Concept explainers

Cho Sportswear: Aged Schedule of Accounts Receivable

| Past Due | ||||||

| Customer | Current | 1-30 Days | 31-60 Days | 61-90 Days | Over 90 Days | Totals |

| Ryoko Design Assosciates | $100,000 | $23,800 | $ 123,800 | |||

| Marcy Fashions, Inc | 657,000 | 198,000 | $76,000 | 931,000 | ||

| Conory Clothing | $456,000 | $789,412 | 1,245,412 | |||

| Lee Womensware | 237,200 | 10,230 | 54,570 | 349,200 | 651,200 | |

| Bauer Brands, Ltd. | 100,230 | 76,770 | 41,588 | 19,000 | 237,588 | |

| Totals | $1,094,430 | $308,800 | $130,570 | $846,788 | $808,412 | $3,189,000 |

The company estimated an allowance for uncollectible accounts based on the following estimates

| Aging Category | Allowance Provided |

| Current | 5% |

| 1 -30 days past due | 9 |

| 31-60 days past due | 20 |

| 61-90 days past due | 55* |

| Over 90 days past due | 80* |

After a specific review of the company’s accounts receivable, Cho’s credit manager decided to provide a full allowance against all Bauer Brands’ balances that are more than 60 days past due. The percentage allowance is applied to the 61-90 days and over 90 days past due aging categories only after deducting the balances due from Bauer Brands.

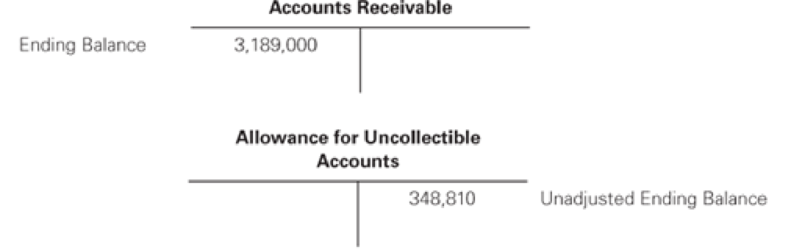

Cho reported net credit sales of $45,000,000 for the current year. We present the company’s of accounts receivable and the allowance for uncollectible accounts:

Required

- a. Compute the balance required in the allowance for uncollectible accounts at the end of the year.

- b. Prepare the journal entry to record the bad debt provision for the current year.

- c. Independent of your answer to part (b) prepare the journal entry to record the bad debt provision for the current year assuming that the allowance for uncollectible accounts had a $331,000 debit balance.

- d. In the following year, Cho’s credit management decided to write off all accounts that were over 90 days past due. Prepare the journal entry.

- e. After the write-offs recorded in part (d), assume that Conroy Clothing pays the entire balance due. Prepare the journal entries required to record the subsequent recovery of the Conroy Clothing receivables.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Intermediate Accounting

- Olena Mirrors records bad debt using the allowance, balance sheet method. They recorded $343,160 in accounts receivable for the year and $577,930 in credit sales. The uncollectible percentage is 4.4%. On June 11, Olena Mirrors identifies one uncollectible account from Nadia White in the amount of $4,265. On September 14, Nadia Chernoff unexpectedly pays $1,732 toward her account. Record journal entries for the following. A. Year-end adjusting entry for 2017 bad debt B. June 11, 2018 identification entry C. Entry for payment on September 14, 2018arrow_forwardDetermining Bad Debt Expense Using the Aging Method At the beginning of the year, Tennyson Auto Parts had an accounts receivable balance of $31,800 and a balance in the allowance for doubtful accounts of $2,980 (credit). During the year, Tennyson had credit sales of $624,300, collected accounts receivable in the amount of $602,700, wrote off $18,600 of accounts receivable, and had the following data for accounts receivable at the end of the period: Required: 1. Determine the desired post adjustment balance in allowance for doubtful accounts. 2. Determine the balance in allowance for doubtful accounts before the bad debt expense adjusting entry is posted. 3. Compute bad debt expense. 4. Prepare the adjusting entry to record bad debt expense.arrow_forwardCustomer Bad Debt Expense, Aging of Accounts Receivable, Journal Entry. Giaraldi Garden Products, Inc. developed an aged schedule of accounts receivable at the end of each year. Giaraldi Garden Products: Aged Schedule of Accounts Receivable Past Due Current 1-30 Days 31-60 Days 61-90 Days Over 90 Days The company estimated an allowance for uncollectible accounts based on the following estimates: Aging Category Current Allowance Provided 3% 1-30 days past due 6% 31-60 days past due 18% Totals 61-90 days past due 45% Carey Company $ 10,000 $ 34,500 $ 44,500 Over 90 days past due 100% Gibson, Ltd. $ 423,000 $ 27,000 450,000 KW Quarterly Onix Construction 33,000 $ 67,000 100,000 1,500 101,500 Giaraldi reported for the current year: 45,000 Carpenter Lumber Totals 387,000 $ 125,000 810,000 $ 185,000 $ 167,000 $ 90,500 500 235,500 512,500 Net credit sales $ 18,500,000 55,000 $ 127,000 $ 1,344,000 The company's ending balances of accounts receivable and the allowance for uncollectible accounts…arrow_forward

- Marigold Inc. uses the allowance method to estimate uncollectibles. The company produced the following aging of the accounts receivable at year-end. (a) Correct answer icon Your answer is correct. Calculate the total estimated uncollectibles based on the below information. Number of Days Outstanding Total 0–30 31–60 61–90 91–120 Over 120 Accounts receivable $212,900 $80,500 $47,100 $41,900 $25,500 $17,900 % uncollectible 1% 4% 5% 8% 20% Estimated Bad debts $enter a dollar amount $enter a dollar amount $enter a dollar amount $enter a dollar amount $enter a dollar amount $enter a dollar amount eTextbook and Media List of Accounts Attempts: 1 of 3 used (b) - (d) (b) Prepare the year-end adjusting journal entry to record the Bad Debt Expense using the aged uncollectible accounts receivable…arrow_forwardBlossom Inc. uses the allowance method to estimate uncollectibles. The company produced the following aging of the accounts receivable at year-end. (a) Calculate the total estimated uncollectibles based on the below information. Accounts receivable % uncollectible Estimated Bad debts $ Total $216,800 0-30 $81,000 2% 31-60 $50,000 5% Number of Days Outstanding $ 61-90 $42,100 6% $ 91-120 $25,700 9% Over 120 $18,000 21%arrow_forwardThe beginning balance in the Allowance for Uncollectible Accounts account is a $3,500 credit. After conducting an aging analysis, management has determined that $4,700 of accounts receivable will be uncollectible. What was the Uncollectible Accounts Expense for the year? $8,200 $3,500 $4,700 $1,200arrow_forward

- Wohoo Publishers uses the allowance method to estimate uncollectible accounts receivables. The company produced the following aging of the accounts receivable at year-end (Y in thousands). Accounts receivable % uncollectible Estimated bad debts Total 200,000 0-30 days 77,000 2% 31-60 days 46,000 5% 61-90 days 91-120 days 39,000 6% 23,000 10% Over 120 days 15,000 25%arrow_forwardKingbird Merchandising uses an aging schedule to determine its estimated uncollectible accounts at year end. The percentage estimates of bad debts are as follows: KINGBIRD MERCHANDISING Aged Schedule of Accounts Receivable No. of Days Outstanding 0-30 days 31-60 days 61-90 days Over 90 days (a) Number of Days Outstanding 0-30 days 31-60 days Amount $61,400 26,000 61-90 days 11,700 Using the information above for Kingbird Merchandising, prepare the adjusting entry to record bad debt expense for each of the following independent situations: Over 90 days 4,900 $104,000 The Allowance for Doubtful Accounts has an unadjusted $1,590 debit balance and the company uses the aging schedule to determine estimated uncollectible accounts. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry. Round answers to 2 decimal…arrow_forwardข้อ1 Sammy’s Downtown Properties developed an aged schedule of accounts receivable at the end of each year.Sammy’s Downtown Properties: Aged Schedule of Accounts Receivable (In the picture) The company estimated an expected credit loss based on the following rules:Aging Category Probability of CollectionCurrent 4%1-30 Days 8%31-60 Days 10%61-90 Days 35%Over 90 Days 50%Sammy’s reported net credit sales of 4,500,000 for the current year. We present the company’s ending balancesof accounts receivable and the credit loss allowance below: Accounts ReceivableEnding Balance 587,400 Credit loss allowance 120,000 Unadjusted Ending…arrow_forward

- . Facebook uses the balance sheet approacy to estimate uncollectible accounts expense. At year-end an aging of the accounts receivable produced the following five grouping: Groups Accounts receivable by age Age group total Estimated Uncollectible accounts a. Not yet due $400,000 b. 1-30 days 90,000 c. 31-60 days 40,000 d. 61-90 days 20,000 e. Over 90 days past due 50,000 Total $600000 On the basis of past experience, the company estimated the percentage probability uncollectible for the above five age groups to be as follows: a, 1%; Group b, 2%; Group c, 9%; Group d, 15%; and Group e, 40%. a) Compute the estimated amount of uncollectible accounts based on the above classification by age group. Show your calculation in the table provided above. Please also show the total estimated uncollectible accounts. b) The allowance for doubtful accounts before adjustments at December 31,2020…arrow_forward1. Orr Company prepared an aging of accounts receivable on December 31, 20XX and determined that the net realizable value of the accounts receivable was P2,500,000. Additional information is available as follows: Allowance for doubtful accounts on January 1 - 280,000 Accounts written off as uncollectible - 230,000 Accounts receivable on December 31 - 2,700,000 Uncollectible accounts recovery - 50,000 For the year ended December 31, 20XX, what amount should be recognized as doubtful accounts expense?arrow_forwardABC Company has the following account balances at year-end: Accounts receivable P80,000 Allowance for doubtful accounts 4,800 Bad debts expense 3,200 ABC should report accounts receivable at a. P72,000. b. P75,200. c. P76,800. d. P80,000.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College