On September 30, 2013, the general ledger of Leonʼs Golf Shop, which uses the calendar year as its accounting period, showed the following year-to-date account balances:

The merchandise inventory account had a $48,000 balance on January 1, 2013. The historical gross profit percentage is 40%.

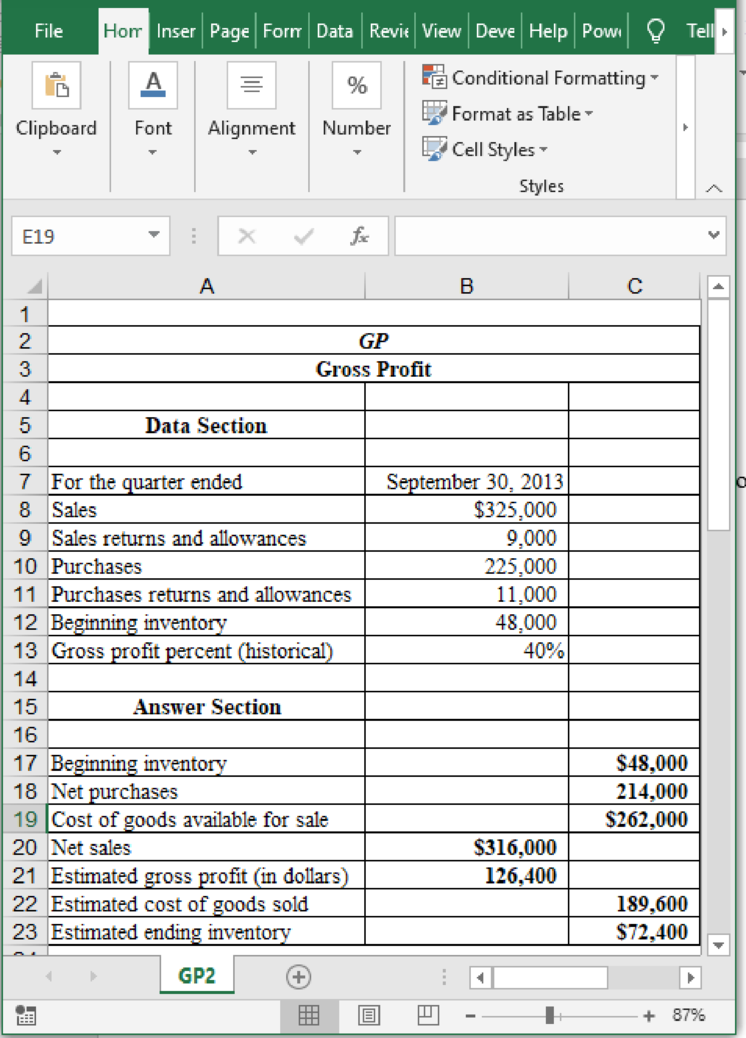

Leon prepares quarterly financial statements and takes physical inventory once a year–at the end of the accounting period. In order to prepare the financial statements for the third quarter, the store needs to have an estimate of ending inventory. You have been asked to use the gross profit method to estimate the ending inventory. Review the worksheet called GP. Study it carefully because it may have a solution format somewhat different from the one shown in your textbook.

Compute the ending inventory using the gross profit method.

Explanation of Solution

Compute the ending inventory using the gross profit method:

Table (1)

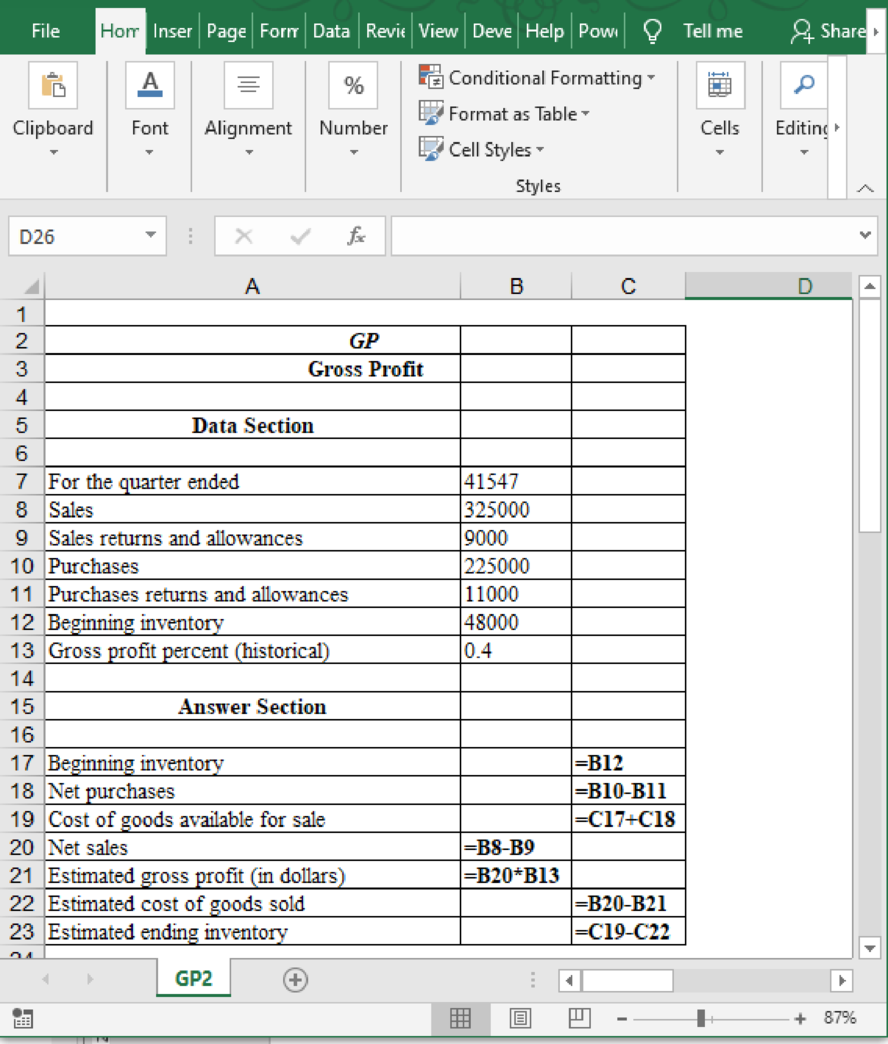

The formulae used in the table are given below:

Want to see more full solutions like this?

Chapter 8 Solutions

Excel Applications for Accounting Principles

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning