Concept explainers

Dollar-value LIFO retail

• LO9–5

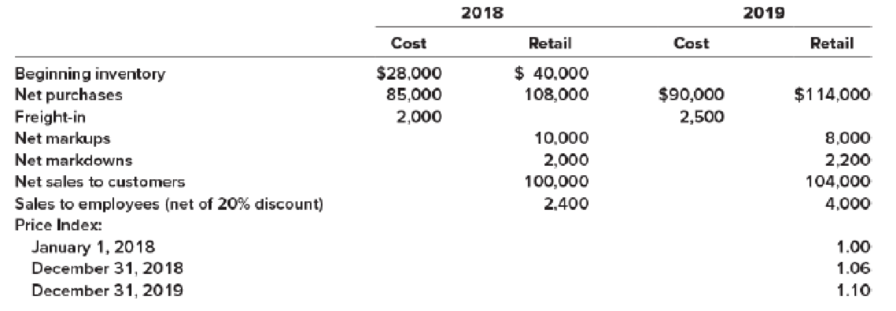

On January 1, 2018, HGC Camera Store adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2018 and 2019 are as follows:

Required:

Estimate the 2018 and 2019 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method.

Dollar-Value-LIFO

This method shows all the inventory figures at dollar price rather than units. Under this inventory method, the units that are purchased last, are sold first. Thus, it starts from the selling of the units recently purchased and ending with the beginning inventory.

To Estimate: the ending inventory and cost of goods sold in 2018 using dollar-value LIFO retail method.

Explanation of Solution

Solution:

Calculate the amount of estimated ending inventory and cost of goods sold at retail.

| Details | Cost ($) | Retail ($) |

| Beginning inventory | 28,000 | 40,000 |

| Add: Net purchase | 85,000 | 108,000 |

| Freight-in | 2,000 | |

| Net markups | 10,000 | |

| Less: Net markdowns | (2,000) | |

| Goods available for sale – Excluding beginning inventory | 87,000 | 116,000 |

| Goods available for sale – Including beginning inventory | 115,000 | 156,000 |

| Less: Net sales | 0 | (102,400) |

| Employees discounts | (600) | |

| Estimated ending inventory at current year retail prices | 53,000 | |

| Estimated ending inventory at cost (Refer Table 2) | (35,950) | |

| Estimated Cost of Goods Sold | 79,050 |

Table (1)

Working Notes:

Calculate base layer cost-to retail percentage.

Calculate current year cost-to retail percentage.

Calculate the amount of estimated ending inventory at cost.

| Ending inventory at dollar-value LIFO retail cost | ||||

| Ending inventory at year-end retail prices ($) | Ending inventory at base year retail prices ($) | Inventory layers at base year retail prices ($) | Inventory layers converted to cost ($) | |

| 53,000 | 50,000 | 40,000 (Base) | 28,000 | |

| 10,000 (2018) | 7,950 | |||

| Total ending inventory at dollar-value LIFO retail cost | 35,950 | |||

Table (2)

Calculate the amount of ending inventory at base year retail prices.

Calculate the amount of inventory layers at base year retail prices.

Calculate the amount of inventory layers at current year retail prices.

Calculate the amount of inventory layers converted to cost (Base).

Calculate the amount of inventory layers converted to cost (2018).

Calculate the amount of estimated ending inventory and cost of goods sold at retail.

| Details | Cost ($) | Retail ($) |

| Beginning inventory | 35,950 | 53,000 |

| Add: Net purchase | 90,000 | 114,000 |

| Freight-in | 2,500 | |

| Net markups | 8,000 | |

| Less: Net markdowns | (2,200) | |

| Goods available for sale – Excluding beginning inventory | 92,500 | 119,800 |

| Goods available for sale – Including beginning inventory | 128,450 | 172,800 |

| Less: Net sales | 0 | (108,000) |

| Employees discounts | (1,000) | |

| Estimated ending inventory at current year retail prices | 63,800 | |

| Estimated ending inventory at cost (Refer Table 2) | (42,744) | |

| Estimated Cost of Goods Sold | 85,706 |

Table (3)

Working Notes:

Calculate base layer cost-to retail percentage.

Calculate 2018 year cost-to retail percentage.

Calculate current year cost-to retail percentage.

Calculate the amount of estimated ending inventory at cost.

| Ending inventory at dollar-value LIFO retail cost | ||||

| Ending inventory at year-end retail prices ($) | Ending inventory at base year retail prices ($) | Inventory layers at base year retail prices ($) | Inventory layers converted to cost ($) | |

| 63,800 | 58,000 | 40,000 (Base) | 28,000 | |

| 10,000 (2018) | 7,950 | |||

| 8,000 (2019) | 6,794 | |||

| Total ending inventory at dollar-value LIFO retail cost | 42,744 | |||

Table (4)

Calculate the amount of ending inventory at base year retail prices.

Calculate the amount of inventory layers at base year retail prices.

Calculate the amount of inventory layers at current year retail prices.

Calculate the amount of inventory layers converted to cost (Base).

Calculate the amount of inventory layers converted to cost (2018).

Calculate the amount of inventory layers converted to cost (2019).

Want to see more full solutions like this?

Chapter 9 Solutions

INTERMEDIATE ACTG+CONNECT <LOOSE>

- ( Appendix 6B) Refer to the information for Morgan Inc. above. If Morgan uses a periodic inventory system, what is the cost of goods sold under FIFO at April 30? a. $32,800 b. $38,400 c. $63,600 d. $69,200arrow_forward( Appendix 6B) Refer to the information for Morgan Inc. above. If Morgan uses a periodic inventory system, what is the cost of ending inventory under LIFO at April 30? a. $32,800 b. $38,400 c. $63,600 d. $69,200arrow_forwardRetail Inventory Method Turner Corporation uses the retail inventory method. The following information relates to 2019: Required: Compute the cost of the ending inventory under each of the following cost flow assumptions (round the cost-to-retail ratio to 3 decimal places): 1. FIFO 2. average cost 3. LIFO 4. lower of cost or market (based on average cost)arrow_forward

- (Appendix 8.1) Inventory Write-Down The following are the inventories for the years 2019, 2020, and 2021 for Parry Company: Required: 1. Assume the inventory that existed at the end of each year was sold in the subsequent year. Prepare journal entries to record the lower of cost or net realizable value for each of the following alternatives: a. allowance method, periodic inventory system b. direct method, periodic inventory system 2. Next Level Refer to your answer for P8-2. How does the use of the periodic inventory system affect the write-down of inventory to the lower of cost or net realizable value?arrow_forward(Appendix 8.1) Inventory Write-Down The inventories of Berry Company for the years 2019 and 2020 are as follows: Berry uses the periodic inventory method and the FIFO inventory cost flow assumption. Required: 1. Assume the inventory that existed at the end of 2019 was sold in 2020. Prepare the necessary journal entries at the end of each year to record the correct inventory valuation if Berry uses the: a. direct method b. allowance method 2. Next Level Refer to your answer for E8-6. How does the use of a periodic or perpetual inventory system affect the valuation of inventory?arrow_forwardGoods in Transit Gravais Company made two purchases on December 29, 2019. One purchase for 3,000 was shipped FOB destination, and the second for 4,000 was shipped FOB shipping point. Neither purchase had been received nor paid for on December 31, 2019. Required: Which of these purchases, if either, does Gravais include in inventory on December 31, 2019? What is the cost?arrow_forward

- ( Appendix 6B) Inventory Costing Methods: Periodic Inventory Systems. Refer to the information for Tyler Company in Brief Exercise 6-35 and assume that the company uses the periodic inventory system. Required: Calculate the cost of goods sold and the cost of ending inventory using the FIFO, LIFO, and average cost methods. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest whole dollar.)arrow_forwardRetail Inventory Method The following information relates to the retail inventory method used by Jeffress Company: Required: 1. Compute the ending inventory by the retail inventory method using the following cost flow' assumptions (round the cost-to-retail ratio to 3 decimal places): a. FIFO b. average cost c. LIFO d. lower of cost or market (based on average cost) 2. Next Level What assumptions are necessary for the retail inventory method to produce accurate estimates of ending inventory?arrow_forwardCalculate the cost of goods sold dollar value for A74 Company for the sale on March 11, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average (AVG).arrow_forward

- Our narrative and DFDs are created assuming that accounts payable result from the purchase of inventory using a perpetual inventory system. However, inventory is not the only item that a company might purchase. For each of the following situations, show the journal entry (in debit/credit journal entry format with no dollar amounts) that would result when the accounts payable was created. Make and state any assumptions you think are necessary. Situations: 1. Merchandise is purchased, and a periodic inventory process is used. 2. Merchandise is purchased, and a perpetual inventory process is used. 3. Office supplies are purchased. 4. Plant assets are purchased. 5. Legal services are purchased.arrow_forward( Appendices 6A and 6B) Inventory Costing Methods Edwards Company began operations in February 2019. Edwards accounting records provide the following data for the remainder of 2019 for one of the items the company sells: Â Edwards uses a periodic inventory system. All purchases and sales were for cash. Required: 1. Compute cost of goods sold and the cost of ending inventory using FIFO. 2. Compute cost of goods sold and the cost of ending inventory using LIFO. 3. Compute cost of goods sold and the cost of ending inventory using the average cost method. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.) 4. Prepare the journal entries to record these transactions assuming Edwards chooses to use the FIFO method. 5. CONCEPTUAL CONNECTION Which method would result in the lowest amount paid for taxes? 6. CONCEPTUAL CONNECTION Refer to Problem 6-67B and compare your results. What are the differences? Be sure to explain why the differences occurred.arrow_forwardPerpetual and Periodic Inventory Systems Below is a list of inventory systems options. a. Perpetual inventory system b. Periodic inventory system c. Both perpetual and periodic inventory systems Required: Match each option with one of the following: 1. Only revenue is recorded as sales are made during the period; the cost of goods sold is recorded at the end of the period. 2. Cost of goods sold is determined as each sale is made. 3. Inventory purchases are recorded in an inventory account. 4. Inventory purchases are recorded in a purchases account. 5. Cost of goods sold is determined only at the end of the period by subtracting the cost of ending inventory from the cost of goods available for sale. 6. Both revenue and cost of goods sold are recorded during the period as sales are made. 7. The inventory is verified by a physical count.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College