PRINCIPLES OF TAXATION F/BUS...(LL)

23rd Edition

ISBN: 9781260433197

Author: Jones

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 1QPD

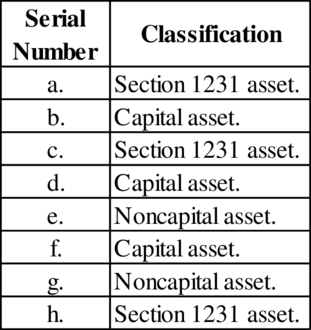

BBB Company, which manufactures industrial plastics, owns the following assets. Characterize each asset as either a capital, ordinary, or Section 1231 asset.

- a. A computer system used in BBB’s main office.

- b. A 50 percent interest in a business

partnership organized to conduct a mining operation in Utah. - c. Heavy equipment used to mold BBB’s best-selling plastic item.

- d. BBB’s customer list developed over 12 years of business.

- e. BBB’s inventory of raw materials used in the manufacturing process.

- f. An oil painting of BBB’s founder and first president that hangs in the boardroom. The painting was commissioned by the company from a local artist and paid for in cash.

- g. A patent developed by BBB’s research and development department.

- h. BBB’s company airplane.

Expert Solution & Answer

To determine

Characterize each asset as either a capital, ordinary or section 1231 asset.

Explanation of Solution

Characterize each asset as either a capital, ordinary or section 1231 asset.

Figure (1)

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Orioles Construction & Paving expanded its business by purchasing Alcott Maintenance, a division that provides road maintenance services. The division was purchased three years ago for $3,130,000 and has been identified as a reporting unit. The net assets for the division including goodwill are as follows:

Cash

$229,000

Accounts Receivables

295,000

Inventory

767,000

Property, Plant & Equipment

898,000

Goodwill

1,307,000

Accounts Payable

(137,000

)

Unearned Revenue

(70,000

)

Net assets, at carrying amounts

$3,289,000

The fair value of the Alcott Maintenance Division reporting unit as a whole is estimated to be $3,008,000. Management determines that the unit’s value in use is $3,117,000.

Prepare any appropriate journal entries for goodwill impairment assuming that Oriole Construction & Paving is reporting under ASPE. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.…

Smithson Exploration Corporation was formed on January 1, 20X3. The company was formed by

Cliff Smithson with the goal of conducting geophysical support services related to natural gas drilling

operations in the Unita Basin region of eastern Utah. The company's initial capitalization consisted of

shareholder investments of $2,000,000 and an additional bank loan of $1,500,000.

During the first year of operation, the company purchased land, buildings, and equipment in the amount

of $400,000, $1,000,000, and $600,000, respectively. (Hint: In subsequent chapters you will be introduced

to the concepts of depreciation relating to certain of these assets; for now you may ignore this issue).

During 20X3, the company signed contracts to deliver consulting services with a total value of $5,000,000.

By year's end, $3,200,000 of services had been provided and billed under these agreements. The other

$1,800,000 of work will not be performed until 20X4. All amounts billed had been collected during…

M

Starn Tool & Manufacturing Company, located in Meadville, PA, provides component machining for robotics, drones, vision systems,

and special machines and assemblies for the aerospace, military, commercial, automotive, and medical Industries. Assume the

company has five different intangible assets to be accounted for and reported on the financial statements. The management is

concerned about the amortization of the cost of each of these intangibles. Facts about each Intangible follow.

a. Patent. The company purchased a patent for a new tool at a cash cost of $71,500 on January 1, 2023. The patent has an estimated

useful life of 13 years.

b. Copyright. On January 1, 2023, the company purchased a copyright for $28,500 cash. It is estimated that the copyrighted Item will

have no value by the end of 10 years.

c. Franchise. The company obtained a franchise from H & H Tool Company to make and distribute a special item for the automotive

Industry. It obtained the franchise on January 1,…

Chapter 8 Solutions

PRINCIPLES OF TAXATION F/BUS...(LL)

Ch. 8 - BBB Company, which manufactures industrial...Ch. 8 - Prob. 2QPDCh. 8 - Prob. 3QPDCh. 8 - Prob. 4QPDCh. 8 - Does the characterization of gain or loss as...Ch. 8 - Distinguish between a firms tax basis in an asset...Ch. 8 - Both Corporation A and Corporation Z have business...Ch. 8 - Mrs. Carly called her accountant with a question....Ch. 8 - Prob. 9QPDCh. 8 - Mr. K realized a loss on the sale of an asset to...

Ch. 8 - Prob. 11QPDCh. 8 - Prob. 12QPDCh. 8 - Prob. 13QPDCh. 8 - Prob. 14QPDCh. 8 - Prob. 1APCh. 8 - Several years ago, PTR purchased business...Ch. 8 - Prob. 3APCh. 8 - Prob. 4APCh. 8 - Prob. 5APCh. 8 - Prob. 6APCh. 8 - TPW, a calendar year taxpayer, sold land with a...Ch. 8 - Refer to the facts in the preceding problem and...Ch. 8 - Refer to the facts in problem 7. In the first year...Ch. 8 - Prob. 10APCh. 8 - Prob. 11APCh. 8 - In year 1, Aldo sold investment land with a 61,000...Ch. 8 - Prob. 13APCh. 8 - Prob. 14APCh. 8 - Silo Inc. sold investment land to PPR Inc. for...Ch. 8 - Prob. 16APCh. 8 - Prob. 17APCh. 8 - Prob. 18APCh. 8 - Shenandoah Skies is the name of an oil painting by...Ch. 8 - Koil Corporation generated 718,400 ordinary income...Ch. 8 - Prob. 21APCh. 8 - Alto Corporation sold two capital assets this...Ch. 8 - Zeno Inc. sold two capital assets in 2019. The...Ch. 8 - Prob. 24APCh. 8 - Prob. 25APCh. 8 - Firm OCS sold business equipment with a 20,000...Ch. 8 - Prob. 27APCh. 8 - Prob. 28APCh. 8 - This year, QIO Company generated 192,400 income...Ch. 8 - Prob. 30APCh. 8 - Prob. 31APCh. 8 - Since its formation, Roof Corporation has incurred...Ch. 8 - Corporation Q, a calendar year taxpayer, has...Ch. 8 - Prob. 34APCh. 8 - Firm P, a noncorporate taxpayer, purchased...Ch. 8 - Prob. 36APCh. 8 - Prob. 37APCh. 8 - Prob. 38APCh. 8 - A taxpayer owned 1,000 shares of common stock in...Ch. 8 - Prob. 40APCh. 8 - Prob. 41APCh. 8 - Prob. 42APCh. 8 - Prob. 43APCh. 8 - A fire recently destroyed a warehouse owned by...Ch. 8 - Prob. 45APCh. 8 - Bali Inc. reported 605,800 net income before tax...Ch. 8 - Prob. 47APCh. 8 - Prob. 48APCh. 8 - Prob. 49APCh. 8 - Prob. 1IRPCh. 8 - Prob. 2IRPCh. 8 - Prob. 3IRPCh. 8 - Prob. 4IRPCh. 8 - Prob. 5IRPCh. 8 - Prob. 6IRPCh. 8 - Firm WD sold depreciable realty for 225,000. The...Ch. 8 - Prob. 8IRPCh. 8 - Prob. 9IRPCh. 8 - Prob. 10IRPCh. 8 - Prob. 11IRPCh. 8 - For the past 12 years, George Link has operated...Ch. 8 - Prob. 2RPCh. 8 - Prob. 3RPCh. 8 - Prob. 4RPCh. 8 - Firm Z, a corporation with a 21 percent tax rate,...Ch. 8 - Mr. RH purchased 30 acres of undeveloped ranch...Ch. 8 - Prob. 3TPCCh. 8 - Prob. 4TPCCh. 8 - Prob. 5TPC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Orioles Construction & Paving expanded its business by purchasing Alcott Maintenance, a division that provides road maintenance services. The division was purchased three years ago for $3,130,000 and has been identified as a reporting unit. The net assets for the division including goodwill are as follows: Cash $229,000 Accounts Receivables 295,000 Inventory 767,000 Property, Plant & Equipment 898,000 Goodwill 1,307,000 Accounts Payable (137,000 ) Unearned Revenue (70,000 ) Net assets, at carrying amounts $3,289,000 The fair value of the Alcott Maintenance Division reporting unit as a whole is estimated to be $3,008,000. Management determines that the unit’s value in use is $3,117,000. Prepare any appropriate journal entries for goodwill impairment assuming that Oriole Construction & Paving is reporting under ASPE. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.…arrow_forwardDalmatian Corp. follows IFRS and had the following transactions during its year ended December 31: Spent $135,000 developing its brand. Incurred development costs of $254,000 for a new product that met all the intangible asset recognition criteria on September 30 of that same year. Of the $254,000 spent, $160,000 was incurred after September 30. Purchased a customer list for $89,000 from a competitor that was closing its business. What is the total cost of intangible assets that were capitalized during 2020?arrow_forwardWhat is the total amount that Bryant Inc. should expense during the year (versus the company capitalizing the costs): 1. Purchased the cost of a patent from another company for $165,500. 2. Incurred $278,900 of Research and Development Costs. 3. Internal costs incurred to create a patent for $105,490. 4. Purchased a tradename for $97,300. 5. Goodwill from purchasing another division for $205,800.arrow_forward

- Nashs Construction & Paving expanded its business by purchasing Alcott Maintenance, a division that provides road maintenance services. The division was purchased three years ago for $3,227,000 and has been identified as a reporting unit. The net assets for the division including goodwill are as follows: Cash $239,000 Accounts Receivables 301,000 Inventory 838,000 Property, Plant & Equipment 1,019,000 Goodwill 1,193,000 Accounts Payable (120,000 ) Unearned Revenue (75,000 ) Net assets, at carrying amounts $3,395,000 The fair value of the Alcott Maintenance Division reporting unit as a whole is estimated to be $3,125,000. Management determines that the unit’s value in use is $3,231,000. Prepare any appropriate journal entries for goodwill impairment assuming that Nash Construction & Paving is reporting under ASPE. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.…arrow_forwardNashs Construction & Paving expanded its business by purchasing Alcott Maintenance, a division that provides road maintenance services. The division was purchased three years ago for $3,227,000 and has been identified as a reporting unit. The net assets for the division including goodwill are as follows: Cash $239,000 Accounts Receivables 301,000 Inventory 838,000 Property, Plant & Equipment 1,019,000 Goodwill 1,193,000 Accounts Payable (120,000 ) Unearned Revenue (75,000 ) Net assets, at carrying amounts $3,395,000 The fair value of the Alcott Maintenance Division reporting unit as a whole is estimated to be $3,125,000. Management determines that the unit’s value in use is $3,231,000. Prepare any appropriate journal entries for goodwill impairment assuming that Nash Construction & Paving is reporting under ASPE. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.…arrow_forwardDuring the current year, Cartwright Corporation’s accountant recorded numerous transactions in an account entitled Intangible Assets, as follows: Jan. 2 Paid incorporation fees. $17,500 11 Paid legal fees for the organization of the company. 7,500 25 Paid for large-scale advertising campaign for the year. 15,000 Apr. 1 Acquired land for $15,000 and a building for $20,000 to house the R&D activities. The building has a 20-year life. 35,000 May 15 Purchased materials exclusively for use in R&D activities. Of these materials, 20% are left at the end of the year and will be used in the same project next year. (They have no alternative use.) 15,000 June 30 Paid expenses related to obtaining a patent. 10,000 Dec. 11 Purchased an experimental machine from an inventor. The machine is expected to be used for a particular R&D activity for 2 years, after which it will have no residual value. 12,000 31 Paid salaries of employees involved in R&D. 30,000…arrow_forward

- Taste-T Company has been in business for 30 years and has developed a large group of loyal restaurant customers. Down Home Foods made an offer to buy Taste-T Company for $6,000,000. Themarket value of Taste-T’s tangible assets, net of liabilities, on the date of the offer is $5,600,000.Taste-T also holds a patent for a fluting machine that the company invented (the patent with a market value of $200,000 was never recorded by Taste-T because it was developed internally). Howmuch has Down Home Foods included for intangibles in its offer of $6,000,000? Assuming TasteT accepts this offer, which company will report Goodwill on its balance sheet and at what amount?arrow_forwardpatagonia Corp., a large, privately held company, is preparing its year-end entries. As senior accountant, you have been asked to prepare the entries related to the company's intangible assets. Patagonia currently carries the following intangible assets* on its balance sheet: Trade name $ 130,000 net of accumulated amortization of $ 75,000 Patent $ 124,000 net of accumulated amortization of $ 56,000 Other intangibles $ 345,000 no amortization recorded Trademark $ 120,000 net of accumulated amortization of $ 32,00 *Current year amortization has already been recorded. The following additional information is available: After recent negative press releases relating to the technology that underlies the patent, the company has carried out a recoverability test that indicates that the patent's carrying value is higher than its undiscounted future net cash flows. The patent's fair value has now been…arrow_forward6. Bluestone Company had three intangible assets at the end of the current year: a. A patent purchased this year from Miller Co. on January 1 for a cash cost of $6,000. When purchased, the patent had an estimated life of 12 years. b. A trademark was registered with the federal government for $4,000. Management estimated that the trademark could be worth as much as $120,000 because it has an indefinite life. c. Computer licensing rights were purchased this year on January 1 for $42,000. The rights are expected to have a six-year useful life to the company. polnts еВook Print Required: References 1. Compute the acquisition cost of each intangible asset. 2. Compute the amortization of each intangible for the current year ended December 31. 3. Show how these assets and any related expenses should be reported on the balance sheet and income statement for the current year. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 3A Reg 3B Compute the acquisition…arrow_forward

- Marins Construction & Paving expanded its business by purchasing Alcott Maintenance, a division that provides road maintenance services. The division was purchased three years ago for $3,015,000 and has been identified as a reporting unit. The net assets for the division including goodwill are as follows: Cash $262,000 Accounts Receivables 323,000 Inventory 774,000 Property, Plant & Equipment 867,000 Goodwill 1,137,000 Accounts Payable (121,000) Unearned Revenue (70,000) Net assets, at carrying amounts $3,172,000 The fair value of the Alcott Maintenance Division reporting unit as a whole is estimated to be $2,887,000. Management determines that the unit’s value in use is $2,984,000. (a) Prepare any appropriate journal entries for goodwill impairment assuming that Marin Construction & Paving is reporting under ASPE. (If no entry is required, select "No Entry" for the account titles and enter 0 for the…arrow_forwardDuring the year, Cartwright Corporation’s accountant recorded numerous transactions in an account entitled Intangible Assets, as follows: Jan. 2 Paid incorporation fees. $17,500 11 Paid legal fees for the organization of the company. 7,500 25 Paid for large-scale advertising campaign for the year. 15,000 Apr. 1 Acquired land for $15,000 and a building for $20,000 to house the R&D activities. The building has a 20-year life and no residual value. 35,000 May 15 Purchased materials exclusively for use in R&D activities. Of these materials, 20% are left at the end of the year and will be used in the same project next year. (They have no alternative use.) 15,000 June 30 Paid expenses related to obtaining a patent. 10,000 Dec. 11 Purchased an experimental machine from an inventor. The machine is expected to be used for a particular R&D activity for 2 years, after which it will have no residual value. 12,000…arrow_forwardDuring the year, Cartwright Corporation’s accountant recorded numerous transactions in an account entitled Intangible Assets, as follows: Jan. 2 Paid incorporation fees. $17,500 11 Paid legal fees for the organization of the company. 7,500 25 Paid for large-scale advertising campaign for the year. 15,000 Apr. 1 Acquired land for $15,000 and a building for $20,000 to house the R&D activities. The building has a 20-year life. 35,000 May 15 Purchased materials exclusively for use in R&D activities. Of these materials, 20% are left at the end of the year and will be used in the same project next year. (They have no alternative use.) 15,000 June 30 Paid expenses related to obtaining a patent. 10,000 Dec. 11 Purchased an experimental machine from an inventor. The machine is expected to be used for multiple projects over a course of 10 years, after which it will have a residual value of $1,000. 12,000 31 Paid…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License