1.

Prepare

1.

Explanation of Solution

Journal entry:

Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Prepare journal entry to record each transactions of FF as follows:

| Date | Account titles and Explanation | Debit | Credit |

| January 1 | Cash | $100,000 | |

| Notes payable | $100,000 | ||

| (To record issuance of long-term notes payable) | |||

| January 4 | Cash | $31,000 | |

| | $31,000 | ||

| (To record cash received on account) | |||

| January 11 | Accounts payable | $11,000 | |

| Cash | $11,000 | ||

| (To record cash paid on account) | |||

| January 15 | Salaries expense | $28,900 | |

| Cash | $28,900 | ||

| (To record payment of salaries) | |||

| January 30 | Cash | $65,000 | |

| Accounts receivable | $130,000 | ||

| Sales revenue | $195,000 | ||

| (To record inventory sold for cash and on account) | |||

| Cost of goods sold | $112,500 | ||

| Inventory | $112,500 | ||

| (To record cost of inventory sold) | |||

| January 31 | Interest expense | $583 | |

| Notes payable | $1,397 | ||

| Cash | $1,980 | ||

| (To record payment of monthly instalment on long-term note) |

Table (1)

2.

Prepare adjusting entry as on January 31.

2.

Explanation of Solution

Adjusting entries are those entries which are made at the end of the year to update all the balances in the financial statements to show the true financial information and to maintain the records according to accrual basis principle.

Prepare adjusting entry as on January 31.

a.

Prepare adjusting entry to record depreciation expense.

| Date | Account titles and Explanation | Debit | Credit |

| January 31 | Depreciation expenses (1) | $800 | |

| Accumulated depreciation | $800 | ||

| (To record adjusting entry for depreciation expenses) |

Table (2)

Working note:

Calculate depreciation expense.

- Depreciation expense is a component of

stockholders’ equity , and it is increased. Therefore, debit depreciation expense account for $800. - Accumulated depreciation is a contra asset, and it is increased. Therefore, credit accumulated depreciation account for $800.

b.

Prepare adjusting entry to record allowance for uncollectible accounts.

| Date | Account titles and Explanation | Debit | Credit |

| January 31 | $2,300 | ||

| Allowance for uncollectible accounts | $2,300 | ||

| (To adjust estimated uncollectible accounts) |

Table (3)

Working note:

Calculate allowance for uncollectible accounts.

Calculate the remaining accounts receivable.

- Bad debt expense is a component of stockholders’ equity and it is increased. So, debit bad debt expense for $2,300 and,

- Allowance for uncollectible accounts is a contra asset account and it is increased. So, credit allowance for uncollectible accounts for $2,300.

c.

Prepare adjusting entry to record salaries payable.

| Date | Account titles and Explanation | Debit | Credit |

| January 31 | Salaries expense | $26,100 | |

| Salaries payable | $26,100 | ||

| (To adjust salaries payable) |

Table (4)

- Salaries expense is a component of stockholders’ equity, and it is increased. Therefore, debit salaries expense account for $26,100.

- Salaries payable is a current liability, and it is increased. Therefore, credit salaries payable account for $26,100.

d.

Prepare adjusting entry to record income taxes.

| Date | Account titles and Explanation | Debit | Credit |

| January 31 | Income tax expense | $8,000 | |

| Income tax payable | $8,000 | ||

| (To adjust income taxes) |

Table (5)

- Income tax expense is a component of stockholders’ equity, and it is increased. Therefore, debit income tax expense account for $8,000.

- Income tax payable is a current liability, and it is increased. Therefore, credit income tax payable account for $8,000.

3.

Prepare an adjusted trail balance as of January 31, 2021.

3.

Explanation of Solution

Adjusted

Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Prepare an adjusted trail balance as of January 31, 2021

| FF | ||

| Adjusted Trial Balance | ||

| As of December 31, 2021 | ||

| Accounts | Debit | Credit |

| Cash | $165,320 | |

| Accounts Receivable | $133,000 | |

| Allowance for Uncollectible Accounts | $4,100 | |

| Inventory | $39,500 | |

| Land | $67,300 | |

| Buildings | $120,000 | |

| Accumulated Depreciation | $10,400 | |

| Accounts Payable | $6,700 | |

| Salaries Payable | $26,100 | |

| Income Tax Payable | $8,000 | |

| Notes Payable (Current) | $17,411 | |

| Notes Payable (Long-term) | $81,192 | |

| Common Stock | $200,000 | |

| $155,400 | ||

| Sales Revenue | $195,000 | |

| Cost of Goods Sold | $112,500 | |

| Salaries Expense | $55,000 | |

| Bad Debt Expense | $2,300 | |

| Depreciation Expense | $800 | |

| Interest Expense | $583 | |

| Income Tax Expense | $8,000 | |

| Totals | $704,303 | $704,303 |

Table (6)

Working notes:

Calculate adjusted ending balance amount for each accounts.

| Accounts | Ending Balance | Beginning balance, entries during January , and adjusting entries | |

| Cash | $165,320 | = | |

| Accounts Receivable | 133,000 | = | |

| Allow for Uncollectible Accounts | 4,100 | = | |

| Inventory | 39,500 | = | |

| Land | 67,300 | = | 67,300 |

| Buildings | 120,000 | = | 120,000 |

| Accumulated Depreciation | 10,400 | = | |

| Accounts Payable | 6,700 | = | |

| Salaries Payable | 26,100 | = | 26,100 |

| Income Tax Payable | 8,000 | = | 8,000 |

| Notes Payable (Current) | 17,411 | = | 17,411 |

| Notes Payable (Long-term) | 81,192 | = | |

| Common Stock | 200,000 | = | 200,000 |

| Retained Earnings | 155,400 | = | 155,400 |

| Sales Revenue | 195,000 | = | 195,000 |

| Cost of Goods Sold | 112,500 | = | 112,500 |

| Salaries Expense | 55,000 | = | |

| Bad Debt Expense | 2,300 | = | 2,300 |

| Depreciation Expense | 800 | = | 800 |

| Interest Expense | 583 | = | 583 |

| Income Tax Expense | 8,000 | = | 8,000 |

Table (7) (4)

4.

Prepare a multi-step income statement for the period ended as on January 31, 2021.

4.

Explanation of Solution

Prepare a multi-step income statement for the period ended as on January 31, 2021 as follows:

| FF | ||

| Multiple-Step Income Statement | ||

| For the year month ended January 31, 2021 | ||

| Particulars | Amount | Amount |

| Sales revenue | $195,000 | |

| Cost of goods sold | $112,500 | |

| Gross profit | $82,500 | |

| Salaries expense | $55,000 | |

| Bad debt expense | $2,300 | |

| Depreciation expense | $800 | |

| Total operating expenses | $58,100 | |

| Operating income | $24,400 | |

| Interest expense | $583 | |

| Income before taxes | $23,817 | |

| Income tax expense | $8,000 | |

| Net income | $15,817 | |

Table (8)

Therefore, Net income of FF is $15,817.

5.

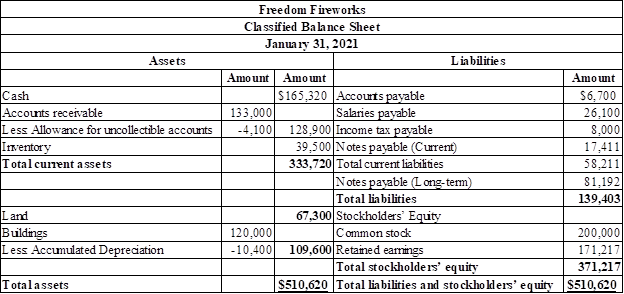

Prepare classified balance sheet as on January 31, 2021.

5.

Explanation of Solution

Prepare classified balance sheet as on January 31, 2021 as follows:

Figure (1)

Working note:

Calculate retained earnings.

6.

Record the closing entries of FF.

6.

Explanation of Solution

Closing entries:

The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare revenue closing entry.

| Date | Account titles and Explanation | Debit | Credit |

| January 31 | Sales revenue | $195,000 | |

| Retained earnings | $195,000 | ||

| (To close revenue accounts) |

Table (9)

- Sales revenue is a component of stockholders’ equity, and it is decreased. Therefore, debit sales revenue account for $195,000.

- Retained earnings are a component of stockholders’ equity, and it is increased. Therefore, credit retained earnings account for $195,000.

Prepare expense closing entry.

| Date | Account titles and Explanation | Debit | Credit |

| January 31 | Retained earnings | $179,183 | |

| Cost of goods sold | $112,500 | ||

| Salaries expense | $55,000 | ||

| Bad debt expense | $2,300 | ||

| Depreciation expense | $800 | ||

| Interest expense | $583 | ||

| Income tax expense | $8,000 | ||

| (To close expense accounts) |

Table (10)

- Retained earnings are a component of stockholders’ equity, and it is decreased. Therefore, debit retained earnings account for $179,183.

- Cost of goods sold is a component of stockholders’ equity, and it is increased. Therefore, credit cost of goods sold account for $112,500.

- Salaries expense is a component of stockholders’ equity, and it is increased. Therefore, credit salaries expense account for $55,000.

- Bad debts expense is a component of stockholders’ equity, and it is increased. Therefore, credit Bad debts expense account for $2,300.

- Depreciation expense is a component of stockholders’ equity, and it is increased. Therefore, credit Depreciation expense account for $800.

- Interest expense is a component of stockholders’ equity, and it is increased. Therefore, credit Interest expense account for $583.

- Income tax expense is a component of stockholders’ equity, and it is increased. Therefore, credit Income tax expense account for $8,000.

7.a.

Calculate debt to equity ratio, and find outout whether the average debt to equity ratio of FF is more or less leveraged than other companies in the same industry, if the industries debt to equity ratio is 1.0.

7.a.

Explanation of Solution

Calculate debt to equity ratio.

FF debt equity ratio (0.38) is less leveraged than the same industry average (1.0). Therefore, FF has lesser proportion of liabilities compares with the stockholders’ equity.

b.

Calculate the times interest earned ratio and find out whether the company has more or less ability to meet interest payments than other companies in the same industry, if the average times interest earned ratio for the same industry is 20 times.

b.

Explanation of Solution

Calculate times interest earned ratio.

FF times interest earned ratio (41.9 times) is more than industry average ratio (20 times). Therefore, FF is more able to meet interest payments than other companies in the same industry.

c.

Ascertain whether FF is likely to receive higher or lower interest rate than the average borrowing rate in the industry.

c.

Explanation of Solution

Based on the debt to equity ratio and the times interest earned ratio, ratio, Freedom Fireworks would more likely receive a lower interest rate than the average borrowing rate in the industry. Freedom Fireworks carries less debt than the industry average and is better able to meet interest payments than the average company in the industry.

Want to see more full solutions like this?

Chapter 9 Solutions

Financial Accounting (Connect NOT Included)

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education