Survey Of Accounting

5th Edition

ISBN: 9781259631122

Author: Edmonds, Thomas P.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 21P

Problem 9-21 Ratio analysis

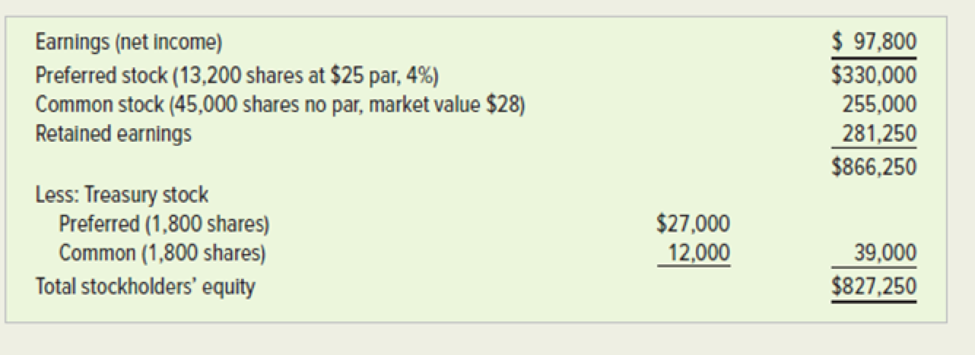

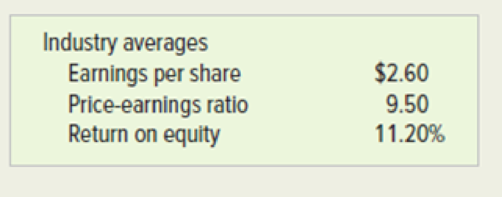

Selected data for Dalton Company for 2018 and additional information on industry averages follow:

Required

- a. Calculate and compare Dalton Company’s ratios with the industry averages.

- b. Discuss factors you would consider in deciding whether to invest in the company.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Problem 1: Viance Queen Company

Required:

Compute for the company’s profitability and operating efficiency ratios for 2019

Compute for the financial health ratios of the company for 2019

A.Profitability ratio

a.Gross Profit Ratio

b. Operating income margin

c. Net profit margin

d. Return on Assets:

ROA (NI/Total Assets)

ROA (NI/Average Assets)

ROA (EBIT/Total Assets)

ROA (EBIT/Average Assets)

ROE (NI/Capital)

ROE (NI/Average Capital

B.Operating Efficiency

a. Asset Turnover

b. Fixed Asset Turnover

c. Inventory Turnover

d. Days in Inventory

e. AR Turnover

f. Days in AR

C.Financial Health/ (Solvency and Liquidity) Solvency ratio:

a. Debt to equity ratio

b. Debt Ratio

c. Equity Ratio

d. Interest Coverage Ratio

Liquidity ratio:

a. Current Ratio

b. Quick Ratio

Problem 1: Viance Queen Company

Required:

Compute for the company’s profitability and operating efficiency ratios for 2019

Compute for the financial health ratios of the company for 2019

A.Profitability ratio

a. Return on Assets:

ROA (NI/Total Assets)

ROA (NI/Average Assets)

ROA (EBIT/Total Assets)

ROA (EBIT/Average Assets)

ROE (NI/Capital)

ROE (NI/Average Capital

Problem 1: Viance Queen Company

Required:

Compute for the company’s profitability and operating efficiency ratios for 2019

Compute for the financial health ratios of the company for 2019

A.Profitability ratio

Return on Assets:

ROA (EBIT/Average Assets)

ROE (NI/Capital)

ROE (NI/Average Capital

Chapter 9 Solutions

Survey Of Accounting

Ch. 9 - 1. Why are ratios and trends used in financial...Ch. 9 - Prob. 2QCh. 9 - Prob. 3QCh. 9 - 4. What is the significance of inventory turnover,...Ch. 9 - 5. What is the difference between the current...Ch. 9 - Prob. 6QCh. 9 - Prob. 7QCh. 9 - Prob. 8QCh. 9 - 9. What are some limitations of the earnings per...Ch. 9 - Prob. 10Q

Ch. 9 - Prob. 11QCh. 9 - Prob. 12QCh. 9 - Prob. 13QCh. 9 - Prob. 14QCh. 9 - Exercise 9-1 Horizontal analysis Winthrop...Ch. 9 - Prob. 2ECh. 9 - Prob. 3ECh. 9 - Prob. 4ECh. 9 - Prob. 5ECh. 9 - Prob. 6ECh. 9 - Prob. 7ECh. 9 - Prob. 8ECh. 9 - Comprehensive analysis The December 31, 2019,...Ch. 9 - Prob. 10ECh. 9 - Prob. 11ECh. 9 - Prob. 12ECh. 9 - Ratio analysis Compute the specified ratios using...Ch. 9 - Prob. 14ECh. 9 - LO 13-2, 13-3, 13-4, 13-5 Exercise 13-15A...Ch. 9 - Prob. 16PCh. 9 - Prob. 17PCh. 9 - Prob. 18PCh. 9 - Prob. 19PCh. 9 - Prob. 20PCh. 9 - Problem 9-21 Ratio analysis Selected data for...Ch. 9 - Prob. 22PCh. 9 - Problem 9-23 Ratio analysis The following...Ch. 9 - Prob. 24PCh. 9 - Prob. 1ATCCh. 9 - Prob. 3ATCCh. 9 - ATC 9-5 Ethical Dilemma Making the ratios look...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Data for Lozano Chip Company and its industry averages follow. Calculate the indicated ratios for Lozano. Construct the extended DuPont equation for both Lozano and the industry. Outline Lozano’s strengths and weaknesses as revealed by your analysis. Lozano Chip Company: Balance Sheet as of December 31, 2019 (Thousands of Dollars) Lozano Chip Company: Income Statement for Year Ended December 31, 2019 (Thousands of Dollars)arrow_forwardRatio Analysis Consider the following information taken from the stockholders equity section: How do you interpret the companys payout and profitability performance? Required: 1. Calculate the following for 2020. (Note. Round answers to two decimal places.) 2. CONCEPTUAL CONNECTION Assume 2019 ratios were: and the current year industry averages are: How do you interpret the companys payout and profitability performance?arrow_forwardFinancial information for Lighthizer Trading Company for the fiscal year-ended September 30, 20xx, was collected. As part of a management training session, you have been asked to prepare an income statement format that will be used to distribute to management. Subtotals and totals are included in the information, but you will need to calculate the values. A. In the correct format, prepare the income statement using this information: B. Calculate the profit margin, return on investment, and residual income. Assume an investment base of $42,000 and 8% cost of capital. C. Prepare a short response to accompany the income statement that explains why uncontrollable costs are included in the income statement.arrow_forward

- Problem 1: Viance Queen Company Required: Compute for the company’s profitability and operating efficiency ratios for 2019 Compute for the financial health ratios of the company for 2019 B.Operating Efficiency Days in Inventory AR Turnover Days in ARarrow_forwardQuestion 1 The following table reports IBEX Company's Return on Net Operating Assets (RNOA) ratios for the years 2020 and 2021, and an industry average RNOA Ratio 2020 RNOA 17.83% 2021 16.92% Industry average 19.21% Required: (a) Based on the provided financial statements, calculate IBEX Company's RNOA ratio for the year 2022. (b) Evaluate the company's profitability performance over 2020-2022 periods and compared to the industry average.arrow_forwardWhich of the following best describes horizontal analysis? A comparing a company's financial statements with other companies B calculating key ratios to evaluate performance C comparing financial statement amounts from year to year for the same company D expressing each financial statement amount as a percentage of a budgeted amountarrow_forward

- Assume you are a financial analyst in an investment company, and you are required to analyse and compare the profitability dimensions of Natural Minerals Pty Ltd with the industry average for the year 2019 and 2020. Natural Minerals Pty Ltd Profitability 2020 2019 Industry Average Return on Equity Ratio = 12% 9% 10% Return on Assets Ratio = 26% 22% 24%arrow_forwardItem 20 of 30 Following are the selected ratios for Petron Corp. (an oil and gas exploration company) and Selecta Co. (a dairy products firm) for the year 2020. Which set of ratios belongs to Petron? Why do you think so? Company A Company B Asset turnover ratio 2.15 40 Profit margin 0.04 47arrow_forwardQuestions: 1. Make a comparison for each company based on computed ratio. 2. What is your financial analysis on their overall performance?arrow_forward

- Question 1 Mabel is a potter and sells her pottery at stalls that she rents in four tourist information centres across the south of England. Extracts from her financial statements for the years ended 31 December 2021 and 2020 are shown below. Statement of profit or loss for the year ended 31 December: 2021 28,900 |(16,500) 12,400 (3,800) 8,600 |(4,000) 4,600 2020 Revenue 27,200 (14,000) 13,200 (3,600) 9,600 Cost of sales Gross profit Operating expenses Operating profit Non-operating expenses Net profit 9,600 Statement of financial position as at 31 December: 2021 Non-current assets Current assets Total assets 22,660 4,360 27,020 2020 20,920 3,750 24,670 Equity Non-current liabilities Current liabilities Equity and liabilities 20,940 3,000 3,080 27,020 16,340 3,500 4,830 24,670 The following information is also relevant: In July 2021 the rent on one of Mabel's stalls was increased significantly for the third time in three years so she decided not to renew the annual contract. She sold…arrow_forwardFind the average current ratio for the three following companies Current Ratio 2016 2017 2018 2019 2020 BHP 1.44 1.85 2.51 1.89 1.45 RIO 1.61 1.71 1.98 1.56 1.80 FMG 1.48 1.18 1.33 1.37 2.25arrow_forwardThe comparative financial statements of Global Technology are as follows: Review the worksheet RATIOA that follows these requirements. You have been asked to perform a ratio analysis of this company for 2012.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Projections for Startups Basic Walkthrough; Author: Mike Lingle;https://www.youtube.com/watch?v=7avegQF4dxI;License: Standard youtube license