Concept explainers

Aging of receivables; estimating allowance for doubtful accounts

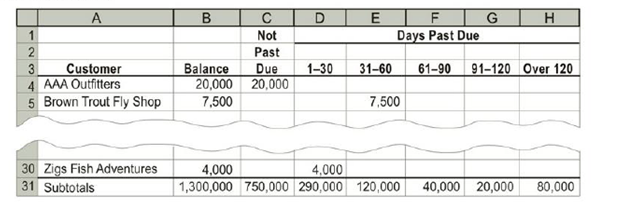

Trophy Fish Company supplies flies and fishing gear to sporting goods stores and outfitters throughout the western United States. The

The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Wolfe Sports, which is due in the next year.

| Customer | Due Date | Balance |

| Adams Sports & Flies | May 22 | $5,000 |

| Blue Dun Flies | Oct. 10 | 4,900 |

| Cicada Fish Co. | Sept. 29 | 8,400 |

| Deschutes Sports | Oct. 20 | 7,000 |

| Green River Sports | Nov. 7 | 3,500 |

| Smith River Co. | Nov. 28 | 2,400 |

| Western Trout Company | Dec. 7 | 6,800 |

| Wolfe Sports | Jan. 20 | 4,400 |

Trophy Fish has a past history of uncollectible accounts by age category, as follows:

| Age Class | Percent Uncollectible |

| Not past due | 1% |

| 1-30 days past due | 2 |

| 31-60 days past due | 10 |

| 61-90 days past due | 30 |

| 91-120 days past due | 40 |

| Over 120 days past due | 80 |

Instructions

- 1. Determine the number of days past due for each of the preceding accounts.

- 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.

- 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule.

- 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $3,600 before adjustment on December 31. Journalize the

adjusting entry for uncollectible accounts. - 5. Assume that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the

balance sheet and income statement?

Trending nowThis is a popular solution!

Chapter 8 Solutions

Financial & Managerial Accounting

Additional Business Textbook Solutions

Accounting Information Systems (14th Edition)

Essentials of MIS (13th Edition)

MARKETING:REAL PEOPLE,REAL CHOICES

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

- Subject: general Accountingarrow_forwardHow much will you accumulated after 35 year?arrow_forwardOn a particular date, FedEx has a stock price of $89.27 and an EPS of $7.11. Its competitor, UPS, had an EPS of $0.38. What would be the expected price of UPS stock on this date, if estimated using the method of comparables? A) $4.77 B) $7.16 C) $9.54 D) $10.50arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning