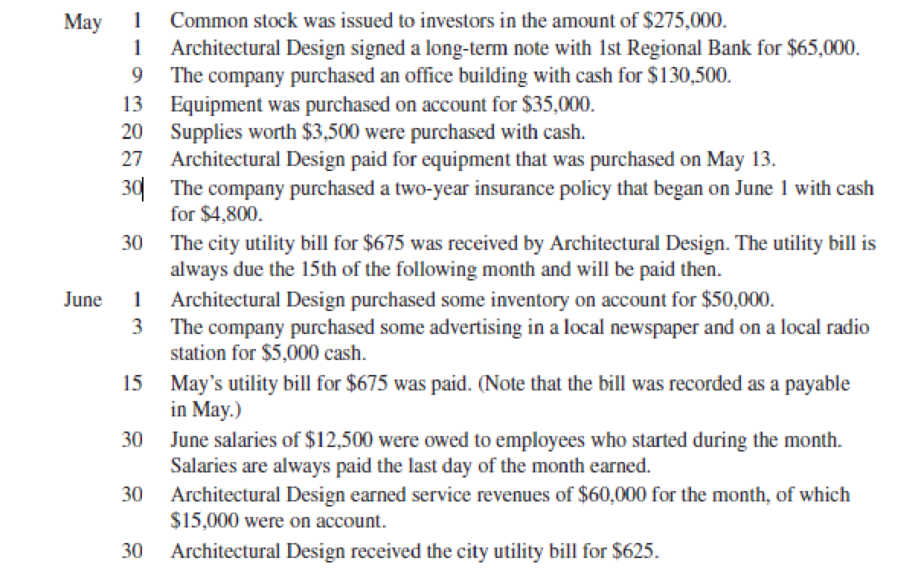

Chapter B, Problem 36PA

Record journal entries, post to T-accounts, and prepare an unadjusted

Requirements

- 1. Give the

journal entry for each transaction. - 2.

Post each transaction to T-accounts. - 3. Prepare an unadjusted trial balance.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Required:

Part 1. Prepare a journal entry to record each transaction. You must provide a short explanation for each transaction.

Part 2. Setup appropriate T-accounts. All accounts begin with 0 balances.

Part 3. Record in the T-accounts the effects of each transaction for Sydney Stables in April, referencing each transaction in the accounts with the transaction letter. Show the ending balances in the T-accounts.

Part 4. Prepare a trial balance.

Part 5. Prepare a statement of earnings, a statement of shareholders’ equity and a statement of financial position for the month ended April 30, 2020.

The following transactions occurred for Luminary Engineering:

View the transactions. View the journal entries.

Read the requirements.

Requirements 1 and 2. Post the journal entries (including dates) to the T-accounts. Compute the July 31 balance for each account. Use a "Bal." posting reference on the proper side of each account to show the ending balances of the

accounts. (For accounts with a $0 balance, make sure to enter "0" in the appropriate input field on the normal side of the account.)

Accounts Payable

Cash

Accounts Receivable

Supplies

Equipment

Notes Payable

Common Stock

Dividends

Service Revenue

Utilities Expense

Transactions

Jul. 2

Jul. 4

Jul. 5

Jul. 10

Jul. 12

Jul. 19

Jul. 21

Jul. 27

Requirements

Received $9,000 contribution from Bob Luminary in exchange for common stock.

Paid utilities expense of $420.

Purchased equipment on account, $2,400.

Performed services for a client on account, $2,900.

Borrowed $7,600 cash, signing a notes payable.

Paid cash dividends of $500 to…

The following selected transactions were completed by Interlocking Devices Co., a supplier of zippers for clothing:

20Y7

Dec. 7.

Dec. 31.

Dec. 31.

20Y8

Feb. 5.

Received payment of note and interest from Unitarian Clothing & Bags Co.

Journalize the entries to record the transactions. Assume 360 days in a year. If an amount box does not require an entry, leave it blank. Assume

February has 28 days in 2018

If required, round the interest to the nearest cent.

20Y7, Dec. 7

Dec. 31

Received from Unitarian Clothing and Bags Co., on account, a $84,000, 60-day, 7% note dated December 7.

Recorded an adjusting entry for accrued interest on the note of December 7.

Recorded the closing entry for interest revenue.

Dec. 31

20Y8, Feb. 5

Chapter B Solutions

Financial Accounting

Ch. B - Indicate whether each of the following accounts...Ch. B - Prob. 2YTCh. B - Prob. 1QCh. B - Prob. 2QCh. B - Prob. 3QCh. B - Prob. 4QCh. B - Prob. 5QCh. B - Prob. 6QCh. B - Prob. 7QCh. B - Prob. 8Q

Ch. B - Prob. 9QCh. B - Prob. 1MCQCh. B - Prob. 2MCQCh. B - Prob. 3MCQCh. B - Prob. 4MCQCh. B - Prob. 5MCQCh. B - Prob. 6MCQCh. B - Prob. 7MCQCh. B - Prob. 8MCQCh. B - Prob. 9MCQCh. B - Prob. 10MCQCh. B - Prob. 1SEACh. B - Prob. 2SEACh. B - Prob. 3SEACh. B - Prob. 4SEACh. B - Prob. 5SEACh. B - Prob. 6SEACh. B - Prob. 7SEACh. B - Prob. 8SEACh. B - Prob. 9SEACh. B - Prob. 10SEBCh. B - Prob. 11SEBCh. B - Prob. 12SEBCh. B - Prob. 13SEBCh. B - Prob. 14SEBCh. B - Prob. 15SEBCh. B - Prob. 16SEBCh. B - Prob. 17SEBCh. B - Prob. 18SEBCh. B - Prob. 19EACh. B - Prob. 20EACh. B - Record transactions to T-accounts and prepare an...Ch. B - Prob. 22EACh. B - Prob. 23EACh. B - Record closing entries and compute net income. (LO...Ch. B - Record journal entries, record adjusting entries,...Ch. B - Record journal entries, post to T-accounts, and...Ch. B - Prob. 27EBCh. B - Prob. 28EBCh. B - Prob. 29EBCh. B - Prob. 30EBCh. B - Prob. 31EBCh. B - Prob. 32EBCh. B - Prob. 33EBCh. B - Prob. 34EBCh. B - Prepare a trial balance and financial statements....Ch. B - Record journal entries, post to T-accounts, and...Ch. B - Prepare closing entries and financial statements....Ch. B - Record adjusting journal entries, post to...Ch. B - Prob. 39PACh. B - Prob. 40PACh. B - Prob. 41PACh. B - Prob. 42PACh. B - Prob. 43PBCh. B - Prob. 44PBCh. B - Prob. 45PBCh. B - Prob. 46PBCh. B - Prob. 47PBCh. B - Prob. 48PBCh. B - Prob. 49PBCh. B - Prob. 50PBCh. B - Prob. 51FSACh. B - Prob. 52CTP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sage Learning Centers was established on July 20, 2016, to provide educational services. The services provided during the remainder of the month are as follows: Instructions 1. Journalize the transactions for July, using a single-column revenue journal and a two-column general journal. Post to the following customer accounts in the accounts receivable ledger, and insert the balance immediately after recording each entry: D. Chase; J. Dunlop; F. Mintz; T. Quinn; K. Tisdale. 2. Post the revenue journal and the general journal to the following accounts in the general ledger, inserting the account balances only after the last postings: 3. a. What is the sum of the balances of the customer accounts in the subsidiary ledger at July 31? b. What is the balance of the accounts receivable controlling account at July 31? 4. Assume Sage Learning Centers began using a computerized accounting system to record the sales transactions on August 1. What are some of the benefits of the computerized system over the manual system?arrow_forwardComplex Company prepares monthly financial statements. Below are listed some selected accounts and their balances in the September 30 trial balance before any adjustments have been made for the month of September. Instruction: Using the information given, prepare the adjusting entries that should be made by Complex Company on September 30. Complex COMPANY Trial Balance (Selected Accounts) September 30, 2010 Debit Credit Office Supplies....................................................................................$ 2,700 Prepaid Insurance..............................................................................$4,200 Office Equipment............................................................................. $16,200 Accumulated Depreciation—Office…arrow_forwardKatie Long owns and operates KL Company. Transactions for the month of March have been posted to the T accounts. An intern has prepared a trial balance from the T accounts, but there seem to be some errors. Required: 1. In the Transactions panel, descriptions of the transactions for the month of March are provided. Each of the transactions in the Transactions panel has been posted to the T accounts. Referring to the T accounts, select the date on which each transaction occurred, enter the amount of the transaction, and select the account to debit and credit. 2. The trial balance prepared by the intern can be found in the Trial Balance: Unequal Totals panel. The intern is puzzled by the unequal totals. Prepare a corrected trial balance on the Trial Balance: Correct panel. 3. Compare the trial balance prepared by the intern (Trial Balance: Unequal Totals) to the trial balance that you prepared (Trial Balance: Correct). Use the table provided in the Errors in Trial Balance…arrow_forward

- Sage Learning Centers was established on July 20 to provide educational services. The services provided during the remainder of the month are as follows: Instructions 1. Journalize the transactions for July, using a single-column revenue journal and a two-column general journal. Post to the following customer accounts in the accounts receivable ledger and insert the balance immediately after recording each entry: D. Chase; J. Dunlop; F. Mintz; T. Quinn; K. Tisdale. 2. Post the revenue journal and the general journal to the following accounts in the general ledger, inserting the account balances only after the last postings: 3. a. What is the sum of the balances of the customer accounts in the subsidiary ledger at July 31? b. What is the balance of the accounts receivable controlling account at July 31? 4. Assume Sage Learning Centers began using a computerized accounting system to record the sales transactions on August 1. What are some of the benefits of the computerized system over the manual system?arrow_forwardPrepare journal entries for each transaction listed. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) a. At the end of June, bad debt expense is estimated to be $14,600. b. In July, customer balances are written off in the amount of $8,300.arrow_forwardAdditional Activities Directions: Do the task listed bélow using the transacions of Matapang Company for Deccmber 2019. Writc your answers on a separate sheet of paper. 1. Prepare the journal entries. 2. Post each transaction to its ledger account. 3. Prepare the trial balance. 4. Use the provided account numbers. Ralph Matapang cstablishcd Happy Repair Busincss. The following are the transactions for the montb of Decembocr 2019. Dec. He invested P150,000 in the firm. He paid P8,000 for monthly rent. He bought supplies on account amounting to P7,200. He purchascd office equipment amounting to P75,000. paid P37,000 and the balance on account. 2. 2. 3. He paid accounts payable for supplies purchased worth P7,200. He paid P6,000 for the salary of an employec. He received P20,000 for services rendered. He billed clients P48,000 for services on account. 8. 14. 20. 28. 31. Matapang withdrew P12,000 for his personal use. 302 Matapang, Drawings 401 Service Revenue 101 Cash 102 Accounts…arrow_forward

- Assuming a year-end in March 31,it is now April 4.A staff member asks you to process an unpaid invoice with details as follows: The invoice is for bus transportation in the amount of P800 and is dated April. The invoice indicates the charges relate to transportation on March 20.A transfer is processed to pay the invoice on April 7. Hiw would you proceed? You may describe how you would record the transaction in the general ledger, including a description of journal entries and the dates each item will be recordedarrow_forward1. Using EXCEL => Prepare the appropriate journal entry for each of the transactions for CampIn Inc. during the first three months of 2021 (see transactions on page 2). 2. Using EXCEL => Post the journal entries to the appropriate “T-Accounts.”arrow_forward1. When should you select settings and customizations for your company file? A. At the time you create the company file B. As work related to the settings comes up C. Before the end of the business's first fiscal year D. In the second quarter 2. What is the Chart of Accounts? A. The list of accounts for each transaction in the accounting system or general ledger B. The menu of products and services that the company offers its customers C. The full list of account numbers associated with the company's customers and vendors D. The balance of each account as of the start date of the business 3. Which of these would be an appropriate start date for a business? A. December 31 of the current year B. The first day of a period, month, quarter, or year C. The day of your first expense D. The day of your first sale 4. What is an historical transaction? A. A transaction that occurred before the start date of the company B. A transaction that appears in the company file by default in QuickBooks…arrow_forward

- Requirements: Record the transactions stated above in the general journal. Post the transactions to the general ledger and balance off each account Extract a trial balance on August 31st.arrow_forwardJohn Doe founded Premier Construction. Operations started on October 1, 2021. John’s son, a teenager, kept the books for the first two months. John decides that it is time to hire a bookkeeper with formal training. He asks you to record the activity for December and to complete the accounting cycle for the quarter ended December 31, 2021. The trial balance as of 11/30/2021 and the detail for the Accounts Receivable account balance is on page 2.The December 2021 events are on page 3. Additional Information: • Ellie Smith is the only employee. She is paid on the 1st of month for the pay period ending on the last day of the prior month and on the 16th of the month for the pay period covering the first fifteen days of the current month. Required1. Enter the balances as of 11/30/2021 in the general ledger. 2. Prepare journal entries to record each of the December transactions for Premier Construction. If an event is not a transaction, write the date and “no entry needed” on the journal…arrow_forwardQuantum Solutions Company, a computer consulting firm, has decided to write off the $33,550 balance of an account owed by a customer, Alliance Inc. Required: On March 1, journalize the entry to record the write-off, assuming that (a) the direct write-off method is used and (b) the allowance method is used. Refer to the Chart of Accounts for exact wording of account titles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning - Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY