Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

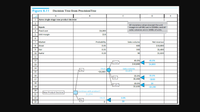

Explain in some detail how the PrecisionTree calculations in Figure 6.11 for the Acme problem are exactly the same as those for the hand-drawn decision tree in Figure 6.6. In other words, explain exactly how PrecisionTree gets the monetary values in the colored cells in Figure 6.11.

If your answer is negative number, enter "minus" sign.

| Market | EMV | |

| Great | ( $18 × - $ ) = $ | |

| Fair | ( $18 × - $ ) = $ | |

| Awful | ( $18 × - $ ) = $ | |

| Total | 0.45 × __ $ + 0.35 × ___$ + 0.20 × ___ $ = ___ $ |

Transcribed Image Text:Great

600(18) – 6000 = 4800

Figure 6.6

Equivalent Decision

0.45

Tree

1074

Fair

0.35

300(18) – 6000 = -600

Awful

0.20

Market product

90(18) – 6000 =-4380

-6000

1074

Abandon product

Transcribed Image Text:Figure 6.11

Decision Tree from PrecisionTree

A

B

1

Acme single-stage new product decision

2

All monetary values (except the unit

margin in cell B5) are in $1000s, and all

sa les volumes are in 1000s of units.

3 Inputs

4 Fixed cost

5 Unit margin

$6,000

$18

6

7 Market

8 Great

Probability

Sales volume

Net revenue

600

$10,800

$5,400

0.45

9 Fair

10 Awful

0.35

300

0.20

90

$1,620

11

12

45.0%

45.0%

Great

13

$10,800

$4,800

14

TRUE

Sales volume

$1,074

Yes

15

-$6,000

16

35.0%

35.0%

Fair

17

$5,400

-$600

18

20.0%

Awful

19

$1,620

-$4,380

20

Continue with product?

New Product Decision

21

$1,074

22

FALSE

0.0%

No

23

$0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- Please answer quickly and coarrow_forwardEight years ago, Burt Brownlee purchased a government bond that pays 3.60 percent interest. The face value of the bond was $1,000. What is the dollar amount of annual interest that Burt received from his bond investment each year? Assuming that comparable bonds are now paying 2.40 percent, will Burt's bond increase or decrease in value? Why did the bond increase or decrease in value?arrow_forwardIf money can be invested at 5% compounded annually, A.Accumulate $1,000 for 15 years. B. Discount the result of problem A for 10 years. C. Accumulate 1,000 for 5 years. Compare the results of B and C.arrow_forward

- A loan of 200,000 is to be repaid with level monthly payments based on a 30 -year amort zation schedule. At the end of 7 years, The loan will be paid off with a balloon payment. The annual effective interest rate is 7%. Calculate the amount of the balloon payment. ◻ 181,677 181,950 182,979 183,593 183,625arrow_forwardSuppose the amount of steel was decreased by D units.What is the impact on the optimum objective value?How large can the increase in steel availability be sothat the shadow price remains as 228 4/7 (1,600/7)?Suppose that steel becomes available at $545 perthousand pounds. Should you purchase the steel? Suppose that you could purchase a thousand pounds ofsteel for $205. Should you purchase the steel?arrow_forward5. If money can be invested at 5% compounded annually, A. Accumulate P1,000 for 15 years. B. Discount the result of problem A for 10 years. C. Accumulate P1,000 for 5 years. Compare the results of B and C.arrow_forward

- Please answer along with the excel formulas - 1. Sue now has $125. How much would she have after 8 years if she leaves it invested at 8.5% with annual compounding? $205.83 $216.67 $228.07 $240.08 $252.08 2. Suppose you have $1,500 and plan to purchase a 5-year certificate of deposit (CD) that pays 3.5% interest, compounded annually. How much will you have when the CD matures? $1,781.53 $1,870.61 $1,964.14 $2,062.34 $2,165.46 3. Last year Rocco Corporation's sales were $225 million. If sales grow at 6% per year, how large (in millions) will they be 5 years later? $271.74 $286.05 $301.10 $316.16 $331.96arrow_forwardWhich of the following statements is correct for the Black-Scholes model? A) The price of an American call written on a stock is: c = SN(d1)-Ke-rTN(d2) B) The stock price at a future point in time follows a log-normal distribution. C) The continuously compounded return on the stock follows a log-normal distribution. D) Black-Scholes prices may allow for arbitrage opportunities. Please explain and justify your choice.arrow_forwardFind the present values of these ordinary annuities. Discounting occurs once a year. Do not round intermediate calculations. Round your answers to the nearest cent. $400 per year for 10 years at 4%. $ $200 per year for 5 years at 2%. $ $300 per year for 6 years at 0%. $ Rework previous parts assuming they are annuities due. Present value of $400 per year for 10 years at 4%: $ Present value of $200 per year for 5 years at 2%: $ Present value of $300 per year for 6 years at 0%: $arrow_forward

- The Free Cash Flow model has the following advantage over the Dividend Growth model: In the case of variable growth, it does not require the calculation of any horizon value. It can be applied even if growth rates are unknown. It can be applied to companies with variable growth in the initial years that eventually settle down to a fixed rate of growth for the long term. It can be applied to divisions of companies. O It does not require any forecasting.arrow_forwardWhat is the relative tax advantage of corporate debt if the corporate tax rate is Tc=0.21 , the personal tax rate on interest is TpD=0.37 , but all equity income is received as capital gains and escapes tax entirely ( TpE=0 )? How does the relative tax advantage change if the company decides to pay out all equity income as cash dividends that are taxed at 20%? Note: Do not round intermediate calculations. Round your answers to 4 decimal places.arrow_forwardSuppose the equilibrium price for good quality used cars is $20,000. And the equilibrium price for poor quality used cars is $10,000. Assume a potential used car buyer has imperfect information as to the condition of any given used car. Assume this potential buyer believes the probability a given used car is good quality is .60 and the probability a given used car is low quality is .40. Assume the seller has perfect information on all cars in inventory. If the seller sells the buyer a good quality car, what is the net-benefit to the seller? a. A net gain of $4,000. b. A net gain of $20,000. c. A net loss of $4,000. d. A net loss of $10,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.