Concept explainers

Lower of cost or net realizable value

• LO9–1

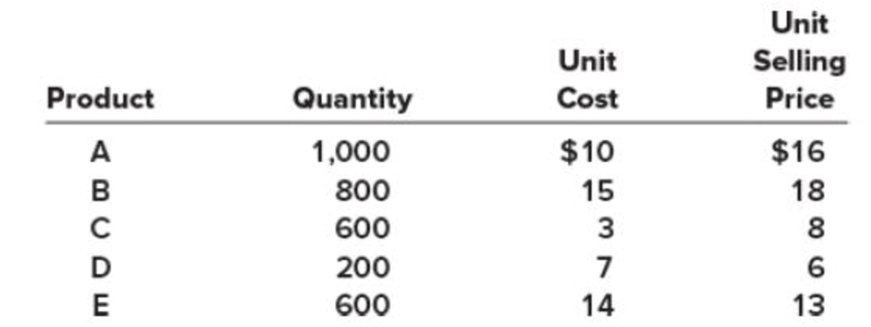

Decker Company has five products in its inventory. Information about the December 31, 2018, inventory follows.

The cost to sell for each product consists of a 15 percent sales commission.

Required:

- 1. Determine the carrying value of inventory at December 31, 2018, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products.

- 2. Determine the carrying value of inventory at December 31, 2018, assuming the LCNRV rule is applied to the entire inventory. Also, assuming inventory write-downs are usual business practice for Decker, record any necessary year-end

adjusting entry.

1.

LCM (Lower of Cost or Market) approach: It is an approach that values the inventory at historical cost or lesser than the market replacement cost. The replacement cost refers to the amount that could be realized from the sale of the inventory.

NRV (Net Realizable Value): It refers to an estimated selling price that a company expects to collect in the form of cash from the customers by the sale of inventory. The value is reduced by the expected cost of completion, disposal and transportation. Sales commission and shipping costs also included in the predictable cost.

To Calculate: The carrying value of inventory at December 31, 2018 by using the rule of LCM and NRV.

Explanation of Solution

The following table shows the carrying value of inventory at December 31, 2018 by using the rule of LCM and NRV.

| Lower of Cost or NRV | |||||

| Product | Units | Unit Cost ($) | Cost ($) | NRV ($) | Inventory value ($) |

| (A) | (B) | (A) × (B) | |||

| A | 1,000 | 10 | 10,000 | 13,600 (1) | 10,000 |

| B | 800 | 15 | 12,000 | 12,240 (2) | 12,000 |

| C | 600 | 3 | 1,800 | 4,080 (3) | 1,800 |

| D | 200 | 7 | 1,400 | 1,020 (4) | 1,020 |

| E | 600 | 14 | 8,400 | 6,630 (5) | 6,630 |

| Total | 33,600 | 37,570 | 31,450 | ||

Table (1)

Working Notes:

Calculate the amount of NRV for product A.

Calculate the amount of NRV for product B.

Calculate the amount of NRV for product C.

Calculate the amount of NRV for product D.

Calculate the amount of NRV for product E.

Therefore, the carrying value of inventory at December 31, 2018 by using the rule of LCM and NRV is $31,450.

2.

Explanation of Solution

The total aggregate inventory cost and aggregate inventory net realizable value is $33,600 and $37,570 respectively. Therefore, the carrying value of inventory at December 31, 2018, using the LCNRV rule applied for entire inventory is $33,600. There is no inventory write-downs as the LCNRV is already recorded at cost.

Want to see more full solutions like this?

Chapter 9 Solutions

GEN CMB(LL)INTRM ACCTG

- 10 Vargas Company uses the perpetual inventory method. Vargas purchased 2,200 units of inventory that cost $23.00 each. At a later date the company purchased an additional 2,600 units of inventory that cost $24.00 each. Vargas sold 2,300 units of inventory for $27.00. If Vargas uses a FIFO cost flow method, the amount of cost of goods sold appearing on the income statement will be: 1 nts 01:10:09 Multiple Choice $50,600. $53,000 $9,100 $6,900.arrow_forwardQUESTION 1a. Kpogo Ltd has the following products in inventory at the end of 2019:Units Cost per unit GH¢XYZ (completed) 540 22ABC (part complete) 280 26Each product normally sells at GH¢34 per unit. Due to the difficult trading conditions, Kpogo Ltdintends to offer a discount of 15% per unit and expects to incur GH¢4 per unit in selling costs.GH¢10 per unit is expected to be incurred to complete each unit of ABC.Required:In accordance with IAS 2 Inventories, at what amount should inventory be stated in the financialstatements of Kpogo Ltd as at 31 December 2019?b. According to IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors,an entity must select and apply its accounting policies consistently from one period to thenext and among various items in the financial statements. However, an entity may changeits accounting policies under certain conditions.Required:Identify the circumstances under which it may be appropriate to change accounting policyin accordance with…arrow_forwardTetum Company has four products in its inventory. Information sbout the December 31, 2021, inventory is os follows: Total Net Realizable Value $187,0e0 Product Tatal Cost $134, 000 97,e00 101 102 117,00 57, 0ee 57,080 103 67, e00 37,e00 184 Required: 1. Determine the carrying value of inventory at December 31, 2021, assuming the lower of cost or net reslizable value (LCNRV) rule is applied to individual products. 2 Assuming that inventory write-downs are common for Tatum Company, record any necessary year-end adjusting entry. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the carrying value of inventory at December 31, 2021, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. Inventory Value Product Cost NRV 101 134,000 107,000 102 97,000 117,000 103 67,000 57,000 104 37,000 57,000 335,000arrow_forward

- Decker Company has five products in its inventory. Information about ending inventory follows. Unit Unit Selling Cost Product ABCDE Quantity 1,250 1,050 850 450 850 $ 23 29 5 12 28 Price The cost to sell for each product consists of a 10 percent sales commission. Required: 1. Determine the carrying value of ending inventory, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. $ 30 32 13 11 27 2. Determine the carrying value of ending inventory, assuming the LCNRV rule is applied to the entire inventory. 3. Assuming inventory write-downs are common for Decker, record any necessary year-end adjusting entry based on the amount calculated in requirement 2. View transaction list Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Assuming inventory write-downs are common for Decker, record any necessary year-end adjusting entry based on the amount calculated in requirement 2. Note: If no entry is…arrow_forwardExercise 9-6 (Algo) Lower of cost or market [LO9-1] Tatum Company has four products in its inventory. Information about the December 31, 2021, inventory is as follows: Total Total Net Product Total Cost Replacement Cost $118,100 91,000 42,800 30,200 Realizable Value $129,000 96,400 64,200 32,300 $107,300 117,800 53,700 54,000 101 102 103 104 The normal profit is 30% of total cost. Required: 1. Determine the carrying value of inventory at December 31, 2021, assuming the lower of cost or market (LCM) rule is applied to individual products. 2. Assuming that inventory write-downs are common for Tatum Company, record any necessary year-end adjusting entry. X Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the carrying value of inventory at December 31, 2021, assuming the lower of cost or market (LCM) rule is applied to individual products. Inventory Value Replacement NRV NRV - NP Market Product…arrow_forwardEA 6. LO 10.2 Akira Company had the following transactions for the month. Cost per Unit $1,500 1,920 1,950 5,370 ? Beginning inventory Purchased Mar. 31 Purchased Oct. 15 Total goods available for sale Ending inventory Number of Units 150 160 130 440 50 Calculate the gross margin for the period for each of the following cost allocation methods, using periodic inventory updating. Assume that all units were sold for $25 each. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forward

- Inventory Write-Down Stiles Corporation uses the LIFO cost flow assumption and is in the process of applying the LCM rule for each of two products in its ending inventory. A profit margin of 30% on the selling price is considered normal for each product. Specific data for each product are as follows: Historical cost Replacement cost Estimated cost of disposal Estimated selling price Product A Product B $80 $96 70 98 32 30 150 120 Required: 1. What is the correct inventory value for each product? Product A Product B $ per unit per unit 2. Next Level With regard to requirement 1, what effect does the imposition of the constraints on market value have on the inventory valuations? For Product A, For Product B,arrow_forwardProblem 2 The Bertolo Corporation has eight items in inventory at December 31, 20x4. Cost data on each item of inventory is as follows: Required a) b) A101 A105 A109 B202 B203 B205 C101 C102 Z Cost $ 45,250 18,500 16,700 89,700 158,500 75,800 6,900 41,200 $452,550 SP Selling Price $ 54,300 22,200 20,900 125,600 166,500 98,500 7,900 50,600 $546,500 Cost to sell $ 2,800 5,550 2,100 6,300 25,000 19,700 2,000 4,500 $67,950 Calculate the cost of the inventory that would appear on the balance sheet as at December 31, 20x4. If a write-down of inventory is required, write the journal entry. At December 31, 20x5, Bertolo had $45,000 of item B203 on hand that was on hand at December 31, 20x4. The selling price and cost to sell of this inventory is $62,000 and $8,000 respectively. Write the journal entry at December 31, 20x5.arrow_forwardTatum Company has four products in its inventory. Information about the Decemnber 31, 2021, Inventory is as follows: Total Net Realizable Value Product 101 Total Cost $134,000 97,000 67,000 37,000 $107,000 117,000 57,000 57,000 102 103 104 Required: 1. Determine the carrying value of inventory at December 31, 2021, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. 2. Assuming that inventory write-downs are common for Tatum Company, record any necessary year-end adjusting entry. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the carrying value of inventory at December 31, 2021, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. Inventory Value Product Cost NRV 101 S. 134,000 107,000 102 97,000 117,000 57,000 67,000 37,000 103 104 57,000 S. 335,000 Required 2 > Prev 1 of 9 Next > Profile (1).pdf Profile.pdf Profile (1) .pdfarrow_forward

- A. First In, First Out Number of Units Dollar Per Unit Value Total Value Cost of Goods Sold .. ... B. Last In, First Out Number of Units Dollar Per Unit Value Total Value Cost of Goods Sold ... ... C. Weighted Average Number of Units Dollar Per Unit Value Total Value Cost of Goods Sold ... ...arrow_forwardQuestion 14 Sami Company had the following balances and transactions during 2020. ot yet pajƏMS arked out of Beginning inventory 10 units at OR70 D0 March Sold 8 units Flag auns October 30 Purchased 20 units at OR80 Sold 15 units What would the company's Inventory amount be on the December 31, 2020 balance sheet, if the periodic average-costing method IS used? (Answers are rounded to the nearest Rial.) Select one O a OR 490 Ob OR 554 Oc. OR537 Od.OR 50arrow_forwardpvn.4 The following information pertains to inventory for a company:March 1Beginning inventory = 32 units @ $5.60March 3Purchased 21 units @ 4.30March 9Sold 29 units @ 8.10What is the cost of goods sold, assuming the company uses LIFO? (Do not round your intermediate calculations. Round your answer to the nearest dollar amount.)arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education