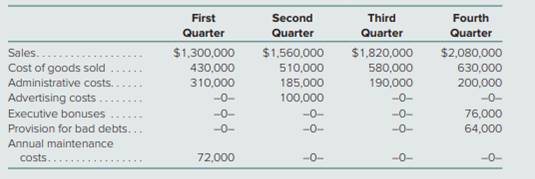

Noventis Corporation prepared the following estimates for the four quarters of the current year:

Additional Information

• First-quarter administrative costs include the $160,000 annual insurance premium.

• Advertising costs paid in the second quarter relate to television advertisements that will be broadcast throughout the entire year.

• No special items affect income during the year.

• Noventis estimates an effective income tax rate for the year of 40 percent.

a. Assuming that actual results do not vary from the estimates provided, determine the amount of net income to be reported each quarter of the current year.

b. Assume that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent. Determine the amount of net income to be reported each quarter of the current year.

a.

Determine the amount of net income to be reported each quarter of the current year assuming that actual results do not vary from the estimates provided.

Answer to Problem 39P

The amount of net income to be reported each quarter of the current year assuming that actual results do not vary from the estimates provided is $361200, $448,200, $559,200, $679,200 respectively.

Explanation of Solution

Amount of net income to be reported each quarter of the current year:

| Particulars | First quarter | Second quarter | Third quarter | Fourth quarter |

| Sales | $ 1,300,000 | $ 1,560,000 | $ 1,820,000 | $ 2,080,000 |

| Less: | ||||

| Cost of goods sold | $ 430,000 | $ 510,000 | $ 580,000 | $ 630,000 |

| Administrative costs | $ 190,000 | $ 225,000 | $ 230,000 | $ 240,000 |

| Advertising costs | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Executive bonuses | $ 19,000 | $ 19,000 | $ 19,000 | $ 19,000 |

| Provision for bad debts | $ 16,000 | $ 16,000 | $ 16,000 | $ 16,000 |

| Annual maintenance costs | $ 18,000 | $ 18,000 | $ 18,000 | $ 18,000 |

| Pre-tax income | $ 602,000 | $ 747,000 | $ 932,000 | $ 1,132,000 |

| Less: Income tax | $ 240,800 | $ 298,800 | $ 372,800 | $ 452,800 |

| Net income | $ 361,200 | $ 448,200 | $ 559,200 | $ 679,200 |

Table: (1)

Working note

Calculate insurance premium per quarter

Thus, insurance premium per quarter is $40,000

Calculate administrative expenses for the first quarter

Thus, administrative expenses for the first quarter is $190,000

Insurance premium per quarter is added to the administrative expenses estimates given.

Advertising costs estimates are equally distributed in the four quarters.

Executive bonuses are equally distributed in four quarters.

Provision for bad debts is equally distributed in four quarters.

Annual maintenance costs are equally distributed in four quarters.

b.

Determine the amount of net income to be reported each quarter of the current year assuming that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent.

Answer to Problem 39P

The amount of net income to be reported each quarter of the current year assuming that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent is $361200, $448,200, $577,840, $701,840 respectively.

Explanation of Solution

Amount of net income to be reported each quarter of the current year:

| Particulars | First quarter | Second quarter | Third quarter | Fourth quarter |

| Sales | $ 1,300,000 | $ 1,560,000 | $ 1,820,000 | $ 2,080,000 |

| Less: | ||||

| Cost of goods sold | $ 430,000 | $ 510,000 | $ 580,000 | $ 630,000 |

| Administrative costs | $ 190,000 | $ 225,000 | $ 230,000 | $ 240,000 |

| Advertising costs | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Executive bonuses | $ 19,000 | $ 19,000 | $ 19,000 | $ 19,000 |

| Provision for bad debts | $ 16,000 | $ 16,000 | $ 16,000 | $ 16,000 |

| Annual maintenance costs | $ 18,000 | $ 18,000 | $ 18,000 | $ 18,000 |

| Pre-tax income | $ 602,000 | $ 747,000 | $ 932,000 | $ 1,132,000 |

| Less: Income tax | $ 240,800 | $ 298,800 | $ 354,160 | $ 430,160 |

| Net income | $ 361,200 | $ 448,200 | $ 577,840 | $ 701,840 |

Table: (2)

Income tax rate is 40 percent for first and second quarter and it has changed to 38 percent in the third and fourth quarter.

Want to see more full solutions like this?

Chapter 8 Solutions

Advanced Accounting - Standalone book

- GHI Company expects to earn P10,000 pre-tax profit in each of the 1st and 2nd quarters of the year and P15,000 pre-tax profit in each of the last two quarters. The tax rate as of the beginning of the year is 20%. However, following a newly enacted tax legislation, the tax rate will be increased to 30% which shall take effect beginning on the last quarter of the year. Actual earnings match expectations. Compute for income tax expense for the 2nd quarter of the year.arrow_forwardAbitz Corporation has the following pretax operating income in its first three quarters of 20X5. The effective tax rate for each quarter is provided. Determine the third quarter income tax or benefit. Current Effective Quarter First Period $40,000 (25,000) 50,000 Tax Rate 25% Second 25% Third 30% a. $3,750 b. $15,000 c. $15,750 d. $20,000arrow_forwardIn its first year of operations, Seagate Tech reported pretax accounting income of $780 million for the current year. Depreciation reported in the tax return in excess of depreciation in the income statement was $900 million. The excess tax will reverse itself evenly over the next three years. The current year's tax rate of 25% will be reduced under the current law to 30% next year and 35% for all subsequent years. At the end of the current year, the deferred tax liability related to the excess depreciation will be: Multiple Choice $315 million. $300 million. $270 million. $360 million.arrow_forward

- This is a multiple answer question. Babcock Company just completed its first year of operations and has a net operating loss for tax purposes of $100,000. Babcock expects to be profitable within the next two years. The enacted tax rate is 40%. Which of the following components are included in the journal entry to record the NOL carryforward? (Choose all that apply) A. credit taxes payable $40,000 B. debit income tax expense $40,000 C. credit income tax expense $40,000 D.debit deferred tax asset $40,000 E. credit deferred tax liability $40,000arrow_forwardCee Co.s fiscal year begins April 1. At the beginning of its fiscal year, Cee Co. estimates that it will owe 17,400 in property taxes for the year. On June 1, its property taxes are assessed at 17,000, which it pays immediately. Prepare the related journal entries for April 1, May 1, and June 1. Then compute the monthly property tax expense that Cee Co. would record during June through March.arrow_forwardAt the end of the year, a deductible temporary difference of $40 million has been recognised due to the difference between the carrying amount of a liability account for estimated expenses and its tax base. Taxable income is $50 million. No temporary differences existed at the beginning of the year, and the tax rate is 35%. Required: a. Prepare the journal entry(s) to record income taxes during the period. b.How much will income tax expense be shown in the income statement? c. What will be the balance sheet disclosure during the period regarding taxes?arrow_forward

- At the end of the year, a deductible temporary difference of $40 million has been recognised due to the difference between the carrying amount of a liability account for estimated expenses and its tax base. Taxable income is $50 million. No temporary differences existed at the beginning of the year, and the tax rate is 35%. Required: a. Prepare the journal entry(s) to record income taxes during the period. b.How much will income tax expense be shown in the income statement? c.arrow_forwardA contractor with an effective tax rate of 35% has the following for a tax year: gross income of $155,000, other income of $4000, expenses of $45,000, and other deductions and exemptions of $12,000. The income tax due is closest to:a. $35,700b. $42,700c. $51,750d. $55,750arrow_forwardEntity A publishes quarterly interim financial reports. Entity A’s annual depreciation for items of PPE is P120,000. At the end of the first quarter, Entity A’s inventories have a cost of P600,000 and a net realizable value of P510,000. Entity A expects that the total employee bonuses (13th month pay) that will be paid at year-end will amount to P60,000. How much is the total amount of expense to be recognized from the items described above in Entity A’s first quarter statement of profit or loss?arrow_forward

- Required: 1. Determine the amounts necessary to record Allmond's income taxes for 20: Allmond Corporation, organized on January 3, 2021, had pretax accounting income of $25 million and taxable income of $33 million 2. What is Allmond's 2021 net income? for the year ended December 31, 2021. The 2021 tax rate is 25%. The only difference between accounting income and taxable income is estimated product warranty costs. Assume that expected payments and scheduled tax rates (based on recently enacted tax legislation) are as follows: Complete this question by entering your answers in the tabs below. Required 1 Calculation Required 1 GJ Required 2 Prepare the appropriate journal entry. (If no entry is required for a transaction/e account field. Enter your answers in millions rounded to 2 decimal places (i.e., 5 View transaction list 1 Record 2021 income taxes. X Cr 2022 2023 2024 2025 $2 million 2 million 1 million 3 million 35% 35% 35% 25% Required: 1. Determine the amounts necessary to…arrow_forwardFor the current year, LNS corporation reported the following taxable income at the end of its first, second, and third quarters. Quarter-End First Second Third What are LNS's minimum first-, second-, third-, and fourth-quarter estimated tax payments, using the annualized income method? Note: Enter all amounts as positive values. Leave no answer blank. Enter zero if applicable. Round "Annualization Factor" for Fourth quarter to 7 places. Round other intermediate computations and final answers to the nearest whole dollar amount. Installment First quarter Second quarter Cumulative Taxable Income $ 1,000,000 1,600,000 2,400,000 Third quarter Fourth quarter Taxable Income Annualization Factor Annual Estimated Taxable Income $ $ $ $ 0 0 0 0 Tax on Estimated Taxable Income Percentage of Tax Required to be Paid Required Cumulative Payment % $ |% $ % $ % $ 0 0 0 0 Prior Cumulative Payments Required Estimated Tax Paymentarrow_forwardThe following information relates to Fountain Designs Limited.1. Pretax financial income for 2020 is $100,000.2. The tax rate enacted for 2020 and future years is 40%3. Differences between the 2020 income statement and tax return are listed below:a. Warranty expense accrued for financial reporting purposes amounts to $7,000. Warranty deductionsper the tax return amount to $2,000.b. Income on construction contracts using the percentage to completion method per books amounts to$92,000. Income on construction contracts for tax purposes amounts to $67,000.c. Depreciation of property, plant and equipment for financial reporting purposes amounts to $60,000.Depreciation of these assets amounts to $80,000 for the tax return.d. A $3,500 fine paid for violation of pollution laws was deducted in computing pretax financial income.e. Interest revenue recognized on an investment in tax-exempt bonds amounts to $1,500.4. Taxable income is expected for the next few years. a. Computer taxable income for…arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning