Subpart (a):

The impact of technological advancement on TV production.

Subpart (a):

Explanation of Solution

When the technological advancement in production reduces the world

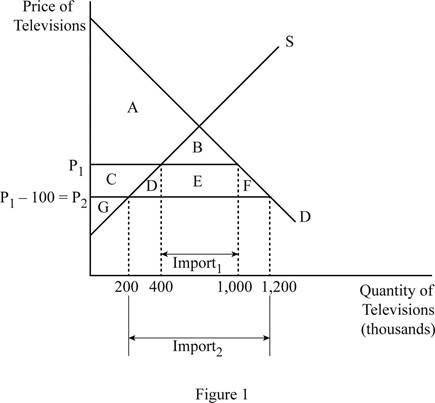

The world price was initially P1, where the consumer surplus was the area of A+B, producer surplus was the area of C+G and the total surplus was the area of A+B+C+G. The quantity of televisions imported is denoted by the Import1 on the graph. When the world price falls to P2 (P1 - 100), the consumer surplus increases to the area of A+B+C+D+E+F, which means that the consumer surplus increases by the area of C+D+E+F. The producer surplus becomes the area of G only which means that the producer surplus declined by the area of C. Thus, the total surplus becomes the area of A+B+C+D+E+F+G which means that the total surplus in the economy increased by the area of D+E+F. As a result of the lower price, the domestic supply falls and the demand increases; this means that the imports increase to Import2, as shown on the graph. The changes can be tabulated as follows:

| P1 | P2 | CHANGE | |

| Consumer Surplus | A + B | A + B + C + D + E + F | C + D + E + F |

| Producer Surplus | C + G | G | –C |

| Total Surplus | A + B + C + G | A + B + C + D + E + F + G | D + E + F |

Concept introduction:

International trade: It is the trade relation between the countries.

Export: It is the process of selling domestic goods in the international market. Thus, the goods produced in the domestic firms will be sold to other foreign countries. So, it is the outflow of domestic goods and services to the foreign economy.

Import: It is the process of purchasing the foreign-made goods and services by the domestic country. Thus, it is the inflow of foreign goods and services to the domestic economy.

Subpart (b):

The impact of technological advancement on TV production.

Subpart (b):

Explanation of Solution

The area of C can be calculated as follows:

Area of C=[(Quantity1×P1−P2)+(12×(Quantity2−Quantity1)×P1−P2)]=[(200,000×(P1−(P1−100)))+(12×(400,000−200,000)×100)]=20,000,000+10,000,000=30,000,000

Area of C is $30 million.

The area of D can be calculated as follows:

Area of D=12×(Quantity2−Quantity1)×P1−P2=12×(4,000,000−200,000)×(P1−(P1−100))=10,000,000

Area of D is $10 million.

The area of E can be calculated as follows:

Area of E=(Quantity3−Quantity2)×P1−P2=(1,000,000−400,000)(P1−(P1−100))=600,000×100=60,000,000

Area of E is $60 million.

The area of F can be calculated as follows:

Area of F=(Quantity4−Quantity3)×P1−P2=12×(1,200,000−1,000,000)×(P1−(P1−100))=12×200,000×100=10,000,000

Area of F is $10 million.

The change in the consumer surplus is by the area of C+D+E+F. Thus, the value of change in consumer surplus can be calculated as follows:

Change in consumer surplus=Area C+Area D+Area E+Area F=30,000,000+10,000,000+60,000,000+10,000,000=110,000,000

Thus, the value of change in consumer surplus is by $110 million.

The change in the producer surplus is by the area of - C. Thus, the value of change in producer surplus is by $30 million.

The change in the total surplus is by the area of D+E+F. Thus, the value of change in total surplus can be calculated as follows:

Change in total surplus=Area D+Area E+Area F=10,000,000+60,000,000+10,000,000=80,000,000

Thus, the value of change in total surplus is by $80 million.

Concept introduction:

International trade: It is the trade relation between the countries.

Export: It is the process of selling domestic goods in the international market. Thus, the goods produced in the domestic firms will be sold to other foreign countries. So, it is the outflow of domestic goods and services to the foreign economy.

Import: It is the process of purchasing the foreign-made goods and services by the domestic country. Thus, it is the inflow of foreign goods and services to the domestic economy.

Comparative advantage: It is the ability of the country to produce the goods and services at lower opportunity costs than the other countries.

Subpart (c):

The impact of technological advancement on TV production.

Subpart (c):

Explanation of Solution

When the government imposes a tax of $100 on the imports, the price of the imports will increase by $100; this means that the price level will revert back to the initial world price. This denotes that the consumer surplus, producer surplus, and the total surplus will revert back to the initial levels. The consumer surplus will fall by the area of C+D+E+F, which is $110 million and the producer surplus will increase by the area of C, which is $30 million.

The government would earn a tax revenue through this and the tax revenue can be calculated as follows:

Tax revenue=(Domestic demand−Domestic supply)×Tax amount=(1,000,000−400,000)×100=600,000×100=60,000,000

Thus, the government will earn a tax revenue of $60 million.

There will be

Concept introduction:

International trade: It is the trade relation between the countries.

Export: It is the process of selling domestic goods in the international market. Thus, the goods produced in the domestic firms will be sold to other foreign countries. So, it is the outflow of domestic goods and services to the foreign economy.

Import: It is the process of purchasing the foreign-made goods and services by the domestic country. Thus, it is the inflow of foreign goods and services to the domestic economy.

Comparative advantage: It is the ability of the country to produce the goods and services at lower opportunity costs than the other countries.

Subpart (d):

The impact of technological advancement on TV production.

Subpart (d):

Explanation of Solution

The fall in the world price benefits the consumers because they are able to get the commodity at lower price than before. Also, the consumer surplus increases by $110 million. The fall in the world price harms the domestic producers because it leads to a fall in the producer surplus by $30 million. Since the consumer is benefited much more than the producer is harmed, the total welfare of the economy increases. Thus, the reason behind the fall in the world price does not matter in the analysis.

Concept introduction:

International trade: It is the trade relation between the countries.

Export: It is the process of selling domestic goods in the international market. Thus, the goods produced in the domestic firms will be sold to other foreign countries. So, it is the outflow of domestic goods and services to the foreign economy.

Import: It is the process of purchasing the foreign-made goods and services by the domestic country. Thus, it is the inflow of foreign goods and services to the domestic economy.

Comparative advantage: It is the ability of the country to produce the goods and services at lower opportunity costs than the other countries.

Want to see more full solutions like this?

Chapter 9 Solutions

Principles of Economics (MindTap Course List)

- subject to X1 X2 Maximize dollars of interest earned = 0.07X1+0.11X2+0.19X3+0.15X4 ≤ 1,000,000 <2,500,000 X3 ≤ 1,500,000 X4 ≤ 1,800,000 X3 + XA ≥ 0.55 (X1+X2+X3+X4) X1 ≥ 0.15 (X1+X2+X3+X4) X1 + X2 X3 + XA < 5,000,000 X1, X2, X3, X4 ≥ 0arrow_forwardnot use aiarrow_forwardPlease help and Solve! (Note: this is a practice problem)arrow_forward

- Please help and thanks! (Note: This is a practice problem!)arrow_forwardUnit VI Assignment Instructions: This assignment has two parts. Answer the questions using the charts. Part 1: Firm 1 High Price Low Price High Price 8,8 0,10 Firm 2 Low Price 10,0 3,3 Question: For the above game, identify the Nash Equilibrium. Does Firm 1 have a dominant strategy? If so, what is it? Does Firm 2 have a dominant strategy? If so, what is it? Your response:arrow_forwardnot use ai please don't kdjdkdkfjnxncjcarrow_forward

- Ask one question at a time. Keep questions specific and include all details. Need more help? Subject matter experts with PhDs and Masters are standing by 24/7 to answer your question.**arrow_forward1b. (5 pts) Under the 1990 Farm Bill and given the initial situation of a target price and marketing loan, indicate where the market price (MP), quantity supplied (QS) and demanded (QD), government stocks (GS), and Deficiency Payments (DP) and Marketing Loan Gains (MLG), if any, would be on the graph below. If applicable, indicate the price floor (PF) on the graph. TP $ NLR So Do Q/yrarrow_forwardNow, let us assume that Brie has altruistic preferences. Her utility function is now given by: 1 UB (xA, YA, TB,YB) = (1/2) (2x+2y) + (2x+2y) What would her utility be at the endowment now? (Round off your answer to the nearest whole number.) 110arrow_forward

- Problema 4 (20 puntos): Supongamos que tenemos un ingreso de $120 y enfrentamos los precios P₁ =6 y P₂ =4. Nuestra función de utilidad es: U(x1, x2) = x0.4x0.6 a) Planteen el problema de optimización y obtengan las condiciones de primer orden. b) Encuentren el consumo óptimo de x1 y x2. c) ¿Cómo cambiará nuestra elección óptima si el ingreso aumenta a $180?arrow_forwardPlease draw the graph for number 4 and 5, I appreciate it!!arrow_forwardnot use ai pleasearrow_forward

Principles of Macroeconomics (MindTap Course List)EconomicsISBN:9781285165912Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Macroeconomics (MindTap Course List)EconomicsISBN:9781285165912Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Principles of MicroeconomicsEconomicsISBN:9781305156050Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of MicroeconomicsEconomicsISBN:9781305156050Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Microeconomics (MindTap Course List)EconomicsISBN:9781305971493Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Microeconomics (MindTap Course List)EconomicsISBN:9781305971493Author:N. Gregory MankiwPublisher:Cengage Learning