The option which should be selected.

Answer to Problem 32P

The option C the building with height of 10 stories should be selected.

Explanation of Solution

Given:

Cost of land is $100000 and the interest rate is 8%.

Concept used:

Write the expression for present worth of benefits.

PWB=A[(1+i)n−1i(1+i)n] ...... (I)

Here, the annual payment is A, the interest rate is i and time period is n.

Write the expression for present worth of costs.

PWC=C+L−S[1(1+i)n] ...... (II)

Here, the cost of building is C, the cost of land is L and the salvage value after 20 years is S.

Write the expression for benefit cost ratio.

B-C ratio=PWBPWC ...... (III)

Calculations:

Consider option A the building with height of 2 stories.

Calculate the present worth of benefits.

Substitute $70000 for A, 8% for i and 20 for n in Equation (I).

PWB=$70000[(1+0.08)20−10.08(1+0.08)20]=$700000[(1.08)20−10.08(1.08)20]=$70000(9.8181)=$687267

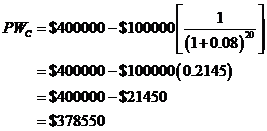

Calculate the present worth of costs.

Substitute $400000 for C, $100000 for L, $200000 for S, 8% for i and 20 for n in Equation (II).

PWC=$400000+$100000−$200000[1(1+0.08)20]=$500000−$200000(0.2145)=$500000−$42900=$457100

Calculate the benefit cost ratio.

Substitute $457100 for PWC and $687267 for PWB in Equation (III).

B-C ratio=$687267$457100=1.5

Consider option B the building with height of 5 stories.

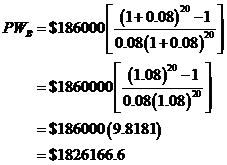

Calculate the present worth of benefits.

Substitute $105000 for A, 8% for i and 20 for n in Equation (I).

PWB=$105000[(1+0.08)20−10.08(1+0.08)20]=$105000[(1.08)20−10.08(1.08)20]=$105000(9.8181)=$1030901

Calculate the present worth of costs.

Substitute $800000 for C, $100000 for L, $300000 for S, 8% for i and 20 for n in Equation (II).

PWC=$800000+$100000−$300000[1(1+0.08)20]=$900000−$300000(0.2145)=$900000−$64350=$8356500

Calculate the benefit cost ratio.

Substitute $8356500 for PWC and $1030901 for PWB in Equation (III).

B-C ratio=$1030901$8356500=1.23

Consider option C the building with height of 10 stories.

Calculate the present worth of benefits.

Substitute $256000 for A, 8% for i and 20 for n in Equation (I).

PWB=$256000[(1+0.08)20−10.08(1+0.08)20]=$256000[(1.08)20−10.08(1.08)20]=$256000(9.8181)=$2513434

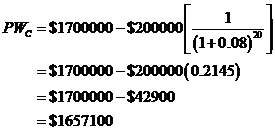

Calculate the present worth of costs.

Substitute $800000 for C, $100000 for L, $300000 for S, 8% for i and 20 for n in Equation (II).

PWC=$2100000+$100000−$400000[1(1+0.08)20]=$2100000−$400000(0.2145)=$2200000−$85800=$2114200

Calculate the benefit cost ratio.

Substitute $2114200 for PWC and $2513434 for PWB in Equation (III).

B-C ratio=$2513434$2114200=1.19

Consider incremental analysis for option B-A.

Calculate the value of A.

A=$105000−$70000=$35000

Calculate the present worth of benefits.

Substitute $35000 for A, 8% for i and 20 for n in Equation (I).

PWB=$35000[(1+0.08)20−10.08(1+0.08)20]=$350000[(1.08)20−10.08(1.08)20]=$35000(9.8181)=$343634

Calculate the value of C.

C=$800000−$400000=$400000

Calculate the value of L.

L=$100000−$100000=0

Calculate the value of S.

S=$300000−$200000=$100000

Calculate the present worth of costs.

Substitute  for

for

for

for

for

for

for

for  and

and  for

for  in Equation (II).

in Equation (II).

Calculate the benefit cost ratio.

Substitute  for

for  and

and  for

for  in Equation (III).

in Equation (III).

The benefit cost ratio is less than  so option A is more preferable to B.

so option A is more preferable to B.

Consider incremental analysis for option C-A.

Calculate the present worth of benefits.

Calculate the value of A.

Substitute  for

for

for

for  and

and  for

for  in Equation (I).

in Equation (I).

Calculate the value of

Calculate the value of

Calculate the value of

Calculate the present worth of costs.

Substitute  for

for

for

for

for

for

for

for  and

and  for

for  in Equation (II).

in Equation (II).

Calculate the benefit cost ratio.

Substitute  for

for  and

and  for

for  in Equation (III).

in Equation (III).

The benefit cost ratio is more than  so option C is more preferable to A.

so option C is more preferable to A.

The option C the building with height of  stories should be selected.

stories should be selected.

Conclusion:

The option C the building with height of  stories should be selected.

stories should be selected.

Want to see more full solutions like this?

Chapter 9 Solutions

Engineering Economic Analysis

- subject to X1 X2 Maximize dollars of interest earned = 0.07X1+0.11X2+0.19X3+0.15X4 ≤ 1,000,000 <2,500,000 X3 ≤ 1,500,000 X4 ≤ 1,800,000 X3 + XA ≥ 0.55 (X1+X2+X3+X4) X1 ≥ 0.15 (X1+X2+X3+X4) X1 + X2 X3 + XA < 5,000,000 X1, X2, X3, X4 ≥ 0arrow_forwardnot use aiarrow_forwardPlease help and Solve! (Note: this is a practice problem)arrow_forward

- Please help and thanks! (Note: This is a practice problem!)arrow_forwardUnit VI Assignment Instructions: This assignment has two parts. Answer the questions using the charts. Part 1: Firm 1 High Price Low Price High Price 8,8 0,10 Firm 2 Low Price 10,0 3,3 Question: For the above game, identify the Nash Equilibrium. Does Firm 1 have a dominant strategy? If so, what is it? Does Firm 2 have a dominant strategy? If so, what is it? Your response:arrow_forwardnot use ai please don't kdjdkdkfjnxncjcarrow_forward

- Ask one question at a time. Keep questions specific and include all details. Need more help? Subject matter experts with PhDs and Masters are standing by 24/7 to answer your question.**arrow_forward1b. (5 pts) Under the 1990 Farm Bill and given the initial situation of a target price and marketing loan, indicate where the market price (MP), quantity supplied (QS) and demanded (QD), government stocks (GS), and Deficiency Payments (DP) and Marketing Loan Gains (MLG), if any, would be on the graph below. If applicable, indicate the price floor (PF) on the graph. TP $ NLR So Do Q/yrarrow_forwardNow, let us assume that Brie has altruistic preferences. Her utility function is now given by: 1 UB (xA, YA, TB,YB) = (1/2) (2x+2y) + (2x+2y) What would her utility be at the endowment now? (Round off your answer to the nearest whole number.) 110arrow_forward

- Problema 4 (20 puntos): Supongamos que tenemos un ingreso de $120 y enfrentamos los precios P₁ =6 y P₂ =4. Nuestra función de utilidad es: U(x1, x2) = x0.4x0.6 a) Planteen el problema de optimización y obtengan las condiciones de primer orden. b) Encuentren el consumo óptimo de x1 y x2. c) ¿Cómo cambiará nuestra elección óptima si el ingreso aumenta a $180?arrow_forwardPlease draw the graph for number 4 and 5, I appreciate it!!arrow_forwardnot use ai pleasearrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education