Fundamental Accounting Principles

23rd Edition

ISBN: 9781259536359

Author: John J Wild, Ken Shaw Accounting Professor, Barbara Chiappetta Fundamental Accounting Principles

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 5QS

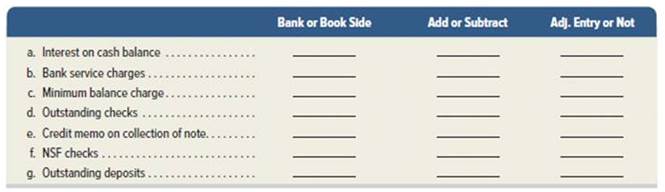

Bank reconciliation

P3

For each of the following items a through g, indicate whether its amount (1) affects the bank or book side of a bank reconciliation, (2) represents an addition or a subtraction in a bank reconciliation, and (3) requires an

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the break even point in sales provide answer general accounting

Financial Accounting

On January 1, 2024, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a four-year period ending December 31,

2027, at which time possession of the leased asset will revert back to Aqua.

• The equipment cost Aqua $423,414 and has an expected economic life of five years.

Aqua and Maywood expect the residual value at December 31, 2027, to be $60,000.

Negotiations led to Maywood guaranteeing a $85,000 residual value.

• Equal payments under the lease are $120,000 and are due on December 31 of each year with the first payment being made on

December 31, 2024.

Maywood is aware that Aqua used a 7% interest rate when calculating lease payments.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Required:

1. & 2. Prepare the appropriate entries for Maywood on January 1, 2024 and December 31, 2024, related to the lease.

Note: If no entry is required for a transaction/event, select "No journal entry required" in…

Chapter 8 Solutions

Fundamental Accounting Principles

Ch. 8 - Prob. 1DQCh. 8 - Prob. 2DQCh. 8 - Prob. 3DQCh. 8 - Prob. 4DQCh. 8 - Prob. 5DQCh. 8 - Prob. 6DQCh. 8 - Prob. 7DQCh. 8 - Prob. 8DQCh. 8 - Prob. 9DQCh. 8 - Prob. 10DQ

Ch. 8 - Prob. 11DQCh. 8 - Prob. 12DQCh. 8 - Prob. 13DQCh. 8 - Prob. 1QSCh. 8 - Prob. 2QSCh. 8 - Prob. 3QSCh. 8 - Prob. 4QSCh. 8 - Bank reconciliation P3 For each of the following...Ch. 8 - Prob. 6QSCh. 8 - Prob. 7QSCh. 8 - Prob. 8QSCh. 8 - Prob. 9AQSCh. 8 - International accounting and internal controls C1...Ch. 8 - Prob. 1ECh. 8 - Prob. 2ECh. 8 - Prob. 3ECh. 8 - Prob. 4ECh. 8 - Prob. 5ECh. 8 - Prob. 6ECh. 8 - Prob. 7ECh. 8 - Prob. 8ECh. 8 - Prob. 9ECh. 8 - Prob. 10ECh. 8 - Prob. 11ECh. 8 - Prob. 12ECh. 8 - Prob. 13AECh. 8 - Prob. 1APSACh. 8 - Prob. 2APSACh. 8 - Prob. 3APSACh. 8 - Prob. 4APSACh. 8 - Prob. 5APSACh. 8 - Prob. 1BPSBCh. 8 - Prob. 2BPSBCh. 8 - Prob. 3BPSBCh. 8 - Prob. 4BPSBCh. 8 - Prob. 5BPSBCh. 8 - Prob. 8SPCh. 8 - Prob. 1GLPCh. 8 - Prob. 1BTNCh. 8 - Prob. 2BTNCh. 8 - Prob. 3BTNCh. 8 - Prob. 4BTNCh. 8 - Prob. 5BTNCh. 8 - Prob. 6BTNCh. 8 - Prob. 7BTNCh. 8 - Prob. 8BTNCh. 8 - Prob. 9BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License