Concept explainers

Recording Daily and

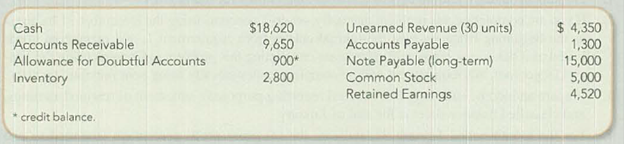

One Trick Pony (OTP) incorporated and began operations near the end of the year, resulting in the following post-closing balances at December 31:

The following information is relevant to the first month of operations in the following year:

- OTP will sell inventory at $145 per unit. OTP’s January 1 inventory balance consists of 35 units at a total cost of $2,800. OTP’s policy is to use the FIFO method, recorded using a perpetual inventory system.

- In December, OTP received a $4,350 payment for 30 units to be delivered in January: this obligation was recorded in Unearned Revenue. Rent of $1,300 was unpaid and recorded in Accounts Payable at December 31.

- OTP’s note payable matures in three years, and accrues interest at a 10% annual rate.

January Transactions

- 1. Included in OTP’s January 1

Accounts Receivable balance is a $1,500 balance due from Jeff Letrotski. Jeff is havingcash flow problems and cannot pay the $1,500 balance at this time. On 01/01, OTP arranges with Jeff to convert the $1,500 balance to a 6-month note, at 12% annual interest. Jeff signs the promissory note, which indicates the principal and all interest will be due and payable to OTP on July 1 of this year. - 2. OTP paid a $500 insurance premium on 01/02, covering the month of January; the payment is recorded directly as an expense.

- 3. OTP purchased an additional 150 units of inventory from a supplier on account on 01/05 at a total cost of $9,000, with terms 2/15, n/30.

- 4. OTP paid a courier $300 cash on 01/05 for same-day delivery of the 150 units of inventory.

- 5. The 30 units that OTP’s customer paid for in advance in December are delivered to the customer on 01/06.

- 6. On 01/07, OTP paid the amount necessary to settle the balance owed to the supplier for the 1/05 purchase of inventory (in 3).

- 7. Sales of 40 units of inventory occuring during the period of 01/07 – 01/10 are recorded on 01/10. The sales terras are 2/10, n/30.

- 8. Collected payments on 01/14 from sales to customers recorded on 01/10. The discount was properly taken by customers on $5,800 of these credit sales: consequently, OTP received less than $5,800.

- 9. OTP paid the first 2 weeks wages to the employees on 01/16. The total paid is $2,200.

- 10. Wrote off a $1,000 customer’s account balance on 01/18. OTP uses the allowance method, not the direct write-off method.

- 11. Paid $2,600 on 01/19 for December and January rent. See the earlier bullets regarding the December portion. The January portion will expire soon, so it is charged directly to expense.

- 12. OTP recovered $400 cash on 01/26 from the customer whose account had previously been written off on 01/18.

- 13. An unrecorded $400 utility bill for January arrived on 01/27. It is due on 02/15 and will be paid then.

- 14. Sales of 65 units of inventory during the period of 01/10–01/28, with terms 2/10, n/30, are recorded on 01/28.

- 15. Of the sales recorded on 1/28, 15 units are returned to OTP on 01/30. The inventor is not damaged and can be resold.

- 16. On 01/31, OTP records the $2,200 employee salary that is owed but will be paid February 1.

- 17. OTP uses the aging method to estimate and adjust for uncollectible accounts on 01/31. All of OTP’s accounts receivable fall into a single aging category, for which 8% is estimated to be uncollectible. (Update the balances of both relevant accounts prior to determining the appropriate adjustment, and round your calculation to the nearest dollar.)

- 18. Accrue interest for January on the note payable on 01/31.

- 19. Accrue interest for January on Jeff Letrotski’s note on 01/31 (see 1).

Required:

- 1. Prepare all January journal entries and adjusting entries for items 1–19.

- 2. If you are completing this problem manually, set up T-accounts using the December 31 balances as the beginning balances,

post the journal entries from requirement 1, and prepare an unadjustedtrial balance at January 31. If you are completing this problem in Connect using the general ledger tool, this requirement will be completed automatically using your previous answers. - 3. Prepare an income statement (for internal reporting purposes), statement of

retained earnings , and classifiedbalance sheet at the end of January. - 4. For the month ended January 31, indicate the (a) gross profit percentage (rounded to one decimal place), (b) number of units in ending inventory, and (c) cost per unit of ending inventory (include dollars and cents).

- 5. If OTP had used the percentage of sales method (using 2% of Net Sales) rather than the aging method, what amounts would OTC’s January financial statements have reported for (a) Bad Debt Expense, and (b) Accounts Receivable, net?

- 6. If OTP had used LIFO rather than FIFO, what amount would OTC have reported for Cost of Goods Sold on 01/10?

- 3. Of the customer account balances shown above on the last page of the aged listing, which should be your highest priority for contacting and pursuing collection?

- 4. Assume Jumpy Jim’s Coffee account is determined to be uncollectible. Prepare the

journal entry to write off the entire account balance.

1.

To prepare: The journal entries and adjusting entries for items 1–19.

Explanation of Solution

Accounts receivable:

Accounts receivable refers to the amounts to be received within a short period from customers upon the sale of goods and services on account. In other words, accounts receivable are amounts customers owe to the business. Accounts receivable is an asset of a business.

Prepare the journal entries and adjusting entries for items 1–19.

| Item | Date | Account Title and Explanation | Debit | Credit |

| 1. | January 1 | Note receivable | $1,500 | |

| Account receivable | $1,500 | |||

| (To record the acceptance of note) | ||||

| 2. | January 2 | Insurance expense | $500 | |

| Cash | $500 | |||

| (To recordthe insurance expense ) | ||||

| 3. | January 5 | Inventory | $9,000 | |

| Accounts payable | $9,000 | |||

| (To recordthe purchase of inventory on account) | ||||

| 4. | January 5 | Inventory | $300 | |

| Cash | $300 | |||

| (To recordthe purchase of inventory on cash) | ||||

| 5. | January 6 | Unearned revenue ($145 per unit×30 units) | $4,350 | |

| Sales revenue | $4,350 | |||

| (To recordthe earned unearned revenue) | ||||

| January 6 | Cost of goods sold ($2,80035 units×30 units delivered) |

$2,400 | ||

| Sales revenue | $2,400 | |||

| (To recordthe cost of goods sold) | ||||

| 6. | January 7 | Accounts payable | $9,000 | |

| Cash ($9,000×98%) | $8,820 | |||

| Inventory ($9,000×2%) | $180 | |||

| (To recordthe settlement of payables) | ||||

| 7. |

January 10 |

Accounts receivable | $5,800 | |

Sales revenue ($145 per unit×40 units) |

$5,800 | |||

| (To recordthe sales provided on account) | ||||

| January 10 | Cost of goods sold {($80×5 units)+(($9,000+$300−$180)150 units×35 units)} |

$2,528 | ||

| Sales revenue | $2,528 | |||

| (To recordthe cost of goods sold) | ||||

| 8. | January 14 | Cash ($5,800×98%) | $5,684 | |

| Sales discount ($5,800×2%) | $116 | |||

| Accounts receivable ($9,000×2%) | $5,800 | |||

| (To recordthe collection of cash on account) | ||||

| 9. | January 16 | Salaries and Wages expense | $2,200 | |

| Cash | $2,200 | |||

| (To recordthe salaries and wages expense) | ||||

| 10. | January 18 | Allowance for doubtful accounts | $1,000 | |

| Accounts receivable | $1,000 | |||

| (To recordthe write off) | ||||

| 11. | January 19 | Accounts payable | $1,300 | |

| Rent expense | $1,300 | |||

| Cash | $2,600 | |||

| (To recordthe payment of rent expense and accounts payable) | ||||

| 12. | January 26 | Accounts receivable | $400 | |

| Allowance for doubtful accounts | $400 | |||

| (To reversethe written off bad debt) | ||||

| January 26 | Cash | $400 | ||

| Accounts receivable | $400 | |||

| (To record the collection of cash on account) | ||||

| 13. | January 27 | Utilities expense | $400 | |

| Accounts payable | $400 | |||

| (To record the accrued utilities expense) | ||||

| 14. |

January 28 |

Accounts receivable | $9,425 | |

Sales revenue ($145 per unit×65 units) |

$9,425 | |||

| (To recordthe sales provided on account) | ||||

| January 28 | Cost of goods sold {($9,000+$300−$180)150 units×65 units} |

$3,952 | ||

| Sales revenue | $3,952 | |||

| (To recordthe cost of goods sold) | ||||

| 15. | January 30 | Sales returns and allowances | $2,175 | |

| Accounts receivable ($145 per unit×15 units) | $2,175 | |||

| (To record the sales returns) | ||||

| January 30 | Inventory | $912 | ||

| Cost of goods sold ($3,95265units×15units) | $912 | |||

| (To record the cost of goods sold) | ||||

| 16. | January 31 | Salaries and Wages expense | $2,200 | |

| Salaries and Wages payable | $2,200 | |||

| (To record the salaries and wages expense) | ||||

| 17. | January 31 | Bad debt expense | $852 | |

| Allowance for doubtful accounts | $852 | |||

| (To record the bad debt expense) | ||||

| 18. | January 31 | Interest expense ($15,000×0.10×112) | $125 | |

| Interest payable | $125 | |||

| (To record the interest expense) | ||||

| 19. | January 31 | Interest receivable ($1,500×0.12×112) | $15 | |

| Interest revenue | $15 | |||

| (To record the interest revenue) | ||||

Table (1)

Working note:

Prepare T-account for accounts receivable.

| Accounts receivable | |||

| Beginning balance | 9,650 | (1) | 1,500 |

| (7) | 5,800 | (8) | 5,800 |

| (12) | 400 | (10) | 1,000 |

| (14) | 9,425 | (12) | 400 |

| (15) | 2,175 | ||

| Balance | 14,400 | ||

Determine the desired ending balance for allowance for doubtful accounts.

Desired ending balance forallowance for doubtful accounts}=[Ending balance of accounts receivable×8% of receivable]=$14,400×8%=$1,152

Now, determine the bad debt expense to be reported on January 31 using T-account for allowance for doubtful accounts.

| Allowance for doubtful accounts | |||

| Beginning balance | 900 | ||

| (10) | 1,000 | (12) | 400 |

| (17) (Balancing figure) | 852 | ||

| Balance | 1,152 | ||

2.

To set up: T-account and post the journal entries and prepare adjusted trial balance.

Explanation of Solution

Adjusted trial balance:

Adjusted trial balance is that statement which contains complete list of accounts with their adjusted balances, after all relevant adjustments have been made. This statement is prepared at the end of every financial period.

Set up T-account and post the journal entries as follows:

| Cash | |||

| Beginning balance | 18,620 | (2) | 500 |

| (8) | 5,684 | (3) | 300 |

| (12) | 400 | (6) | 8,820 |

| (9) | 2,200 | ||

| (11) | 2,600 | ||

| Balance | 10,284 | ||

| Accounts receivable | |||

| Beginning balance | 9,650 | (1) | 1,500 |

| (7) | 5,800 | (8) | 5,800 |

| (12) | 400 | (10) | 1,000 |

| (14) | 9,425 | (12) | 400 |

| (15) | 2,175 | ||

| Balance | 14,400 | ||

| Allowance for doubtful accounts | |||

| Beginning balance | 900 | ||

| (10) | 1,000 | (12) | 400 |

| (17) | 852 | ||

| Balance | 1,152 | ||

| Note receivable | |||

| Beginning balance | 0 | ||

| (1) | 1,500 | ||

| Balance | 1,500 | ||

| Inventory | |||

| Beginning balance | 2,800 | (5) | 2,400 |

| (3) | 9,000 | (6) | 180 |

| (3) | 300 | (7) | 2,528 |

| (15) | 912 | (14) | 3,952 |

| Balance | 3,952 | ||

| Interest receivable | |||

| Beginning balance | 0 | ||

| (19) | 15 | ||

| Balance | 15 | ||

| Unearned revenue | |||

| Beginning balance | 4,350 | ||

| (5) | 4,350 | ||

| Balance | 0 | ||

| Accounts payable | |||

| (6) | 9,000 | Beginning balance | 1,300 |

| (11) | 1,300 | (4) | 9,000 |

| (13) | 400 | ||

| Balance | 400 | ||

| Note payable | |||

| Beginning balance | 15,000 | ||

| Balance | 15,000 | ||

| Salaries and wages payable | |||

| Beginning balance | 0 | ||

| (16) | 2,200 | ||

| Balance | 2,200 | ||

| Interest payable | |||

| Beginning balance | 0 | ||

| (18) | 125 | ||

| Balance | 125 | ||

| Common stock | |||

| Beginning balance | 5,000 | ||

| Balance | 5,000 | ||

| Retained earnings | |||

| Beginning balance | 4,520 | ||

| Balance | 4,520 | ||

| Interest revenue | |||

| Beginning balance | 0 | ||

| (19) | 15 | ||

| Balance | 15 | ||

| Sales revenue | |||

| Beginning balance | 0 | ||

| (5) | 4,350 | ||

| (7) | 5,800 | ||

| (14) | 9,425 | ||

| Balance | 19,575 | ||

| Cost of goods sold | |||

| Beginning balance | 0 | ||

| (5) | 2,400 | ||

| (7) | 2,528 | ||

| (14) | 3,952 | ||

| Balance | 7,968 | ||

| Sales discount | |||

| Beginning balance | 0 | ||

| (8) | 116 | ||

| Balance | 116 | ||

| Sales returns/Allowance | |||

| Beginning balance | 0 | ||

| (15) | 2,175 | ||

| Balance | 2,175 | ||

| Bad debt expense | |||

| Beginning balance | 0 | ||

| (17) | 852 | ||

| Balance | 852 | ||

| Utilities expense | |||

| Beginning balance | 0 | ||

| (13) | 400 | ||

| Balance | 400 | ||

| Interest expense | |||

| Beginning balance | 0 | ||

| (18) | 125 | ||

| Balance | 125 | ||

| Insurance expense | |||

| Beginning balance | 0 | ||

| (2) | 500 | ||

| Balance | 500 | ||

| Rent expense | |||

| Beginning balance | 0 | ||

| (11) | 1,300 | ||

| Balance | 1,300 | ||

| Salaries and Wages expense | |||

| Beginning balance | 0 | ||

| (9) | 2,200 | ||

| (16) | 2,200 | ||

| Balance | 4,400 | ||

Prepare adjusted trial balance for Company OTP as follows:

| Company OTP | ||

| Adjusted trial balance | ||

| January 31 | ||

| Account Titles | Debit | Credit |

| Cash | $10,284 | |

| Accounts Receivable | 14,400 | |

| Allowance for Doubtful Accounts | $1,152 | |

| Inventory | 3,952 | |

| Note Receivable | 1,500 | |

| Interest Receivable | 15 | |

| Unearned Revenue | 0 | |

| Accounts Payable | 400 | |

| Salaries and Wages Payable | 2,200 | |

| Interest Payable | 125 | |

| Note Payable | 15,000 | |

| Common Stock | 5,000 | |

| Retained Earnings | 4,520 | |

| Sales Revenue | 19,575 | |

| Sales Returns and Allowances | 2,175 | |

| Sales Discounts | 116 | |

| Cost of Goods Sold | 7,968 | |

| Salaries and Wages Expense | 4,400 | |

| Rent Expense | 1,300 | |

| Bad Debt Expense | 852 | |

| Insurance Expense | 500 | |

| Utilities Expense | 400 | |

| Interest Expense | 125 | |

| Interest Revenue | 15 | |

| Totals | $47,987 | $47,987 |

Table (2)

3.

To prepare: An income statement, retained earnings statement and balance sheet for the month ended January 31.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for Company OTP as follows:

| Company OTP | |

| Income Statement | |

| For the Month Ended January 31 | |

| Particulars | Amount |

| Sales Revenue | $19,575 |

| Sales Returns and Allowances | -2,175 |

| Sales Discounts | -116 |

| Net Sales | 17,284 |

| Cost of Goods Sold | 7,968 |

| Gross Profit | 9,316 |

| Salaries and Wages Expense | 4,400 |

| Rent Expense | 1,300 |

| Bad Debt Expense | 852 |

| Insurance Expense | 500 |

| Utilities Expense | 400 |

| Income from Operations | 1,864 |

| Interest Revenue (Expense), net | -110 |

| Net Income | $1,754 |

Table (3)

Statement of Retained Earnings: Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

Prepare the statement of retained earnings for Company OTP as follows:

| Company OTP | |

| Statement of Retained Earnings | |

| For the Month Ended January 31 | |

| Particulars | Amount |

| Balance, January 1 | $ 4,520 |

| Add: Net Income | 1,754 |

| Less: Dividends | 0 |

| Balance, December 31 | $ 6,274 |

Table (4)

Balance Sheet: Balance Sheet summarizes the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare balance sheet for Company OTP as follows:

| Company OTP | |

| Balance Sheet | |

| At December 31 | |

| Assets | Amount |

| Current Assets: | |

| Cash | $10,284 |

| Accounts Receivable | 14,400 |

| Allowance for Doubtful Accounts | -1,152 |

| Inventory | 3,952 |

| Note Receivable | 1,500 |

| Interest Receivable | 15 |

| Total Assets | $28,999 |

| Liabilities and Stockholders’ Equity | Amount |

| Liabilities | |

| Current Liabilities: | |

| Accounts Payable | $400 |

| Salaries and Wages Payable | 2,200 |

| Interest Payable | 125 |

| Total Current Liabilities | 2,725 |

| Note Payable | 15,000 |

| Total Liabilities | 17,725 |

| Stockholders’ Equity | |

| Common Stock | 5,000 |

| Retained Earnings | 6,274 |

| Total Stockholders’ Equity | 11,274 |

| Total Liabilities and Stockholders’ Equity | $28,999 |

Table (5)

4. (a)

To calculate: The gross profit percentage.

Explanation of Solution

Calculate the gross profit percentage as follows:

Gross profit percentage = Gross profitNet sales×100=$9,316$17,284×100=0.539×100=53.9%

Thus, the gross profit percentage is 53.9%.

4. (b)

To calculate: The number of units in ending inventory.

Explanation of Solution

Calculate the number of units in ending inventory as follows:

| Particulars | Number of units |

| Inventory as of January 1 | 35 |

| Add: Inventory purchased on January 5 | 150 |

| Less: Inventory sold on January 6 | -30 |

| Less: Inventory sold on January 10 | -40 |

| Less: Inventory sold on January 28 | -65 |

| Add: Inventory returned on January 30 | 15 |

| Number of units on hand as of January 31 | 65 |

Thus, the number of units in ending inventory as of January 31 is 65 units.

4. (c)

To calculate: Cost per unit of ending inventory.

Explanation of Solution

Calculate the cost per unit of ending inventory as follows:

Cost per unit of ending inventory = Inventory as of January 31Number of units in ending inventory=$9,31665 units×100= $60.80 per unit

Hence, the cost per unit of ending inventory is $60.80 per unit.

5.

Explanation of Solution

Bad debt expense:

Bad debt expense is an expense account. The amounts of loss incurred from extending credit to the customers are recorded as bad debt expense. In other words, the estimated uncollectible accounts receivable are known as bad debt expense.

Calculate the amount of bad debt expense.

Bad debt expense = Net sales×2% of sales=$17,284×2%=$346

Therefore, Company OTP would have reported $346 as bad debt expense if it uses percentage of sales method.

Calculate the amount of accounts receivable, net.

Prepare T-account for allowance for doubtful accounts according calculated bad debts based on percentage of credit sales method.

| Allowance for doubtful accounts | ||||

| Beginning balance | 900 | |||

| (10) | 1,000 | (12) | 400 | |

| Bad debt expense | 346 | |||

| Balance | 646 | |||

Now, calculate the accounts receivable, net.

Accounts receivable, net =[Accounts receivable−Allowance for doubtful accounts]=$14,400−$646=$13,754

Therefore, Company OTP would have reported $13,754 as accounts receivable, net, if it uses percentage of sales method.

6.

Explanation of Solution

IF Company OTP uses LIFO (Last-In First Out) instead of FIFO (First-In First Out), then it would have used the cost of goods that was acquired in recent times to calculate the cost of goods sold.

For January 10, the most recently purchased goods is $9,000 of 150 units on January 5, however the cost of goods sold is changed later due to the cost of freight and purchase discount, which is calculated as follows:

| Cost of goodssold | |

| Purchase value of goods | $9,000 |

| Add: Freight-in | $300 |

| Less: Purchase discount | –$180 |

| Cost of goods sold | $9,120 |

These 150 units cost is $9,120, and whose cost per unit is ($9,120150 units) $60.80.

Thus, at a LIFO unit cost of $60.80, the 40 units sold on January 10 would have produced a cost of goods sold of ($60.80×40 units)$2,432.

Thus, at a LIFO unit cost of $60.80, the 40 units sold on January 10 would have produced a cost of goods sold of $2,432.

Want to see more full solutions like this?

Chapter 8 Solutions

Fundamentals of Financial Accounting

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning