a)

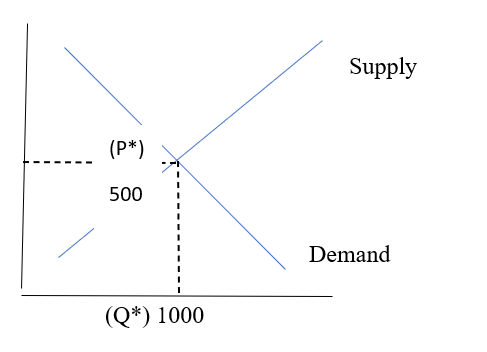

Representation of

a)

Explanation of Solution

Equilibrium price ($500) and equilibrium quantity (1000) would be represented on the graph as follows:

Introduction: The quantity that balances the supply and demand is an equilibrium quantity and the price, where demand and supply are equal is called the equilibrium price.

b)

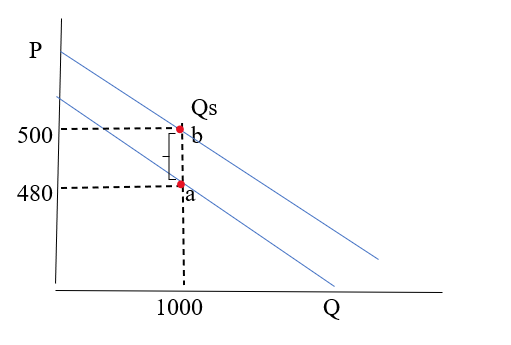

New equilibrium price and equilibrium quantity after tax

b)

Answer to Problem 1FRQ

The new equilibrium price would be $480 and the equilibrium quantity would be $1000

Explanation of Solution

With the effects of the (tax $20) on the graph, the new equilibrium price and equilibrium quantity would be present as follows:

Here, the new equilibrium price would be

And, new equilibrium quantity would be the same which is $1000

Introduction: The quantity that balances the supply and demand is an equilibrium quantity and the price, where demand and supply are equal is called the equilibrium price.

c)

The amount of tax revenue.

c)

Answer to Problem 1FRQ

The amount of tax revenue would be $20,000.

Explanation of Solution

The amount of tax revenue would be:

Introduction: Tax revenue is the earnings that are incurred by imposing a tax on goods and services.

d)

d)

Answer to Problem 1FRQ

The deadweight loss would be $0.

Explanation of Solution

The amount of deadweight loss would be:

Introduction: When supply and demand are out of equilibrium due to market inefficiency, this is a situation of deadweight loss.

e)

The bearer of the burden of the tax.

e)

Answer to Problem 1FRQ

Producers will bear the burden of the tax.

Explanation of Solution

Here, the

Introduction: The burden of tax lies on a person who is liable to pay taxes in a particular time period for buying or selling something or under a proportion of his/her total income.

Chapter 9R Solutions

Krugman's Economics For The Ap® Course

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education