Managerial Accounting: Tools for Business Decision Making

7th Edition

ISBN: 9781118334331

Author: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Publisher: WILEY

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter A, Problem A.2BE

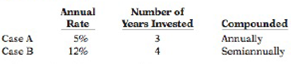

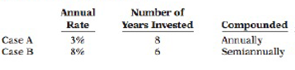

Kor each of the following cases, indicate (a) what interest rate columns and (b) what number of periods you would refer to in looking up the future value factor.

(1) In Table 1 (future value of 1):

(2) In Table 2 (future value of an annuity of 1):

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

For each of the following situations, Identify (1) the case as either (a) a present or a future value and (b) a single amount or an annulty.

(2) the table you would use in your computations (but do not solve the problem), and (3) the Interest rate and time periods you would

use. (PV of $1, FV of $1, PVA of $1, and FVA of $1)

Note: Use appropriate factor(s) from the tables provided. Round "Table Factors" to 4 decimal places.

a. You need to accumulate $10,100 for a trip you wish to take in four years. You are able to earn 10% compounded semiannually on

your savings. You plan to make only one deposit and let the money accumulate for four years. How would you determine the amount

of the one-time deposit?

b. Assume the same facts as in part (a) except that you will make semiannual deposits to your savings account. What is the required

amount of each semiannual deposit?

1. You want to retire after working 40 years with savings in excess of $1,020,000. You expect to save $4,080 a year for 40…

For each of the following situations, identify (1) the case as either (a) a present or a future value and (b) a single amount or an annuity, (2) the table you would use in your computations (but do not solve the problem), and (3) the interest rate and time periods you would use. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factors" to 4 decimal places.)a. You need to accumulate $20,000 for a trip you wish to take in five years. You are able to earn 10% compounded semiannually on your savings. You plan to make only one deposit and let the money accumulate for five years. How would you determine the amount of the one-time deposit?b. Assume the same facts as in part (a) except that you will make semiannual deposits to your savings account. What is the required amount of each semiannual deposit?1. You want to retire after working 40 years with savings in excess of $1,000,000. You expect to save $4,000 a year for 40 years…

Find the following:

a. interest rate per conversion period

b. future amount

c. compound interest

d. conversion period per year

e. total number of conversion period

Chapter A Solutions

Managerial Accounting: Tools for Business Decision Making

Ch. A - Prob. A.1BECh. A - Kor each of the following cases, indicate (a) what...Ch. A - Liam Company signed a lease for an office building...Ch. A - Prob. A.4BECh. A - Prob. A.5BECh. A - Prob. A.6BECh. A - For each of the following cases, indicate (a) what...Ch. A - Prob. A.8BECh. A - Prob. A.9BECh. A - Prob. A.10BE

Ch. A - Prob. A.11BECh. A - Prob. A.12BECh. A - Dempsey Railroad Co. is about to issue 400,000 of...Ch. A - Prob. A.14BECh. A - Neymar Taco Company receives a 75,000, 6-year note...Ch. A - Prob. A.16BECh. A - Frazier Company issues a 10%, 5-year mortgage note...Ch. A - Prob. A.18BECh. A - Prob. A.19BECh. A - Prob. A.20BECh. A - Prob. A.21BECh. A - Prob. A.22BECh. A - Prob. A.23BECh. A - Prob. A.24BECh. A - Prob. A.25BECh. A - As the purchaser of a new house, Carrie Underwood...Ch. A - Using a financial calculator, solve for the...Ch. A - Using a financial calculator, provide a solution...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate the present value of the following annulties, assuming each annuity payment is made at the end of each compounding period. (FV of $1, PV of $1, FVA of $1, and PVA of S1) (Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places.) \table[[, \table[[Annuity], [Payment]], \table [[ Annual], [Rate]], \table[[Interest], [Compounded]], \table [[Period], [Invested]], \table [[Present Value of], [ Annuity]]], [1., $5,000, 7.0%, Semiannually,3 years,], [2., 10, 000, 8.0%, Quarterly,2 years, ], [3., 4,000, 10.0 %, Annually,5 years,]]arrow_forwardThe value of the interest rate depends on the --------- of the time period. Select one: a. length b. size c. minimum d. maximumarrow_forwardInterest rates or discount rates. Fill in the interest rates for the following table using one of the three methods below: a. Use the interest rate formula, r=FVPV1n−1. b. Use the TVM keys from a calculator. c. Use the TVM function in a spreadsheet. Present Value Future Value Number of Periods Interest Rate $ 493.61 $ 1,902.61 20 ? $17,077.77 $228,416.84 32 ? $34,251.51 $ 63,755.61 24 ? $26,813.61 $212,279.67 10 ? Present Value Future Value Number of Periods Interest Rate $ 493.61 $ 1,902.61 20 nothing% (Round to two decimal places.) $17,077.77 $228,416.84 32 nothing% (Round to two decimal places.) $34,251.51 $ 63,755.61 24 nothing% (Round to two decimal places.) $26,813.61 $212,279.67 10 nothing% (Round to two decimal places.)arrow_forward

- When using the interest tables, the needed interest rate is determined from the intersection between the _____________. a interest rate and number of periods b interest rate and factor type c number of periods of factor type d none of thesearrow_forwardTime value of money calculations can be solved using a mathematical equation, a financial calculator, or a spreadsheet. Which of the following equations can be used to solve for the future value of an annuity due? PMT x {[(1 + r)ª − 1]/r} x (1 + r) O FV/(1 + r)¹ PMT x {[(1 + r)" - 1]/r} O PMT x ({1 - [1/(1 + r)"]}/r) x (1 + r)arrow_forward2 Given a set of present value tables, an annual interest rate, the dollar amount of equal payments made, and the number of semiannual payments, what other information is necessary to calculate the present value of the series of payments? A. The future value of the annuity. B. The timing of the payments (whether they are at the beginning or end of the period). C. The rate of inflation. D. No other information is required.arrow_forward

- Increasing the number of periods will increase all of the following except Select one: a. the present value of $1. b. the future value of an annuity. c. the future value of $1.arrow_forwardFor part d, told to manipulate the equation: ΔM(t)= rM(t)Δt M(t) represents the money value at time t E is the final value of the note r is the interest rate Δt is expiration minus today's datearrow_forwardCompute the interest rate if future value (FV) = $8011, present value (FV) = $2685, and number of years (t) = 6.arrow_forward

- Find the interest rate implied by the following combinations of present and future values. present values $330, Years 10, future value 591, interest rate? present values $148, Years 3, future value 192, interest rate? present values $230, Years 6, future value 230, interest rate?arrow_forwardIncreasing the number of periods will increase all of the following except: Select one: A. The present value of an annuity B. The present value of $1 C. The future value of $1 D. The future value of an annuityarrow_forwardUse factors and a spreadsheet to determine the interest rate per period from the following equation: 0 = -26,000 + 8,000(P/A,i∗,5) + 8,000(P/F,i∗,8) What is the interest rate per period? %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Internal Rate of Return (IRR); Author: The Finance Storyteller;https://www.youtube.com/watch?v=aS8XHZ6NM3U;License: Standard Youtube License